| Full disclosure: We may receive financial compensation when you click on links and are approved for products from our advertising partners. Opinions and product recommendations on APYGUY are those of our writers and have not been influenced, reviewed or approved by any advertiser. Learn more about how we make money. |

Although most banks and credit unions won’t let kids or teens open an account until they’re at least 18 years old, parents can set up sub-accounts from their current checking account that should provide a free debit card for their child.

However, many parents are choosing a prepaid debit card for their kid(s) rather than a debit card linked to a checking account for a couple reasons:

- A debit card with a checking account is generally only available to teens (13 – 17) while kids’ prepaid cards are available to children as young as 6 years old.

- Today, there are a plethora of prepaid options on the market that offer rich feature sets via an app. Things like chore and allowance payment features, fun quizzes, educational tools, parental guardrails on spending that can be customized for certain retailers, unique card art and even investment services are all features that can be found with today’s top offers.

If you’re in the market for a debit card for your kid or teen and want a comprehensive look at all of your options, then continue reading our guide below.

GoHenry Debit Card

GoHenry, headquartered in the UK, with US operations and 2 million US customers, was one of the first to market with their debit cards for kids and teens when they launched in 2007.

Today, they remain one of the most popular and trusted brands on the market with a TrustPilot rating of 4.2/5 based on over 2,400 reviews as of December 2022. This is up from a 3.9/5 rating earlier in 2022.

You can learn more about the GoHenry debit card for kids on their website.

Quick Facts:

- Target Age: 6 – 18

- Cost: $3.99/month for each child.

- For Parents: Set up automatic weekly allowance and/or set up chores with a bounty for each completed task. Set limits on how much they can spend in a given week. Lock savings goals, so your child has to reach the agreed upon amount before it is released for them to spend it. “Money Mission Quizzes” – launched in October of 2021 – also provide kids with a fun, interactive way to gain financial literacy. They also recently added “co-parent,” so multiple parents can manage chores/tasks and pay allowances.

- For Kids: You can save, spend and even donate to the Boys & Girls Club of America with this card and app. Set up small or large savings goals. These cards can be used online and anywhere Mastercard is accepted.

Copper Debit Card

Quick Facts:

- Target Age: 13 – 19

- Cost: $0

- For Parents: Free debit card for kids and teens with digital checking account. Monitor activity with real time notifications, set up recurring deposits, request and send funds between linked accounts.

- For Kids: Fun financial literacy quizzes built into the app, receive interest on your savings (albeit just 0.001% APY currently).

Copper is our second overall pick, with its premium features for both parents and kids and the fact that it is 100% free (which makes it the #1 free option on the list!).

Copper is on a mission to create the first financially successful generation by giving them the tools and resources to take control of their financial futures.

Copper requires no minimum deposit to open and does not charge an annual fee, overdraft fees or maintenance fees which makes it the best fee-free offer out there.

Learn more or get started with Copper today.

[Update October 2022: Copper has seen incredible growth since their inception in 2020 and is closing in on 1 million members. They first announced that they had surpassed 550,000 members in February 2022 and then announced surpassing 800,000 in April of 2022.]

Copper also has a promotion running where you can send $3.00 to each of your friends (which copper will pay for) plus you’ll receive $3.00 when/if they sign up.

FamZoo Prepaid Debit Card

Quick Facts:

- Target Age: 6 – 22

- Cost: $5.99/month for up to 4 debit cards, $2 per card after that. You can also pay in advance for a year for $30. 1 month free trial available.

- For Parents: Receive notifications for all purchases, set spending limits, move money between family members, IOU accounts to track how much you owe each kid, automated bookkeeping for allowance and chores, add loans to your kid(s).

- For Kids: Financial literacy tools.

The FamZoo Family Pack of Prepaid Cards gives parents control over how and what their children spend and kids opportunities to learn how to manage their money. FamZoo accounts use private family banking systems to give children hands-on learning experiences that are parent-directed.

