TIAA Bank, previously called EverBank, is an FDIC-insured bank based out of Jacksonville, Florida with an all-inclusive lineup of digital deposit accounts that can be opened online and by consumers in all 50 states.

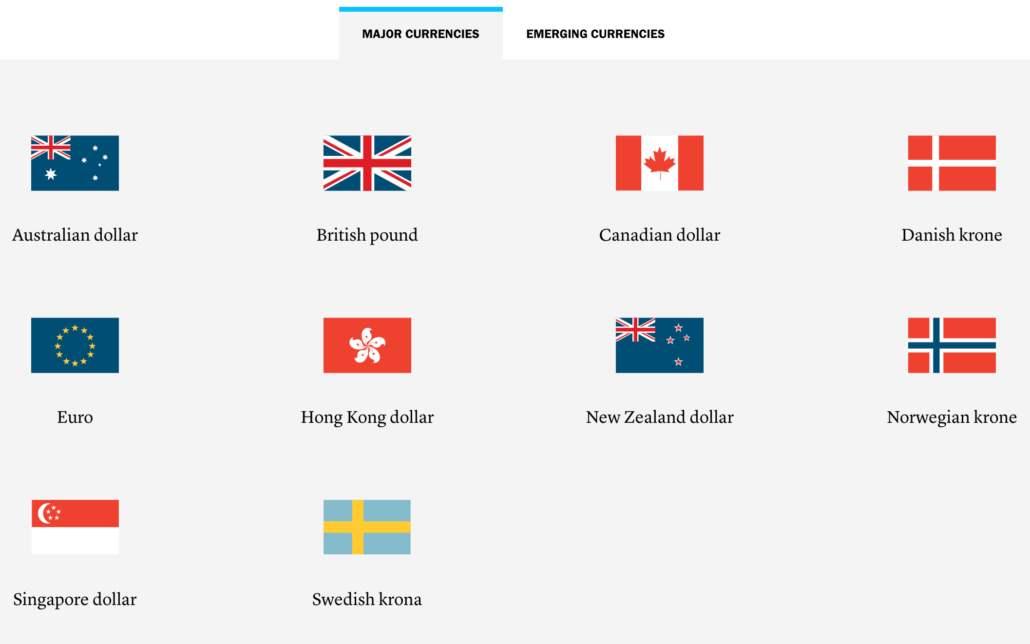

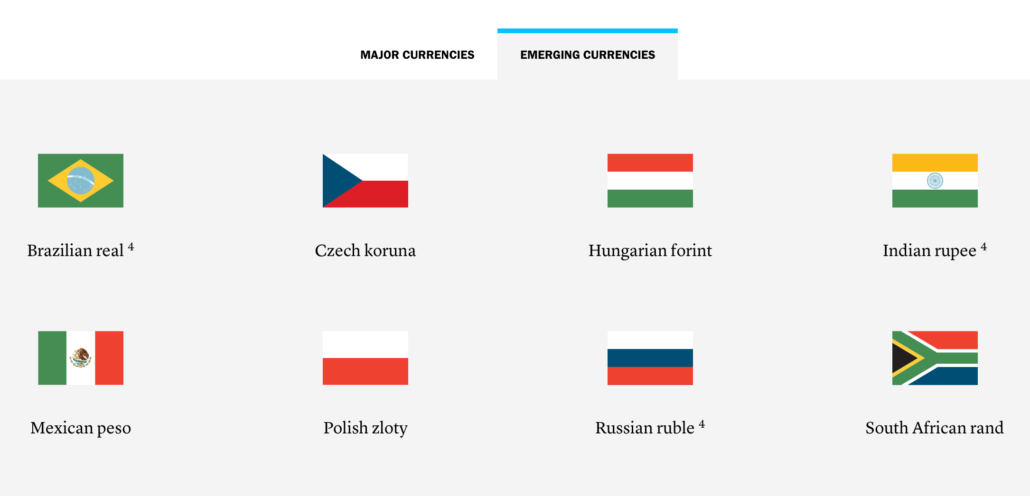

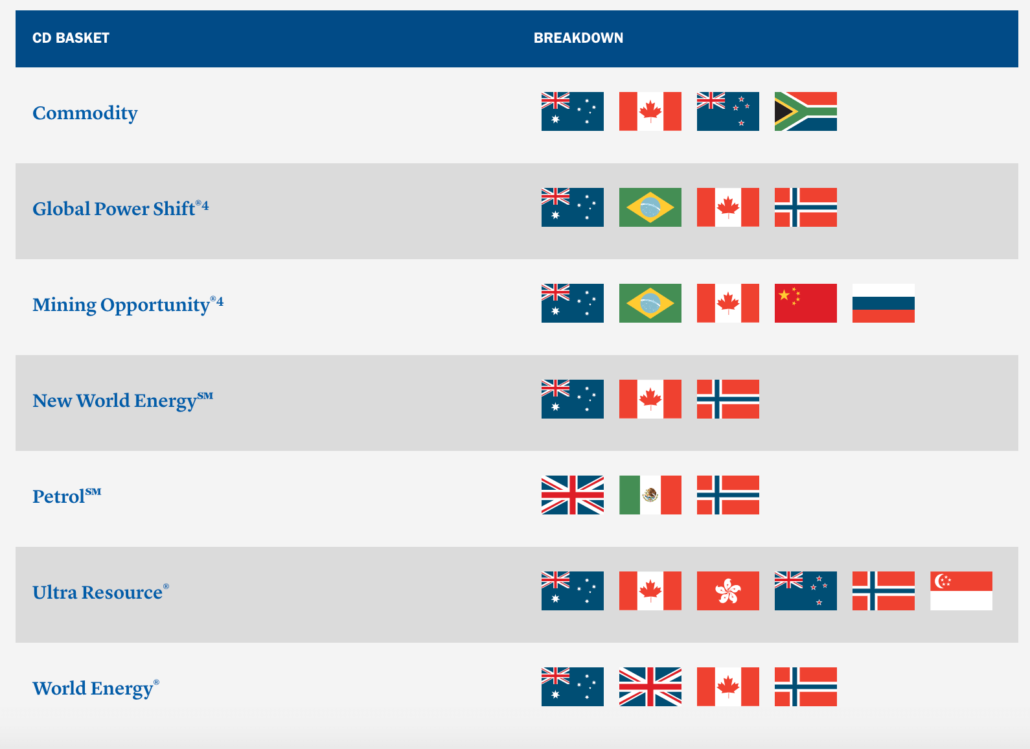

These include CDs (certificates of deposit), an online savings account, money market account, checking account and even foreign currency CDs.

For the purposes of this review, we will focus on TIAA Bank’s CD rates. They offer 10 “Basic” CDs with terms ranging from 3 months to 5 years. They also have one “Rate Bump” CD with a 3.5 year term that allows for one rate increase during its life (if one is available).

To see if TIAA Bank’s CDs are right for you, continue reading below.

TIAA Bank CD Rates + Account Details

TIAA Bank’s certificate of deposit suite only consists of Basic CDs and the Rate Bump CD. As of 2023, TIAA discontinued their “Yield Pledge CDs.”

The Basic CDs come with a minimum deposit requirement of $1,000 and the Bump Rate CD comes with a $1,500 minimum.

Basic CD Rates

| CD Term | APY |

| 3 month | 4.00% |

| 6 month | 4.00% |

| 9 month | 5.25% |

| 1 year | 5.00% |

| 18 month | 4.60% |

| 2 year | 4.40% |

