If you’re dismayed with the current interest rate environment as a saver then you may be considering foreign currency CDs as a potential alternative. Perhaps with the hope that another country might have a more favorable interest rate landscape than our own.

While you’d be correct to assume that other countries have better savings rates, you may be surprised to know that foreign deposits inherently carry quite a bit of risk.

Additionally, for retail investors, we would strongly recommend consulting with a certified financial advisor prior to opening any foreign currency CD. Unless one has a thorough understanding of government and monetary policy in the desired country of investment, outside advice by a certified professional should be sought.

In this article we’ll discuss the benefits and drawbacks of investing in foreign currency CDs and where you can open them.

Understanding Foreign Currency CDs

In many ways a foreign currency CD is just as simple and straightforward as a traditional CD you’d open at your local bank or credit union. The opening process, minimum deposit requirements, potential early withdrawal fees are usually all fairly standard.

The major difference with these products – and where the inherent risk lies – is with the currency fluctuation while the deposit is active.

Any weakening of the foreign currency (relative to the US dollar) while your money is tied up has the potential to eat away your interest and even principal. Conversely, any major strengthening of the foreign currency (relative to the US dollar) could amplify your earnings.

Additional Account Details:

Foreign Currency CDs generally come with similar early withdrawal fees and minimum deposit requirements, however, their durations tend to be shorter than standard US-based certificates of deposit. Maturities on foreign currency CDs usually range from 3 to 12 months.

How To Open A Foreign Currency CD

Opening a foreign currency CD is not easy and only a small handful of institutions even sell the products. It’s possible to purchase foreign currency deposits by reaching out to overseas banks, however you wouldn’t be eligible for FDIC insurance in these cases.

The most notable institution in the US offering foreign currency CDs with FDIC insurance is TIAA Bank (formerly Everbank). They require a minimum of $10,000 to open a WorldCurrency CD and take as much as 1% on currency conversion.

TIAA Bank’s WorldCurrency CD

TIAA Bank’s most popular foreign currency CD product is what they refer to as their “WorldCurrency CD.” These products come with short durations (3 – 12 months) and require a minimum of $10,000 to open. They are IRA eligible and are FDIC-insured against bank insolvency but not currency fluctuations.

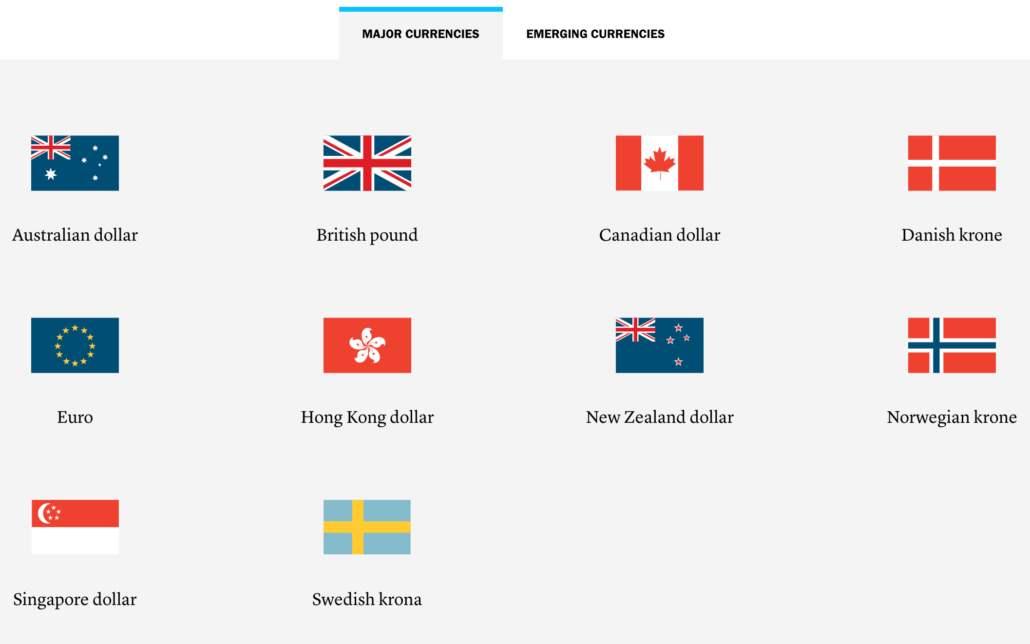

When selecting a WorldCurrency CD you can filter between two groups – major currencies and emerging currencies.