With FamZoo, parents are “bankers” and their children are account holders. They can establish a payroll for their kids, loan money, set up automatic deposits, and even pay interest on savings.

We go into further detail in our FamZoo review found here.

BusyKid Visa Prepaid Spend Card

Quick Facts:

- Target Age: 12 – 18

- Cost: $19.99/year for 1 card. $7.99/year for each additional card.

- For Parents: Chore management app that comes pre-loaded with chores based on your child’s age (which can be customized), link checking account and release funds once chore(s) are completed, match savings in child’s saving account.

- For Kids: receive funds in 3 buckets – save, spend, share. Parents can match the funds in your ‘save’ bucket, invest in actual stocks, and support charities from the ‘share’ bucket. With parental approval, kids can purchase fractional shares of real companies like Netflix and Amazon.

If you have kid(s) between the ages of 5 and 16, you may be interested in the BusyKid Visa Prepaid Spend Card.

BusyKid uses a chores-based system that allocates money based on chores completed.

You can set rates for different chores and your children can mark them complete and see when they will be paid. Parents who use BusyKid appreciate that this system instills a sense of responsibility and ownership over their finances.

You can read our review here if you’d like to learn more.

Akimbo Prepaid Mastercard

An Akimbo prepaid Mastercard offers a safe way for your older children to learn the nuances of banking in a low-risk environment. This card lets your kids have total control over their money but gives you the final say in what they can and can’t spend. Their account will be a sub account of your own, so you can decide how much money to put on it.

Akimbo doesn’t have all of the bells and whistles of some of the kids cards and apps talked about in this list, but it does have the essentials. You’ll be notified when they spend their money and, as the account manager, what they spend it on.

Each Akimbo account may have up to four cards. There is no monthly fee. However, reloading your card costs up to $5 each time and ATM withdrawals are around $2 each.

Capital One MONEY Teen Checking

A MONEY teen checking account with Capital One is a great choice for kids that have already learned the basics of money management and are ready for more independence with their cash. Kids eight years old or older qualify for this account.

The Capital One MONEY app lets your child track their earning and spending as well as set savings goals in different categories. If you choose to, you can reward them for reaching these goals with bonuses. And in cases of emergency, you can lock their card instantly.

There are no monthly fees or account minimums with this account. You also do not need to have a Capital One account to enroll your child in MONEY. This account earns an APY of 0.10% on any balance.

American Express Serve Prepaid Debit Cards

The American Express Serve FREE Reloads prepaid debit card, while not marketed as a teen product, is great for teaching them financial literacy.

It requires no minimum monthly balance and is free to use/reload at over 45,000 ATM and store locations. By giving your teen a certain amount of money and allowing them to decide when and how to spend it, this card encourages independence and offers all of the perks and protections of a true debit card.

This account charges a monthly fee of $6.95, which cannot be waived. As far as teen debit cards go, this is a bit steep. Also, a card is free to order online but may cost up to $3.95 if you go to a physical retail location. These can be used online or anywhere American Express is accepted. To avoid transfer fees, your teen will need their own American Express bank account which you can link to your own.

Alliant Credit Union Free Teen Checking

You might want to look into getting an Alliant Credit Union free teen checking account if you’re a fan of the popular credit union, fee-free banking, or easy-to-use platforms. Teenagers between the ages of 13 and 17 are eligible to open an account.

This checking account is one of the best options out there for giving your teen a comprehensive banking experience that is safe and helpful. They can set their own budget and even earn interest up to 0.25% APY when they save (you will need to enroll in eStatements and make one deposit per month into their account to access this feature); and parents can set ATM and spending limits for their kids and transfer money between accounts at no cost. On top of that, the Alliant mobile app is consistently rated at five stars.

If you’re looking for even more interest, they also have a kids savings account that features an APY of 0.55%. To put this in perspective, the current national average sits at just 0.07% APY.

There is no minimum monthly balance requirement or monthly fee with this account. Just a few of the perks offered include access to over 80,000 free ATMs, up to $20/month in ATM rebates, and the ability to make contactless Visa purchases.

