VyStar Credit Union is among the top 20 credit unions nationwide both by total assets and number of members.

They were founded in 1952 originally as Jax Navy Federal Credit Union at the Naval Air Station Jacksonville, Florida to create a safe place for military and civil service members to save and borrow money.

Today, they have over $9 billion in assets and just over 700,000 members all over the world.

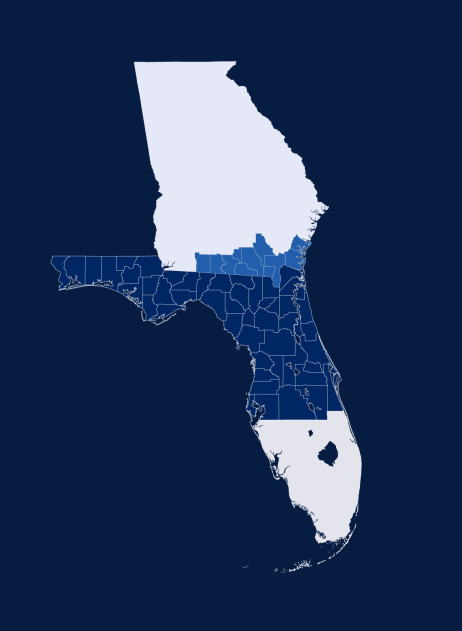

Unfortunately for many, this credit union is only available to those who “live or work in the 49 contiguous counties of Central to North Florida, 10 Southern Georgia counties and past and present military members and their families all over the world.”

For those who are eligible to join VyStar Credit Union, they offer ten CDs (certificates of deposit) with terms ranging from 3 months to 5 years. The current interest rate and APYs (annual percentage yield) on these accounts beat the national average considerably but are still behind the top offers and rates from FDIC-insured, online banks and other nationally available credit unions.

To learn more, continue reading our review below.

VyStar Credit Union CD Rates + Account Details

Vystar Credit Union’s CDs have a minimum deposit requirement of just $500. However, the interest they pay is tiered based on deposit size. In general, higher deposit amounts get higher yields. The tiers are as follows:

- $500 – $9,999

- $10,000 – $24,999

- $25,000 – $49,999

- $50,000 – $99,999

- $100,000+

CD Rates

| Term | Deposit Size | APY |

| 3 months | $500 – $49,999 | 1.15% |

| 3 months | $50,000+ | 1.25% |

| 6 months | $500 – $49,999 | 1.65% |

| 6 months | $50,000+ | 1.75% |

| 9 months | $500 – $49,999 | 1.75% |

| 9 months | $50,000+ | 1.85% |

| 12 months | $500 – $49,999 | 2.55% |

| 12 months | $50,000+ | 2.65% |

| 13 months | $500 – $49,999 | 3.40% |

| 13 months | $50,000+ | 3.50% |

| 18 months | $500 – $49,999 | 2.60% |

| 18 months | $50,000+ | 2.70% |

| 23 months | $500 – $49,999 | 3.90% |

| 23 months | $50,000+ | 4.00% |

| 24 months | $500 – $49,999 | 2.75% |

| 24 months | $50,000+ | 2.85% |

| 30 months | $500 – $49,999 | 2.95% |

| 30 months | $50,000+ | 3.05% |

| 36 months | $500 – $49,999 | 3.15% |

| 36 months | $50,000+ | 3.25% |

| 48 months | $500 – $49,999 | 3.25% |

| 48 months | $50,000+ | 3.35% |

| 60 months | $500 – $49,999 | 3.45% |

| 60 months | $50,000+ | 3.55% |

To put these yields into perspective, the national average for 12 month and 60 month CDs sits at just 0.90% and 0.98% APY, respectively, according to FDIC data.

That said, the top APYs from online banks and nationally available credit unions on 12 month and 60 month CDs are now inching above 4.25% APY and 4.50% APY, respectively.

Compounding and Crediting Interest

VyStar Credit Union’s certificates of deposit feature daily compounding interest. The interest is paid out monthly. Consumers can choose to have the interest go back into the CD for further compounding or paid out to an external bank account, free of charge.

Grace Period and Early Withdrawal Penalties

There is no specific grace period stated on VyStar Credit Union’s CD rate page or their CD FAQ section. Typically banks and credit unions will allow 10 calendar days upon your CD’s maturity to either add or withdraw any or all funds penalty-free before the CD automatically renews into a new CD with the same term.

VyStar’s certificate of deposit section states the following:

“VyStar will contact you 30 days before your CD term ends. If you want to reinvest in another CD, you don’t have to take any additional action — your CD will automatically renew at the same term for the current rate. If you want to withdraw your money or try another type of investment, then let us know before your CD term ends.”

We should also note that we have seen a 7 day grace period stated on 3rd party websites, but not by VyStar Credit Union themselves, so be sure to let them know your intentions with your CD funds prior to its maturity.

Membership and Eligibility

Unfortunately for most of us, VyStar Credit Union isn’t an option.

To join VyStar you must live or work in one of 49 eligible counties in central and north Florida. There are also 10 counties in southern Georgia which are also eligible.

See eligible counties below:

If you do not live in this zone, you will need to have either served in the military or have military members in your family.

You can read more about becoming a member here.

Leave a Reply