TIAA Bank’s Major Currencies:

As you might assume, the ‘major currencies’ feature more economically stable currencies while the ’emerging currencies’ (see below) feature emerging economies with more volatility.

Major currencies don’t often come with major advantages either. Savings rates in these countries aren’t always higher than the US either. For example, Hong Kong closed out 2019 with savings rates near zero and in August of last year a Danish bank launched a savings account with 0.6% negative interest rate for millionaires. So don’t assume you’ll get a stellar rate with minimal currency fluctuation risk.

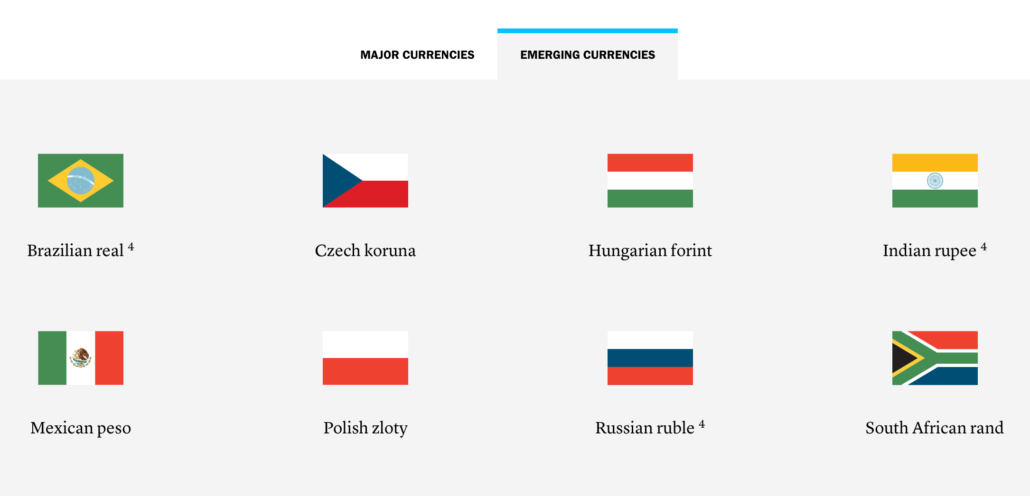

TIAA Bank’s Emerging Currencies:

The ’emerging currencies’ group features a riskier set of currencies.

While many banks in these countries offer attractive deposit rates, their country’s currency will always carry a high degree of risk against the US dollar.

Just to give you an idea of what kind of rates you could potentially lock-in, the current Mexican interest rate Banxico (base rate) is 7.250%. That said, the price of the Mexican Peso relative to the US dollar also fluctuated over 8% in 2019.