Step Banking for Teens

Step is an app and card that is backed by founders with experience at Google and Square. Step has the standard functions of allowing parents to monitor spending and send kids money on the go.

Unlike some of the other offers on this list, Step also adds one of the best features of a kids’ credit card ie: the ability to start building credit early. The best part of this feature is that Step prevents your kids from spending more than they have while letting them establish a positive credit history.

Step’s banking services are provided by their partner-bank, Evolve Bank & Trust, which also allows Step to leverage their FDIC coverage.

Step accounts are protected by bank-grade encryption and authentication and because the debit card is a Visa it benefits from fraud protection and zero-liability guarantee. You can read our full review to learn more.

Fidelity Youth Account

The Fidelity Youth Account was launched back in May of 2021 by the reputable financial services firm. Make no mistake, it is a brokerage account first, but also comes with a free debit card that has no minimum deposit or balance requirements and no fees. On top of that, for a limited time, your teen will get a $50 reward just for opening the account.

Here’s how it works: In order for your teen to receive the $50 reward offer, you (parent/guardian) must initiate the opening of a new Fidelity Youth Account and your teen (aged 13–17) must download the Fidelity Mobile App and activate the new account.

On the brokerage account side, teens can start their investing journey. Fidelity allows for this account to trade most US stocks, ETFs and Fidelity Mutual Funds. Parents won’t have the option to pre-approve trades their child makes, but they can set up alerts and monitor all activity online – both on the debit card and brokerage side.

Family Money by Verizon

On June 15, 2021 Verizon announced the launch of Family Money, an app for kids to learn about personal finance. Verizon worked with fintech firm Galileo to develop the family-centric financial product and it comes with a “spending account,” a “savings vault” and a prepaid debit card for kids issued by Metropolitan Commercial Bank. Parents can monitor their spending activity from the app, set limits and stop or freeze the card if it gets lost or stolen.

Families that are not Verizon customers are still eligible for this product. It can be downloaded from the Google Play and Apple App Store. You’ll just need to create a Verizon Family Money account and link a verified bank account after you download it. Once you’ve done that, you’ll get a 30 day trial period.

At the end of the 30-day trial period, the service auto-renews for $5.99 per month (so be sure to set a reminder if you don’t plan on paying for it!).

The $5.99 fee, which includes up to 5 kids, will be debited from the parent’s Wallet in the app, not charged to your Verizon account (if currently a customer). You must be 18 years or older to create a parent profile in the app and Verizon states that kids accounts are designed for children ages 8-17.

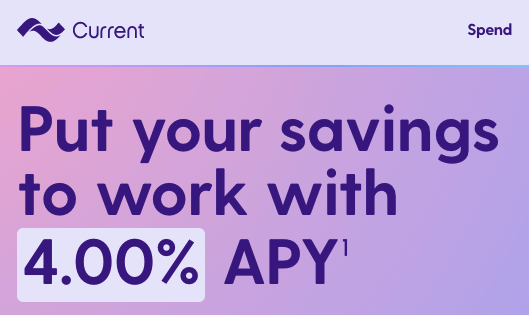

Current Debit Card for Teens

Quick Facts:

- Target Age: 13 – 22

- Cost:

$36.00/year per teen. Current premium accounts cost an extra $4.99/month.Now with no annual fee. - For Parents: Receive notifications for all purchases, set spending limits, set chores, block specific merchants.

- For Kids: No overdraft fees up to $100 with Current premium, receive paychecks up to 2 days early with Current premium, earn up to 15x points at over 14k locations across the US which are redeemable for cash in your Current account.

You and your child will both like the Current debit card for teens. There are no minimum monthly balance fees, overdraft fees, or transfer fees. This card can be used online or anywhere Visa is accepted.

