| Full disclosure: We may receive financial compensation when you click on links and are approved for products from our advertising partners. Opinions and product recommendations on APYGUY are those of our writers and have not been influenced, reviewed or approved by any advertiser. Learn more about how we make money. |

Every investor wants to earn a reasonable rate of return.

Your rate of return can produce an income to pay for living expenses, or funds can be reinvested to increase your investment portfolio.

Today, although interest rates are rising at an unprecedented pace, CDs (certificates of deposit) and savings account rates have been slow to keep up with the new rate environment. On top of that, a relentless and stubborn inflation figure make real returns on CDs and savings accounts nearly impossible.

For those seeking lower risk investment vehicles, there are a number of options to consider outside of traditional bank deposits.

Below is our breakdown of the most worthy alternatives to CDs and savings accounts.

Crowd Funded Real Estate & REIT Investment Platforms

Although we discuss general REIT’s further down in this article, several enticing online real estate investment platforms have popped up over the years allowing everyday, non-accredited investors to get involved in the lucrative commercial real estate investment space.

Yieldstreet is one of these platforms, but they go above and beyond real estate. It’s a great option for non-accredited investors that would like to invest in alternative investments beyond stocks and bonds. With their popular Prism Fund investors can expect to receive quarterly distribution payments of at least 7% at an annualized rate. Yieldstreet target returns are between 7 – 12% annually.

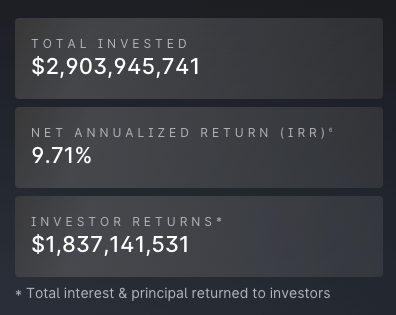

Yieldstreet stats:

Some of the asset classes in the fund include (but are not limited to):

- Real Estate

- Venture Capital

- Private Equity

- Short Term Notes

- Structured Notes

You can learn more at Yieldstreet.

Paying off High Interest Debt

Reducing debt can generate an attractive rate of return.

You can earn a higher rate of return by paying off debt that carries a high rate of interest.

If the rate of interest you remove is higher than the rates available on CDs and saving accounts, you’re financially better off.

The average interest rate on credit card debt is over 21%, and interest rates on student loans average between 4.5% and 7.6%, depending on the type of loan.

Here’s a simple example, assuming that the investor pays off the highest interest rate debt first.

- You pay off a $3,000 credit card balance with a 20% annual interest rate, saving you $600 interest expense. You now have $600 available to use toward another debt.

- Next, you apply the $600 in saved credit card interest and $4,400 additional dollars to pay off $5,000 in student debt. This debit has a 6% annual interest rate, saving you $300 in interest.

- Finally, you apply the $300 in saved student loan interest and $1,700 additional dollars to pay off $2,000 in additional student debt. This debit has a 4.5% annual interest rate, saving you $90 in interest.

The result? You invested $9,100 to pay down debt, and saved $990 in interest costs. Your return, in terms of interest costs eliminated, is over 10%. This is a much higher return than rates for CDs and savings accounts.

A growing number of investors are considering the returns from peer-to-peer lending.

Peer to Peer Lending

Peer to peer lending provides an alternative to traditional bank loans, and offers a competitive rate of return to investors.

With peer-to-peer (P2P) lending, borrowers are connected with lenders through an online marketplace, with the P2P company serving as a facilitator.

The borrower doesn’t have to go through a lengthy loan approval process. The application process is simplified, and decisions are made quickly. The lender earns a return, based on a share of the interest rate charged to the borrower.

Companies such as Upstart and Funding Circle facilitate personal and business loans. PriceWaterhouseCoopers estimates that the market could reach $150 billion or higher by 2025.

As an example, Upstart states that the average 3-year loan has an annual percentage rate of 20%, and that over 478,000 loans have originated on the site. P2P lenders can earn annual returns from 6 to 10%.

These are unsecured loans, and there is a risk of default by a borrower. Upstart’s default rate is between 4% and 9%. Fortunately, you can spread your risk by investing a small dollar amount in a number of different loans.

Both the SEC and state entities regulate P2P lenders.

ETF And Dividend Stocks

Over the long term, common stocks have offered higher returns than CD and savings accounts.

One way to measure the average return on common stocks is to use the Standard and Poor’s (S&P) 500 Index. This is an index that tracks the investment performance of 500 large company stocks.

The average annual return for the index from 1957 through 2018 is roughly 8% (7.96%). While the average return is higher, the year-to-year volatility creates risk for investors. The index generated a 34% increase in 1995, and a 38% decline in 2008.

Common stocks can be a successful investment for individuals who hold a portfolio of stocks over the long term.

An exchange-traded fund (ETF) is a portfolio of stocks that tracks the performance of an underlying index, such as the S&P 500 Index. ETFs are listed on exchanges, and their shares are traded each business day. Purchasing an ETF is an inexpensive way to invest in a diversified portfolio of stocks.