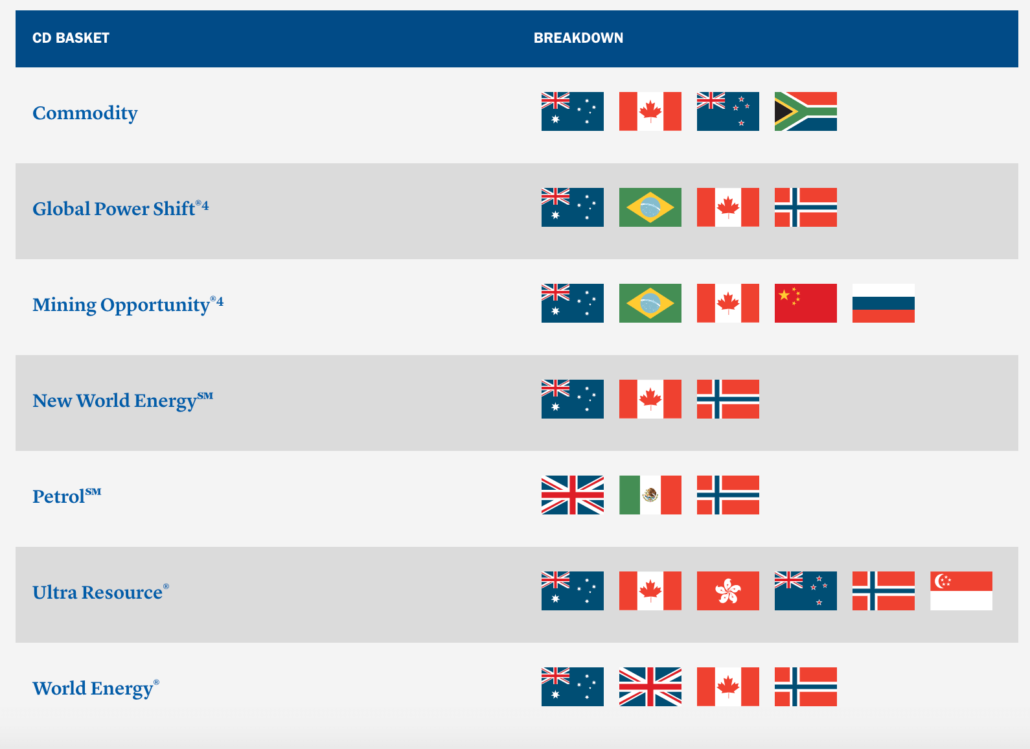

WorldCurrency CD Baskets

TIAA Bank’s “World Currency CD Baskets” are perhaps the most innovative set of foreign currency CD products on the market. These products are designed specifically to diversify currency and deposit holdings to offset risk.

They divide up currencies by three criteria:

- Commodity Rich – The nations whose currencies comprise these baskets may benefit from increased world demand for their tremendous natural resources.

- Economy Driven – The nations whose currencies comprise these baskets may benefit because of sound economic strategies that help drive their monetary strength.

- Geographically Inspired – The nations whose currencies comprise these baskets may benefit from certain regional strengths and geopolitical strategies.

How Can You Lose Money With Foreign Currency CDs

What is the largest risk to your foreign currency CD? A strengthening US dollar.

Consider the following:

You decide to purchase a 6 month CD for $10,000 in Indian Rupees because it is currently paying a generous 5% APY.

To open this CD you first need to exchange your $10,000 US dollars into Indian Rupees.

The current exchange rate at the start of your deposit term is $1 US dollar for 70 Indian Rupees. Therefore your $10,000 USD becomes 700,000 Indian Rupees.

After you’ve converted your currency, you place your 700k Rupees into your 5% certificate of deposit.

Ok, now during the 6 month period in which your CD was open, let’s assume the US dollar strengthened against the Rupee so that $1.00 USD now equalled 75 Indian Rupees.

Let’s see what you’re left with…

First, let’s multiply your starting position (700,000 Indian Rupees) by your guaranteed interest rate of 5%. So, 700,000 x 1.05 = 735,000 Indian Rupees – a gain of 35,000 Rupees.

Second, (and before we celebrate) let’s convert your Rupees back into US dollars so we can return those funds to your domestic bank account.

735,000/75 (75 Indian Rupees now equals $1 USD in our scenario) = $9,800 US dollars.

Ouch! You just lost $200 on your 6 month CD that paid an APY of 5.0%.

Final Thoughts

We know that it is easy to be frustrated with the current savings environment, but before you look outside the US for more favorable rates, be sure you fully understand the risks associated with foreign currencies CDs.

While it’s true that banks in other countries can offer more favorable savings rates than our own domestic banks, a strengthening US dollar against the currency you’re temporarily invested in can negate your earnings and even principal.

Retail investors should always consult with a financial advisor before embarking on their own in foreign currency trading or when opening a deposit. Having a strong understanding of complicated government policies and scrutinizing a country’s monetary policies are a must before opening a deposit in any foreign country.

Leave a Reply