[Update December 2022 Current is still offering an FDIC-insured savings account to go along with their debit card. This account pays 4.0% APY on balances up to $2,000. To put this in perspective, the current national average for a savings account sits at just 0.24% APY according to recent FDIC data, although with the FED’s series of historic rate hikes this year, the best online savings rates are now inching above the 3.50% APY mark. Current launched the 4.0% APY savings feature when top online savings account rates were still well under the 1.00% APY mark and hasn’t given it a raise since.]

In July 2022, Current eliminated the fee associated with the premium account. All new customers get all the premium account features for free.

Current is a financial technology company, not a bank. The banking services they offer – both the debit card and FDIC-insured savings account – are provided by Choice Financial Group and Metropolitan Commercial Bank, member FDIC.

Purewrist Wearable Contactless Payment

The FinTech company Purewrist has partnered with Sutton Bank, member FDIC, to offer quite the unique product – a bracelet that can make contactless payments.

The bracelet costs just $25 and can be used to pay for items by simply tapping it on the point of sale terminal.

Teens can shop online as well. A secure pin protected page within their profile allows them to see their full card number for any online purchases they wish to make.

For parents, they can make one time payments or set up automated payments to their kids.

Mango Prepaid Debit Card

A Mango prepaid debit card is a stand-out option because it offers the opportunity to link a high-interest savings account to your card.

This account has a lot going for it, including the fact that it can be opened even if your teen doesn’t have a checking account of their own. They can open a linked Mango savings account with a deposit of just $25 and earn up to 6% APY (to qualify for this rate, they would need to make signature purchases totaling $1,500 after opening the account and maintain a minimum monthly balance of $25 after).

You can add funds to your teen’s card from your own checking account or load money onto it from a participating retailer like Walmart or Walgreens.

There is no activation fee, but there is a monthly charge of $5 and a $3 ATM withdrawal fee. This card can be used online or anywhere Mastercard is accepted. Mango can also be used virtually from your phone when you enable this from the app.

Jelli

Even though you have to be 18 to open a Jelli account and get their debit card, we added it to the list because it’s an interesting product with some unique budgeting tools.

It uses what’s called envelope style budgeting where you can distribute your paycheck into “JelliJARS.” You can create JelliJARS for budgeting, saving, sharing etc.

These envelopes can also be shared. Let’s say for example the snowboarding trip mentioned above includes lift tickets and a cabin rental for you and 4 friends (and, of course, a higher cost than $120). You can set up and then share the envelope with your friends so they can contribute their share of the funds for the trip.

Jelli has partnered with Metropolitan Commercial Bank for FDIC insurance. Your funds will be held here if you sign up and use the Jelli account and debit card.

Visa Buxx Card

The Visa Buxx Card is a fairly basic debit card for kids and teens offered through Navy Federal Credit Union or TD Bank. For NFCU, you must first be a member of the credit union to open the Visa Buxx Card, but membership is available nationwide. Both offer parents the ability to reload the card from their phone as well as monitor spending. The Navy Federal Credit Union Buxx Card also has a few different designs to choose from whereas the TD Bank Buxx card does not.

Chase First Banking

Chase First Banking is also one of the newer offers on the list and is only available to current Chase customers. This product launched in 2020 in collaboration with Greenlight and is intended for kids between the ages of 6 and 17.

And although kids are eligible up to the age of 17, the product does not allow for direct deposit, so if your high school kid(s) are earning their own income, Chase First Banking won’t be a great fit.

That said, the product has a number of helpful parental controls and functions (most or all of which are powered by Greenlight). You can read more about them in our Chase First Banking review.

Kachinga Prepaid Debit Card + Chore App

Much like the other offers on this list, the Kachinga prepaid debit card comes with a chore app where parents can track chore progress, set alerts and spending limits as well as teach kids general financial literacy.

The app + debit card costs $36 per year per child which is a little bit pricier than other options on this list with a larger feature set.

New: Now with 1 month free trial.

Mazoola Virtual Debit Card

The Mazoola Virtual Mastercard debit card for kids is managed by parents and comes with a flat subscription fee of $9.99/month for the whole family. They also have a 1% purchase fee and charge $0.11 as a loading fee which can make it a more costly product to use than the other options. You can read more about their fees in our full review.

