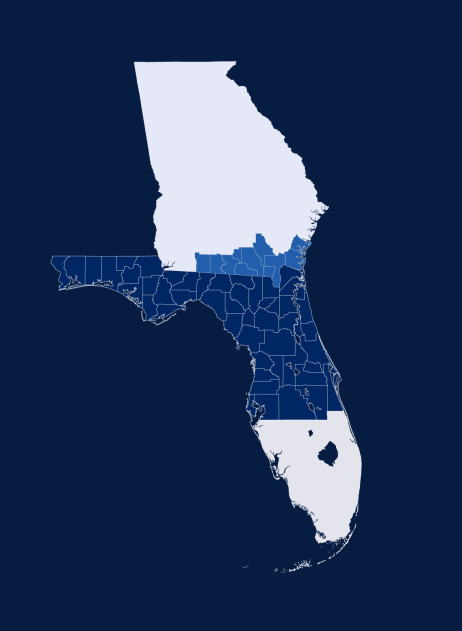

Pen Air Federal Credit Union is a rather tiny credit union based out of Pensacola, Florida featuring some extraordinary CD rates. They’re just the 15th largest credit union in Florida by asset size and not even within the top 200 of US credit unions nationwide. They have 15 locations across Northwest Florida and Southeast Alabama, but membership and their suite of savings products can be opened online by nearly any US resident.

Pen Air Federal Credit Union was founded in 1936 in Pensacola, Florida to serve civil service employees and military families. They’ve since teamed up with the Friends of the Navy-Marine Corps Relief Society to offer membership to anyone in the country by joining this organization and making a $3 donation (minimum).

Pen Air has earned top ratings from financial rating agency Bauer Financial for more than 25 years. They are a nonprofit, member-owned institution, that supports the efforts of the Navy-Marine Corps Relief Society.

Pen Air Federal Credit Union CD Rates + Account Details

All of the products listed below are federally insured by the NCUA (FDIC equivalent for credit unions) up to $250,000.

The minimum deposit requirement is $500 on every CD Pen Air sells except for their 3 month CD. This term, for whatever reason, currently requires a $1,500 minimum deposit to open currently.

CD Rates

| CD Term | APY |

| 3 month | 1.00% |

| 6 month | 1.35% |

| 12 month | 2.45% |

| 15 month (Add-On) | 4.00% |

| 18 month | 5.02% |

| 24 month | 2.65% |

| 36 month | 2.70% |

| 48 month | 2.75% |

| 60 month | 2.85% |

| *28 month | 4.00% |

| **54 month | 4.00% |

*The 28 month CD is available for a limited time and may be discontinued at any time. This product renews into a 24 month CD if nothing is done during the grace period.

**The 54 month CD is also a promotional deposit available for a limited time. This product renews into a 48 month CD if nothing is done during the grace period.

The 15 month “Add-On CD” allows you to add any additional deposit amounts you’d like to the account and earn the same APY on the entire sum throughout the duration of the product.

To put these offers in perspective the current national average for a 12 month and 60 month CD sit at just 1.07% and 1.09% APY, respectively, according to FDIC data.

Compounding and Crediting Interest

Interest on Pen Air CDs are both paid and compounded monthly.

Grace Period and Early Withdrawal Fees

Pen Air will send you a notification when your CD is close to maturity. Upon your CD’s maturity you will have a 7 calendar day grace period in which you are allowed to modify or close out your CD. If nothing is done during this 7 day period your CD will automatically renew with the same term and the going APY at that time.

If you need access to your funds prior to maturity, you’ll face an early withdrawal fee of 90 days interest for deposit terms less than 12 months and 180 days interest for terms greater than 12 months.

Money Market Rates & Account Details

You won’t earn the same APY as you do with CDs on Pen Air Federal Credit Union’s money market account but you will get more flexibility and easier access to your money.

Pen Air Federal Credit Union offers free checks, but with limited check writing capabilities. Currently just 3 checks are allowed per month with these accounts. Also, due to federal regulation D, customers are only allowed up to 6 withdrawals from your money market account per month. After that you’ll be paying $29 per additional withdrawal or the transaction could simply be denied by Pen Air.

There is also no ATM access available with these accounts.

Money Market Rates

| Balance | APY |

| $0 – $2,499.00 | 0% |

| $2,500 – 24,999.99 | 0.35% |

| $25k – $74,999 | 1.00% |

| $75k – 199,999.99 | 1.25% |

| $200,000+ | 2.00% |

Pen Air Credit Union’s money market rates still sit above the national average by quite a bit. To give these APYs some context, the current national average for a money market account hovers around 0.38% APY.

Other Savings Accounts Offered by Pen Air Federal Credit Union

Before you join Pen Air Federal Credit Union all new members must first buy a share of the credit union for $25. This $25 is then automatically placed in a Pen Air savings account. Therefore all Pen Air Federal Credit Union’s members have a savings account as soon as they join. Of course, this account can be added to. Below are the savings rates and tiers associated with the savings account.

| Account Balance | APY |

| $25-$4,999.99 | 0.10% |

| $5,000-$24,999.99 | 0.10% |

| $25,000-$74,999.99 | 0.29% |

| $75,000 and over | 0.29% |

Dividends on your savings are compounded daily and paid out quarterly.

Lastly, they have a novel savings product designed to help savers get a boost during the holiday season called the Christmas Club savings account. While I suspect this account was more promising and lucrative in the past, today it comes with an APY of just 0.299%.

This account can be funded with a minimum deposit requirement of just $25. You can add funds at any time before November when the balance is then transferred into a savings account.

About Pen Air Federal Credit Union + Eligibility

Pen Air has 15 locations in the states of Florida and Alabama. Use this tool to find addresses and toggle for branches, surcharge-free ATMs, deposit-taking ATMs, or co-op shared branches to refine your search. Cities with Pen Air Fed locations in Florida include (but are not limited to) Pensacola, Pace, and Milton and cities with locations in Alabama include Foley, Robertsdale, and Spanish Fort.

Pen Air also participates in Shared Branching with other credit unions in their network. This gives members the option of visiting thousands of bank and ATM locations across the U.S. to carry out their Pen Air Fed banking at minimal or no cost to the member. Just search bank and ATM locations (using the tool cited above) and select “co-op shared branches” to find the location nearest to you.

As mentioned, to become a member and stay a member, you must purchase and keep a single Pen Air Federal Credit Union share for $25. You will be charged a $15 monthly inactive account fee if there is no monetary activity for 12 months on a share or share draft account. Joining or opening an account can be done online or at a Florida/Alabama branch.

Anyone is eligible to join Pen Air Federal Credit Union by simply donating to the Navy-Marine Corps Relief Society. With a one-time donation of just $3 to the Navy-Marine Corps Relief Society—a 501(c)3 organization that provides assistance to retired and active Sailors and Marines—any U.S. citizen with a valid Social Security number can become a member.

There are other ways to join as well without donating to the organization mentioned above.

Those that meet one or more of the following criteria qualify to become a member of the Pen Air Federal Credit Union:

- active duty or retired military,

- civil service employee,

- member/employee of one of 1,200 partnering select employer groups,

- or an immediate family or household member of someone that meets the previous three requirements.