| 30 month | 4.10% |

| 3 year | 4.10% |

| 4 year | 4.05% |

| 5 year | 3.95% |

To put these yields into perspective, a 12 month CD and a 60 month CD have an average yield of just 1.72% APY and 1.37% APY, respectively, according to FDIC data. However, top yields from other FDIC-insured online banks and nationally available credit unions are approaching the 5.50% and 4.50% APY mark for the same respective terms.

Bump Rate CD

TIAA Bank’s Bump Rate CD is a promotional CD that gives users a one-time rate bump if one comes along before their certificate matures (sometimes banks refer to these as step-up CDs or step rate CDs).

TIAA Bank’s Bump Rate CD requires a minimum deposit of $1,500 to open.

| CD Term | APY |

| 3.5 years | 4.10% |

Interest is compounded daily and credited according to your account agreement upon issuance.

How do TIAA Bank’s CD Rates Compare?

To get a better idea of how TIAA Bank’s CD rates stack up against the competition, take a look at the table below. It compares TIAA Bank’s best CD rate with some of the other top CD rates offered by competing banks across the country.

| Bank | Best CD Rate (APY) |

| BMO Harris | 5.10% |

| PNC Bank | 4.00% |

| Truist | 5.00% |

| Webster Bank | 5.00% |

| TIAA Bank | 5.00% |

How Much Can You Earn with a TIAA Bank CD?

