Genisys Credit Union, based out of Michigan, is currently offering some respectable CD rates.

They have 3 promotional CDs (certificates of deposit) with oddball maturity terms of 7, 19 and 30 months and 7 standard term CDs with maturities ranging from 6 months to 5 years.

They also offer Jumbo CDs and Jumbo IRA CDs with slightly higher yields than their standard CDs. These require a minimum deposit of $100,000.

Both their standard and promotional CDs, however, require a minimum deposit of just $500.

To see if these products and this credit union are right for you, continue reading our review below.

Genisys Credit Union CD Rates + Account Details

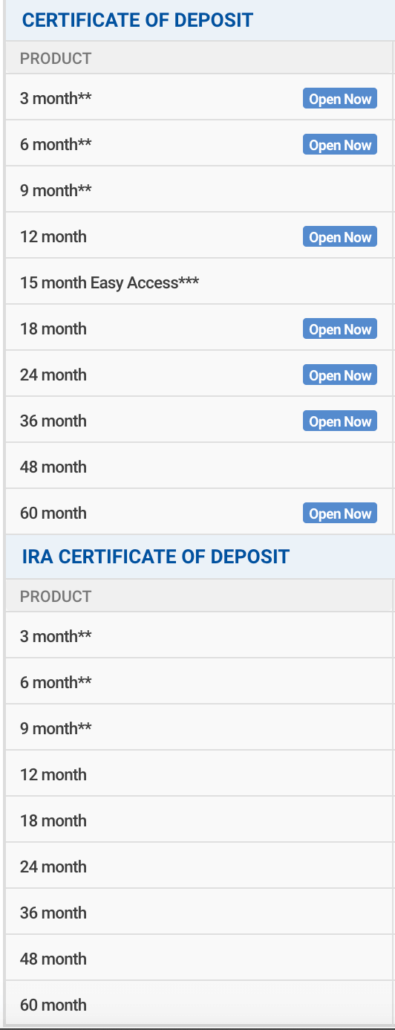

As mentioned, Genisys Credit Union offers a wide range of promotional CDs, standard CDs as well as Jumbo CDs and Jumbo IRA CDs.

We’ll start with their 2 “Flex Certificate” options.

Flex Certificate

Genisys Credit Union’s Flex Certificates come with a minimum deposit requirement of just $100 and have a term of 1 year. They are ‘flexible’ in that they allow you to add to the deposit during its term as well as get a rate bump when/if rates go up.

| Term | APY |

| 1 Year (1,2) | 2.68% |

Flex Certificate Details:

- Additional deposits are allowed daily between $10 to $25,000.

- One time option to change the rate offered on the same product.

- One time option to withdraw up to 25% of principal with no penalty

Promotional CDs

Genisys Credit Union currently offers 3 “Certificate Specials” that come with higher yields, oddball maturities from 7 – 30 months and require just $500 to open.

| Term | APY |

| 7 months | 4.06% |

| 19 months | 4.58% |

| 30 months | 4.84% |

Please note that the Certificate Specials will not renew into the same terms. They will instead renew into standard CDs.

Renewal terms are as follows:

- the 7 month special will renew into a 6 month standard term CD,

- the 19 month special will renew into a 18 month standard term CD, and

- the 30 month special will renew into an 24 month standard term CD

Standard CDs

Genisys Credit Union’s standard term certificates require a minimum deposit of $500.

CD Rates

| Term | APY |

| 6 month | 2.52% |

| 1 year | 2.78% |

| 18 months | 2.88% |

| 2 years | 3.03% |

| 3 years | 3.29% |

| 4 years | 3.44% |

| 5 years | 3.55% |

To put these yields above in perspective, the current national average for 12 and 60 month CDs sit at just 1.28% and 1.21% APY, respectively, according to FDIC data.

Jumbo CD Rates

Jumbo CDs require a minimum deposit of at least $100,000. These are available for IRA accounts as well.

| Term | APY |

| 6 month | 2.57% |

| 1 year | 2.83% |

| 18 months | 2.93% |

| 2 years | 3.09% |

| 3 years | 3.34% |

| 4 years | 3.49% |

| 5 years | 3.60% |

About Genisys Credit Union + Eligibility Rules

Today, Genisys Credit Union headquartered in Auburn Hills, MI, is the 5th largest credit union in the state of Michigan and the 97th largest credit union in the country. They service over 220,000 members in Michigan, Minnesota, and one county in Pennsylvania. They control assets of just over $2.7 billion and have sold nearly $250m in non-brokered deposits.

What’s more impressive is that they’ve seen 10% year over year growth in deposits held at the credit union despite an abysmal savings rates environment.

Genisys Credit Union has had their fair share of re-brands since their inception as General Motors Truck & Coach Federal Credit Union back in 1936. Over the past 40 years they’ve rebranded 3 different times before settling on Genisys Credit Union.

Membership Eligibility

Unfortunately Genisys Credit Union runs a pretty tight ship when it comes to eligibility. And geography is going to be your largest barrier.

Currently Genisys Credit Union only offers membership to those who work, live or worship in:

- Anywhere in Michigan

- The following six counties in Minnesota: 1. Dakota 2. Ramsey 3. Anoka 4. Hennepin 5. Scott and 6. Washington Counties

- or Montgomery County in Pennsylvania.

If you’d like to search eligibility by zip code you can do that here.