You can reduce stock market volatility by purchasing dividend stocks. These stocks pay a high dividend, as compared to the overall stock market. Typically, high-dividend stocks represent companies that are well established, and produce consistent profits.

Assuming dividend reinvestment, high-dividend stocks posted compound annual returns of 11.7% between 1986 and 2016. According to Ned Davis Research, dividend stocks posted an average annual return of 10.07% between 1972 and 2013.

Stock investors are exposed to volatility, as explained earlier. By reinvesting a high dollar amount of dividends, investors can benefit from compounding interest, or the ability to earn a return on prior dividend payments.

Compounding interest increases returns, and reduces the impact of stock price declines on the annual rate of return. ETFs and high-dividend stocks are appropriate for investors who are willing to take a moderate level of risk to earn higher returns.

Series I Savings Bond

Consumers looking to hedge against rising inflation rates can open a Series I Savings Bond through the treasurydirect.gov.

These investment vehicles are designed to hedge against inflation. You can only open one per social security number and investments max out at $10,000.

The current Series I Savings Bond yield is 7.12% and is good through April 2022.

You can also learn more in our comprehensive review here.

Corporate, Municipal, and Government Bonds

A bond is a debt instrument that pays an investor a fixed interest rate each year, and returns the original (principal) amount when the bond reaches maturity. Many investors use bonds to earn a predictable amount of income each year.

Most bonds receive a credit rating, based on their ability to make all required interest payments and repay the investor’s principal amount at maturity.

A default means that the bond missed an interest payment, principal repayment, or both. Investors should consider the bond rating for every investment, in order to minimize the risk of a bond default.

Standard and Poor’s and other institutions analyze bonds and provide a bond rating.

Investors can purchase several types of bonds.

Corporate Bonds

Debt issued by corporations to raise capital. Companies that generate consistent profits and limit the total debt can make all required debt payments. These firms typically receive a higher bond rating than other businesses with inconsistent profits.

Municipal bonds

States, cities, and local governments issue municipal bonds. The bond may be secured by the taxing power of the municipality (general obligation bonds), or funded by a specific revenue source.

Government bonds

The US federal government issues Treasury bonds. These bonds are backed by the full faith and credit of the US, and have the highest bond rating for creditworthiness.

Barclays Capital reports that bonds earned an average annual return of 4.3% from 1915 to 2014. Keep in mind, however, that inflation reduces the purchasing power of the income paid on a bond. Inflation averaged 3.2% during the same time period, meaning that the average “real” return was (4.3% – 3.2%), or 1.1%

CD and savings account investors are also subject to inflation and reduced purchasing power. So, it’s useful to compare CD and savings rates to the 4.3% annual return on bonds.

Real Estate Investing, REITS

Investors can diversify their investment portfolios and earn competitive rates of return by investing in real estate.

Investopedia explains that the average 20-year return in commercial real estate is 9.5%, while residential real estate averages 10.6%.

- Purchasing individual properties is complicated, and carries several forms of risk. You need to understand current prices in the market, so that you can negotiate a reasonable purchase price.

- You’ll need an expert who can ensure that the title of the property is legally transferred to you.

- If you want to build or make changes to an existing structure, you’ll need to get permits and follow local building code regulations.

Real estate investment trusts (REITS) allow you to invest in a portfolio of securities, and avoid the challenges of purchasing individual properties.

Like stocks and mutual funds, REITS are securities, and they trade on exchanges. You can invest in a diversified portfolio of properties, and invest in property management companies.

Kiplinger lists SITE Centers (shopping centers) and Boston Properties (commercial property) as two of the best REITs for investors.

The average 20-year return for a REIT is 11.8%.

Rewards Checking

If you’ve used credit cards and received rewards, you might consider a rewards checking account. You can potentially earn high interest rates, cash back rewards, and even signup bonuses.

Reward checking interest rates may be higher than what you’re currently earning in a checking or savings account. These accounts offer free checking, and many will refund ATM fees.

There are some drawbacks to rewards checking accounts, however.

- Debit card usage: The most common requirement is that the owner must use the account debit card a minimum number of times each month (10 times is typical). If you don’t meet the usage requirement, you’ll earn less interest.

- Types of debit card purchases: Some accounts may also require debit card purchases for a minimum dollar amount. You may not be able to meet the minimum usage requirement with a number of small purchases.

- Balance caps: The bank may cap the dollar amount that you can use to earn the higher interest rate. Read the agreement details carefully to determine if there is a cap.

If you’re self-disciplined and monitor your debit card usage and balance, you can earn a higher return with rewards checking.

Foreign Currency CDs

These CDs can offer a higher rate of return, but investors are exposed to currency risk while their deposits are active.

When the investor converts back to dollars, the owner is exposed to the currency fluctuation that took place during the tenure of his/her deposit. If the US dollar’s value has strengthened compared to the other currency, the investor will get back fewer dollars when the CD matures. Conversely, if the US dollar has weakened compared to the other currency, the investor will get back more dollars when the CD matures.

Many traditional banks do not offer these products. TIAA Bank (formerly EverBank) is the most well known institution serving the space. They have two products – WorldCurrency CDs and WorldCurrency Baskets. You can choose from a number of currencies in both developed and emerging countries. The World Currency Baskets let you diversify into a number of currencies. You can read more in our rundown of foreign currency CDs.