As a parent you can activate a virtual and secure debit card for each child and create flexible and individual spending controls. You can also assign & track chores and the rewards for completing them and set up automatic allowance payments. You can also provide them with financial literacy resources, but you can not require them to read them before unlocking allowance payments. Wouldn’t that be neat. For kids, you can use Apple Pay, set savings goals, manage chores and shop online (with restrictions). You can also make p2p payments to friends and family.

Wingocard Prepaid Visa Card

The Wingocard launched in May of 2021 and is gaining traction quickly with over 75,000 users on the platform so far.

They only have a mobile app on IOS at the moment however, but are looking to launch the android version soon.

We should also note that Wingocard has the largest network of free ATMs out of all the debit cards for kids on the market – with roughly 87,000 nationwide.

Read more about this up-and-comer in our full review.

Till Financial

Till Financial is another new one on the list. This collaborative family banking platform is a savings and budgeting product first, but does come with a debit card that is attached to the child’s “Spend Balance” which is why we included it in our list.

Till was named the Best App for Teaching Teens to Budget in 2021 by U.S. News & World Report.

You can learn more about Till in our full review.

Goalsetter: Family Banking

Goalsetter and the Cashola debit card is an education based banking solution for the family. It comes with a savings account and different card art for kids to choose from. It also has some fun quizzes that can be tied to cash rewards and are mapped to financial literacy standards. “Learn before you burn” allows your tween to take quizzes before they get to use their debit card.

USAA Youth Spending Account

This one may not have all the bells and whistles like chore apps, financial literacy tools and quizzes, or the like, but it is a simple and free card that gets the job done if you’re just looking for basics.

It’s geared towards kids and teens ages 13 – 18, comes with a Visa debit card and has absolutely no maintenance fees or monthly fees of any kind. You’ll also get free ATM usage both in network and out of network, although 3rd party ATMs may charge you up to $2 per withdrawal. You can learn more about the USAA Youth Spending Account in our review.

Axos Bank First Checking Account + Debit Card

Like the USAA Youth Spending account, the Axos Bank First Checking account is a free checking account and debit card that keeps things simple and leaves most of the bells and whistles behind.

There are no chore apps, allowance distribution features, financial literacy tools and even limited parental controls.

That said, parents can still receive notifications of all purchases and can turn the card on and off from the dashboard. But you can not toggle with withdrawal limits as these are set by Axos bank, nor can you restrict certain merchants. For more information read our full review.

Movo Digital Cash Card

Although this is more of a general prepaid debit card than one specifically geared towards kids and teens, we put it on the list because of a unique feature for those who hold cryptocurrency and would like to convert it to cash.

MOVO Chain is a proprietary technology that allows you to convert your cryptocurrency to cash which can then be loaded onto your Movo prepaid digital cash card.

You must be at least 18 years old to get the card and use the crypto-to-cash feature, but kids and teens can be added as authorized users to a parent’s card. Learn more in our full review here.

Revolut Junior Prepaid Card

Revolut, based out of London, UK, and their debit card for kids is another option for families. Just note that this is one of the most expensive options on the market and doesn’t offer any features that most of the competitors do not.

Families with 2 kids or more can easily pay more than $100/year for these cards PLUS at least one of the parents or guardians has to already have an account with Revolut. On the off chance you fall in this category you’re likely better off with another option above. You can learn more about the Revolut card here.

Bluebird Prepaid Debit Card

The Bluebird American Express prepaid debit card has partnered with Walmart to bring consumers this family-focused debit card. It allows parents to create up to 4 sub accounts for their kids or teens.

As the primary account holder you can limit ATM access or withdrawal amounts. You can also limit spending and even have store level controls (ie. you can control how much your child spends at specific stores).

There is no fee associated with this card and the sub accounts.

Bluebird also offers a bank account with a Visa debit card. This card is more widely accepted than the American Express offer. You can read more and compare the two options here.