How much money you can make with a TIAA Bank CD is going to depend on your deposit size, the CD term you choose and its going APY (annual percentage yield). The table below shows potential earnings with some of TIAA Bank’s CDs assuming a deposit size of $10,000.

| CD Term | APY | Earnings |

| 6 months | 4.00% | $198.04 |

| 9 months | 5.25% | $391.22 |

| 2 years | 4.40% | $899.36 |

| 5 years | 3.95% | $2,137.31 |

Grace Period and Early Withdrawal Fees

TIAA Bank allows for 10 calendar days (the grace period) upon your CD’s maturity in which you can add/withdraw funds, change terms, or close out the CD entirely without incurring any penalty fee. If nothing is done during the grace period your funds will automatically renew into a new CD of equal terms and the going yield at that time.

If you need funds prior to CD’s maturity, you will incur an early withdrawal fee.

Early withdrawal policies on Basic CDs are as follows:

- 22 days’ interest on 3 month CDs,

- 45 days’ interest on 6 month CDs,

- 68 days’ interest on 9 month CDs,

- 91 days’ interest on 1 year CDs,

- 136 days’ interest on 18 month CDs,

- 182 days’ interest on 2 year CDs,

- 228 days’ interest on 30 month CDs,

- 273 days’ interest on 3 year CDs,

- 365 days’ interest on 4 year CDs, and

- 456 days’ interest on 5 year CDs.

Other Deposit Accounts Offered

If you’re looking for a variable rate deposit account, TIAA Bank offers a “Yield Pledge” online savings account and a “Yield Pledge” money market account that both offer competitive rates.

Both come with first year intro APYs of 4.50% then lower, ongoing yields after that.

Yield Pledge Online Savings

| Min. to open | First Year APY | Ongoing APY |

| $0 | 4.75% | 4.30% |

Yield Pledge Money Market

There is no minimum deposit requirement to open a Yield Pledge Money Market account.

| Balance | First Year APY | Ongoing APY |

| $0 – $9,999.99 | 4.75% | 3.75% |

| $10k – $24,999.99 | 4.75% | 3.75% |

| $25k – $49,999.99 | 4.75% | 3.75% |

| $50k – $99,999.99 | 4.75% | 4.05% |

| $100k + | 4.75% | 4.10% |

To put these yields into perspective, the average for a money market account and a savings account sit at just 0.63% and 0.42%, respectively, according to FDIC data. However the top yields from online banks are inching up to the 5.00% APY mark for both account types.

Interest is compounded daily and credited monthly on both the Yield Pledge savings and money market account.

Per federal regulation D, you are limited to 6 transfers each month. This includes ACH transfers, checks, internet, phone, and mobile-initiated transactions, and more. Should you exceed this limit excessively or frequently, TIAA Bank reserves the right to restrict your access further and transfer your balance into a Cash Reserves account.

Banking Experience and Customer Sentiment

Unlike many online banks today, TIAA Bank actually does offer ATM cash access at an impressive 80,000+ fee-free locations. TIAA Bank does not charge ATM fees and will reimburse out-of-network fees imposed by other institutions if your average daily balance is at least $5,000. If your balance is below this, you’ll be reimbursed up to $15. There are 11 TIAA Bank branch locations across Florida.

TIAA Bank offers both a Basic Checking and a Yield Pledge Checking account option. A TIAA Bank Basic Checking will not pay you interest, but a TIAA Bank Yield Pledge Checking is an interest-bearing account that earns 0.25% APY on all tiers at the time of this writing.

Overall, people seem to have a lukewarm impression of TIAA Bank from a customer experience perspective. Out of 119 user reviews left for the bank on WalletHub, 45% of reviewers gave the bank 3 stars for an average rating of 3 stars. And out of 23 reviews on DepositAccounts, TIAA Bank scored just 2.5 stars.

Customer service at TIAA Bank could use some work, according to customers themselves. The overwhelming majority of negative reviews left for the company are related to bad experiences with customer support, with representatives being called condescending, rude, arrogant, and unhelpful by several users. Most positive reviews pertain to good rates and simple sign-ups.

The TIAA Bank apps, on the other hand, are supposed to be really solid. With 4.7 stars on the App Store and 4.4 on Google Play, it’s safe to assume that you can count on a user-friendly and comprehensive mobile banking experience through the TIAA Bank app.

TIAA Bank limits ACH transfers from a TIAA account to an external account to $50,000 daily and from an external account into a TIAA account to $250,000 daily.

To reach customer service, call the client solutions team at 1-(888)-882-3837 or tweet @TIAABankHelp. Representatives are standing by 7 days a week from 8 AM to 11 PM (ET).