[Update January 2021: Pawtucket’s Credit Union’s CD rates remain the same to start the new year. The only APY change that has occurred within their deposit suite since May of last year has been their promotional 15 month “Easy Access” CD which lowered from 0.55% APY to 0.50% APY.]

[Update May 2020: Pawtucket lowered the APY on their standard CDs, IRA CDs and promotional deposits.]

[Update April 2020: Pawtucket lowered the APYs on their 6 month and 18 month CDs for both standard deposits and IRA CDs.]

Pawtucket Credit Union, based out of Pawtucket, Rhode Island, has consistently provided savers with above average rates over the years despite an unfavorable landscape for savers in general.

Up until February of 2020 they had one of the highest yielding 6 month CD rates in Rhode Island. However, given the FED’s recent rate drop to near zero, the annual percentage yields have come down some, but still offer respectable APYs.

Below you’ll find Pawtucket Credit Union’s CD rates and any available promotional CD offers.

If you live in Rhode Island or have family members who do that can assist you in getting membership, then you may want to consider one of Pawtucket’s deposit products.

Who Is Eligible To Join Pawtucket Credit Union

Although Pawtucket Credit Union doesn’t make it clear on their website who is eligible for membership we called them and confirmed that you would have to be a resident of the state – OR – have family in the state that could co-sign an account for you.

DepositAccounts states that they also accept a few neighboring counties in Massachusetts and Connecticut although we weren’t able to confirm that over the phone.

About Pawtucket Credit Union

Founded in 1926 Pawtucket Credit Union is the largest credit union in the state of Rhode Island with more than 110,000 members and assets exceeding $2.1 billion.

What’s also noteworthy is that they’ve seen incredible deposit growth despite a sluggish savings rate environment. Pawtucket Credit Union now has more than $110m in non-brokered deposits under their roof with an annual growth rate of more than 7% despite falling rates nationwide.

Pawtucket Credit Union’s CD Rates

Pawtucket Credit Union has certificates of deposit that can be opened online and certificates of deposit that can be opened by visiting one of their 15 branch locations.

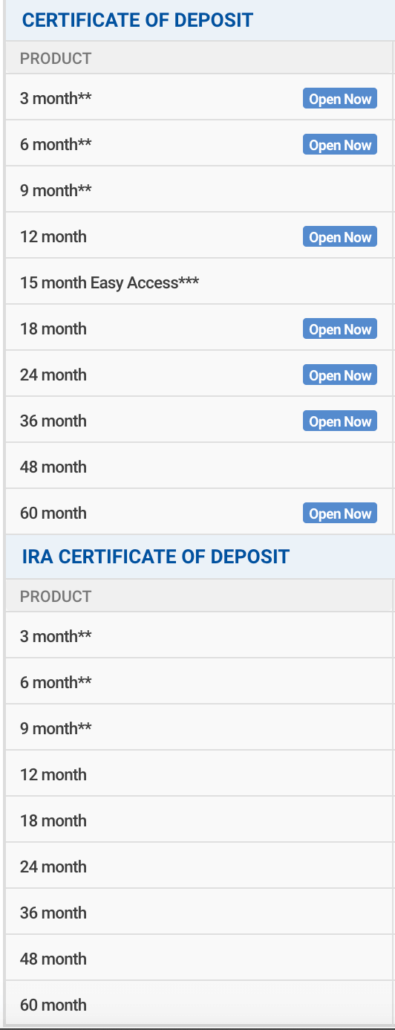

When browsing Pawtucket Credit Union’s deposit rate page look for the little blue button titled “Open Now” to see whether or not it can be opened online. If there is no blue button, then you must go into a branch.

You’ll see the button next to the product name if it can be opened online. See below.

Below are all of Pawtucket Credit Union’s standard certificates of deposit and their APY. All of these standard CDs come with a minimum deposit requirement of $1,000.

| CD Term | Annual Percentage Yield (APY) |

| 3 month* | 0.40% |

| 6 month* | 0.60% |

| 9 month* | 0.40% |

| 12 month | 0.40% |

| 18 month | 0.55% |

| 24 month | 0.60% |

| 36 month | 0.70% |

| 48 month | 0.70% |

| 60 month | 0.70% |

*Their 3 month, 6 month and 9 month CDs calculate interest using simple interest, the rest are compounded daily.

Below are Pawtucket Credit Union’s IRA CDs and APY. They currently provide the same yield as their standard CD counterparts, however, they come with a lower minimum deposit requirement of $500 and, unfortunately, none of them can be opened online.

| IRA CD Term | Annual Percentage Yield (APY) |

| 3 month* | 0.40% |

| 6 month* | 0.60% |

| 9 month* | 0.40% |

| 12 month | 0.40% |

| 18 month | 0.55% |

| 24 month | 0.60% |

| 36 month | 0.70% |

| 48 month | 0.70% |

| 60 month | 0.70% |

*Their 3 month, 6 month and 9 month IRA CDs calculate interest using simple interest, the rest are compounded daily.

15 month Easy Access CD

Pawtucket Credit Union is running a CD promotion with a 15 month term called their “15 month Easy Access CD.” This product has a minimum deposit requirement of $5,000 and comes with an APY of 0.50%.

Here’s what you’ll get with the 15 month easy access CD:

- Two penalty-free withdrawals allowed during the 15 month term.

To avoid penalty, withdrawals must be more than 6 days after account opening, and more than 6 days following each partial withdrawal; otherwise, penalty as described below for early withdrawal. Offer not applicable for retirement accounts.

You’ll also want to note, that like the 3 month, 6 month and 9 month standard CDs and IRA CDs, this 15 month easy access CD also uses simple interest rather than compounding your interest daily.

Final Thoughts

If you live in Rhode Island and are in the market for a solid APY on an FDIC-insured or NCUA-insured savings product, then keep your eye on Pawtucket Credit Union’s CDs.

Although their rates were lowered with the latest FED move, they regularly keep their APYs above the national average on many of their standard certificates of deposit products and regularly offer promotional CD’s with generous rates as well.