Home Improvements / Rent Property as Airbnb

Earn a rate of return on an asset that you already own.

Upgrade your home- particularly if you own a second home- and rent your property as an Airbnb.

Airbnb is an online marketplace that connects people who want to rent out their homes with people who are looking for accommodations in that locale. It currently covers more than 81,000 cities and 191 countries worldwide.

The company is the largest home-sharing platform in the U.S., with more than two million people on average booked every night into its listings worldwide.

Many people earn income from Airbnb, particularly if they upgrade their homes to make them more attractive to a potential renter. You can make small improvements in your kitchen, or a spare bedroom, and post photos and a video of your home on Airbnb.

The risk for Airbnb hosts is that a renter may do damage to your home. However, Airbnb’s Host Guarantee program provides protection for up to $1,000,000 in damages to covered property in the rare event of guest damage, in eligible countries.

If you travel or have a second home, you can use the time away as an opportunity to rent your home and earn income.

Use start-ups like AirDNA to estimate how much your rental property could generate in Airbnb income. Research average nightly rates plus expected vacancy rates to get an estimated monthly income report for your property.

Diversified Portfolio of Growth Stocks

Growth stocks offer a potentially higher rate of return than the broad market, with a higher level of risk. A growth mutual fund may be an option for a small percentage of your investment portfolio.

The Motley Fool explains that: “Growth stocks prioritize going from small, up-and-coming businesses to leaders in their respective industries as quickly as possible. Early on, growth stocks tend to concentrate on building up their revenue, often at the cost of delaying profitability until a future date. After a period of time, growth stocks start focusing more on maximizing profit.”

Growth stocks may not produce consistent earnings, and these firms typically reinvest available earnings into the company. In most cases, growth stocks do not pay a dividend, which means that your return is generated from an increase in the stock price.

As mentioned earlier, average annual return for the S&P 500 stocks from 1957 through 2018 is roughly 8% (7.96%). While the average return is higher, the year-to-year volatility creates risk for investors.

You can purchase a growth mutual fund that invests in dozens (or hundreds) of stocks. If a particular growth stock declines sharply in price, the impact on your portfolio is minimized.

Add Capital To Existing Business

Consider investing in yourself.

If you own and operate a successful business, you can invest additional capital. Maybe you use the added capital to fund a marketing campaign for a new product, or to buy inventory to meet seasonal demand.

A company that generates a 10% profit can use additional capital and generate a similar return. You know your business better than anyone else, and you can use the invested capital where your firm needs it the most.

Home Addition To Increase Value

If the owner has a smaller home in a highly desirable location and is considering a home sale, an addition could sharply increase the potential sale price of the home. The gain on sale may be far more than the cost of the home addition.

As mentioned above, the average annual return on residential real estate is 10.6%. However, making the right changes to your home can differentiate your property from others in the neighborhood. Talk with a realtor about an addition or remodeling project, and take advantage of your home’s location.

Private Equity Investing

If you have a high net worth, and can keep dollars invested for at least 4-5 years, private equity investing is an option for you.

Private equity funds invest in private companies that do not trade on an exchange. The fund managers work to make changes and increase the sales and profits of the purchased company. In most cases, the private equity fund attempts to sell the company for a gain after 6-10 years.

You must meet net worth minimums and other requirements before you can invest in a private equity fund. The fund also requires investors to keep funds invested for 4-5 years, so that the funds can be used to improve the company’s performance.

Private equity investing offers higher returns, with a higher level of risk. In some cases, the purchased businesses cannot be sold for a gain, or generate a loss for the fund.

Investing Options to Avoid

If you’re looking for higher rates of return, avoid these three types of investments.

Annuities

An annuity is an investment that pays a fixed stream of payments to an investor over time. Retirees use annuities that pay an income for a fixed number of years, or for the remaining life of the investor. Variable annuities allow purchasers to invest in stock and bond portfolios.

Annuities are complex, and the fees can be expensive. Many annuity investors do not understand the investment, and the fees charged reduce the rate of return.

Stock Options

Options are an investment tool that allows the buyer to speculate on the increase or decrease in the future price of a stock. Option prices are highly volatile, and some options expose the investor to an unlimited amount of risk.

Commodity Trading

Commodities are materials or agricultural products that trade on exchanges. Commodities can change rapidly in price, based on weather, crop production, and world events. Like stock options, this investment exposes the investor to a large level of risk.

If you hold Crypto long term: Cryptocurrency Savings Accounts

Crypto currency savings accounts are fairly new products that started popping up around 2017. If you already own cryptocurrency like Bitcoin, Ethereum, Litecoin or any of the smaller ones AND you plan on holding it for a while, then these may be worthy of further consideration. They can offer crypto holders between 1.5% – 14.99% APY and interest is generally paid out weekly or even daily in some cases.

Next Steps

Talk with a financial advisor, and do your homework. Consider the potential risks and rewards for each investment alternative. If you diversify your investments, you can earn a higher return than rates on Bank CDs and savings accounts.