Revolut for <18s

Revolut is another option for families. This UK based company offers their product and services to US customers. Kids that are 13+ can download the app on IOS or Google Play and then have their parents approve and activate the account from their Revolut account. It comes with a contactless debit card that connects to the app which kids can design and customize by drawing, adding text or emojis, etc.

Parents must have a Revolut account to activate an account and get a free debit card for their kid(s). Kids under 12 years old will need to have the parent create the account.

Learn more here.

Apple Cash Family

Another cashless option for the entire family is Apple Cash Family. If you and your family have an Apple account and associated hardware you can set up Apple Cash Family for all children 13 years old and over.

It has less features than some of the top debit card + app options on this list, but allows for most of the basics.

The “Family Organizer” ie. the parent(s) can:

- set limits on who their child can send money to,

- set up notifications on any/all transactions and

- lock account(s).

Kids and teens on the account can:

- spend money at participating stores, apps and websites,

- send and receive money from people they know (and approved by parents)

This is a free feature by Apple and can be managed through your Apple Wallet. Once set up, you can make payments from your iPhone, iPad, or Apple Watch. Learn how to get started here.

Can You Get a Debit Card for Kids Under 13 Years Old?

Debit cards for kids under 13 are perfectly legal for banks and companies to issue, and ultimately up to the parents to decide.

It doesn’t matter whether a kid is getting money from an allowance, saving money they’ve received for birthdays or holidays, or earning an income from a job. It is common for kids to start earning money at around 10 or 12 years old, so this may be a good time to start thinking about kid-friendly debit cards.

Some financial products geared toward kids, such as the BusyKids Visa Prepaid Spend Card, permit users as young as 5 to join. More common, however, is a minimum age of 8 years old. There are also several cards designed specifically for teens that do not permit users under the age of 13 to create an account.

It may also be a good idea to wait until your child has had some experience handling cash to give them a debit card. This way, they will feel more comfortable keeping track of it and spending money in the real world – since they’ve had a warm up with cash.

Additional Features You May Want to Consider

You’ll want to have a conversation with your kid(s) about the responsibilities (and liabilities) that come with having a debit card and ultimately what you’re trying to achieve beyond just access to money.

If you’re looking for some statistics to help you decide on the necessary features for your kid or teen, you may want to take a look at the GoHenry Youth Economy Report. This report breaks down how kids are earning money and what’s important to them.

Some of the high level take-aways are:

- Kids earned $26 billion in 2021 (including allowances, paid tasks completed, gifts)

- Average weekly earnings were $11.17. Up 16% from the previous year.

- 78% of kids say it is important to earn their own money.

In addition to part-time jobs, paid tasks, allowances, and babysitting, kids made money in these ways:

- Pet-sitting and dog walking (41%)

- Online gaming (35%)

- Selling things online (34%)

- Social media influencer (29%)

- Investing / trading stocks (28%)

- Content creator (28%)

- Investing in cryptocurrency (27%)

Below are additional features to consider.

Savings Account

Many debit cards for kids allow users to save and spend their money all under one account. They may do this by allowing users to choose how much of their money to put into savings and how much of their money to load to their card.

In such cases, the saved money does not go into a separate savings account and remains accessible at any time, but it can’t be immediately spent with the card.

This is the most basic way that a product may create savings opportunities, but there are a number of other additional features out there. For example, some debit card platforms give users the option of creating distinct savings goals and show them their progress.

Some products even let parents or account holders award bonuses when a user contributes to a goal they created or pay interest on balances. And if you want your child earning interest but would prefer not to pay it yourself, you may want to think about an interest-bearing product like the Mango Prepaid Debit Card (albeit savings rates are abysmally low at the moment).

On the opposite side of the spectrum, some products do not make room for this feature. With such platforms, if a child wants to save, they have to do so by refraining from spending. This may be much more challenging for them, especially if they are inexperienced with money management.

If encouraging your kids to hold onto their money and save it for larger purchases and goals is a priority, then a debit card and platform that encourages this in a variety of ways is probably best.

Allowance and Budgeting

How important is it to you to be able to pay your child an allowance and pay them for chores all in one place?

Chores are the focal point of many kids’ money management apps. Parents can assign chores for their kids to encourage them to take charge of their finances and kids can earn money for themselves and start to understand the importance of budgeting and restraint.

All this to say that financial products for kids, especially for young users between the ages of 6 and 13, commonly feature chores management capabilities. These vary in complexity. Here are some questions to consider as you review the choices:

- Do you want to be able to require your kids to complete certain chores or give them a list of options to choose from?

- Do you want to set fixed prices for every chore or create recurring chores that cost the same every time?

- Do you want to approve chores as your child completes them or arrange for them to be paid instantly when they mark a chore as complete?

You may also pay your kids a fixed allowance each week instead of or in addition to paying them for individual chores. This ability is not guaranteed with all apps, so choose wisely.

And if you don’t want your child spending all the money they’ve earned in one place, you probably want a product with budgeting features. You may feel that setting spending limits for them is the best way to set them up for success in the real world. After all, no one knows better than you what is best for your child, and a lot of kids’ financial platforms agree.

Parental Controls and Safety

Have a conversation with your kid(s) and let them know minors are prime targets for identity theft. Most cards will only require the parent’s social security number but some may require the child’s as well. Be on the lookout for credit card applications that come for your child or unsolicited phone calls. Learn more at the FTC on how to protect your family against identity theft.

If monitoring your child’s activity and creating custom controls for their spending is important to you, be sure to look for a product that lets you easily do this.

You should also think about how involved you’d like to be. Start with the following questions:

- Do you want to approve your child’s purchases and transfers or would you rather trust them to make good decisions?

- Do you want to allow them to set their own budgets or create spending limits for them?

- Do you want the ability to automate payments into your child’s account or do you want to initiate transfers each time?

- Do you want to receive real-time push notifications of their activity?

Beyond just parental controls to help your kids grow into prepared and knowledgeable spenders, consider parental responsibilities too.

Most financial products for kids require parents or guardians to fund the account. Often, this means funding their own account, the main account, and transferring money into their children’s accounts from there.

This means you should also think about what funding options are most convenient for you. Read the fine print on every product. If you’re looking for a particular funding option, be sure that it is actually available (you may be surprised by how many accounts don’t allow cash reloads or direct deposit transfers). Some products are extremely limiting when it comes to funding and may only permit ACH transfers or card transactions.

Also look into how many account managers a product allows. If you and your co-parent want equal access to your child’s account, it is important to find a product that can give you this. Some have strict one-parent policies but others are more generous when it comes to adding more adult users and may even allow for the inclusion of other members of the family.

Data Collection

Be sure to read through the debit card company’s privacy policy to understand how they intend to collect and use data from your child’s activity. There are consumer protection laws in place that govern some ways in which these companies can gather and share (sell) data to third parties, but the laws do not cover everything. These companies also reserve the right to change the ways in which they collect and use the data on an ongoing basis, so keeping up with their terms of service is necessary to make sure you’re comfortable with what’s going on behind the scenes.

Introduction to Stocks and Investments

There aren’t a lot of financial products for kids that allow them to invest their money in real companies, but looking for only those that do can help you filter through the ever-growing list of options.

The Fidelity Youth Account and the BusyKid Visa Prepaid Spend Card made this list for a lot of reasons, but one of these was the ability to invest. Giving kids the opportunity to make investments can show them that there is more to money management than spending and budgeting. You can help them choose their investments or let them make their own investing decisions.

Charitable Giving

You may also like the idea of your child donating their money to charity. Apps that allow kids to donate typically do so by pre-selecting a number of reputable organizations and giving users the option of giving charitably to these. Users may then donate a percentage of their entire balance or make donations of fixed amounts.

Parents can decide to take it one step further by awarding account bonuses if their kid makes the decision to donate to charity for themselves. Some apps even let kids set up donation goals just as they would savings goals.

Leave a Reply