| Full disclosure: We may receive financial compensation when you click on links and are approved for products from our advertising partners. Opinions and product recommendations on APYGUY are those of our writers and have not been influenced, reviewed or approved by any advertiser. Learn more about how we make money. |

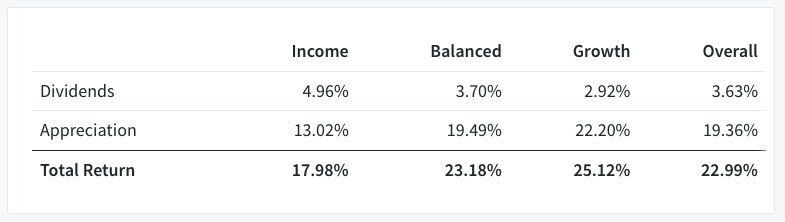

[Update February 2022: Fundrise announced that 2021 was their best year on record for investor returns at 22.99%.]

Fundrise gives investors the ability to get in on private real estate deals by pooling their assets through the Fundrise online platform. Investors can invest in real estate investment trusts (REITs), use pooled money to buy and develop residential neighborhoods or participate in the Interval Fund, which provides diversification and higher liquidity than the platform’s other options.

You don’t need to be an accredited investor to work with Fundrise. Even so, real estate investing can be risky, and fees may be out of reach for many investors. It’s crucial to invest only funds you can leave alone for at least five years to see the maximum possible return and minimize fees.

Get started today with Fundrise.

The barrier to entry with real estate investing is often high enough that beginners shy away from this potentially lucrative sector. Fundrise offers a $10 account minimum and a 12-month waiver on advisory fees, making it an accessible alternative to many competing real estate investment platforms.

What is Fundrise?

Fundrise is an online investment platform that facilitates institutional-quality real estate investing for people who aren’t yet institutional investors. You can choose how much to invest since there are no mandatory minimums to get started. While you can decide your investing strategy, the actual investments are selected by a team of analysts that match various assets to your goals. Your portfolio will change over time as Fundrise acquires new investments.

There’s no need to be (or become) a real estate investing expert to experience success and see your money grow with Fundrise. You can keep up with the latest developments related to individual investments in your Fundrise portfolio. Still, there’s a management team in charge of making big decisions about where and when they invest your money to get the most significant return.

Fundrise Quick Stats

As of January 2022, Fundrise has:

- 210,000 active investors

- More than $7 billion in asset transaction value

- Over $160 million in dividends paid to investors

How Does Investing With Fundrise Work?

New users create an account with the platform and connect a funding source. Decide how much you want to invest initially and provide details about your preferred investment strategy. The properties you invest in at first form the “engine” that drives your portfolio. You can continue to add money to your Fundrise account for investing purposes, but even if you don’t, the team at Fundrise may diversify your investments when new opportunities match your strategy.

Fundrise publishes regular updates about various investments, including exit updates, construction updates, and news relevant to the properties.

The platform advertises that they are suitable for both experienced and new investors. If you decide to invest with Fundrise, you’ll receive regular updates about their strategists’ plans and observations about the real estate market in general.

Fundrise is the first platform providing software-driven reporting for private equity real estate investing. Here’s what you’ll get with the Fundrise investor dashboard:

- Newsfeed: includes educational material to help give investors context for important concepts like how appreciation powers return.

- Real-time performance reporting: see exactly how much your account has appreciated and how much it has earned in dividends to date.

- Investment goal tool (Core level accounts and higher): shows whether projected future performance is on track to meet stated goals.

- Auto invest: allows users to set up automatic deposits for additional investments.

Are Fundrise Investments Any Good?

Investing in non-traded REITs carries some significant risks but can also be lucrative. Fundrise investments potentially generate quarterly dividends, and shares may grow in value over time.

On average, Fundrise’s investments produced average annualized returns of 8.76% to 12.42% between 2014 and 2019. In 2019, Fundrise had a net return across its entire platform of 9.47%. Of course, not all investors experienced a precise 9.47% return; most earned a bit more or a bit less than 9.47%.

In 2020, the year of COVID, Fundrise returned just 7.42% to investors. Last year, however, Fundrise had its best year on record bringing in a whopping 22.99% to investors.

Investors with Fundrise who had the highest return on their investment were the ones who had been with the platform the longest. The time it takes to see a good return may help potential investors understand that succeeding with Fundrise requires patience.

A Note About Fundrise Liquidity

Investors that need to liquidate shares prematurely may incur costs. They may have to wait to receive funds, as well.

Fundrise Platform Portfolio Performance

| Year | Investor Returns |

| 2014 | 12.25% |

| 2015 | 12.42% |

| 2016 | 8.75% |

| 2017 | 11.44% |

| 2018 | 9.11% |

| 2019 | 9.47% |

| 2020 | 7.42% |

| 2021 | 22.99% |

Based on this 8 year performance, Fundrise provided an annualized average return of 11.73% to investors.

Fundrise Returns vs Stocks and Savings:

To put Fundrise’s historical returns into perspective, consider the following yields from the S&P 500 and your average savings account over the same time period.

| Year | S&P 500 | Avg Saving Rate |

| 2014 | 11.39% | 0.06% |

| 2015 | – 0.73% | 0.06% |

| 2016 | 9.54% | 0.06% |

| 2017 | 19.42% | 0.06% |

| 2018 | – 6.24% | 0.08% |

| 2019 | 28.88% | 0.09% |

| 2020 | 16.26% | 0.05% |

| 2021 | 26.61% | 0.05% |

Although the S&P has done well over this time period, its volatility can be too much to stomach for some people.

Conversely, savings accounts, while pretty much risk-free when backed by the FDIC, have provided almost nothing for savers in terms of yields.

Fundrise Returns VS CrowdStreet, DiversyFund and Yieldstreet:

Although Fundrise is one of the early entrants to market, they’re certainly not the only real estate crowdfunding investment platform available.

Here are some of the other big players and the annual returns they’ve provided investors since their inception.

| Fundrise | CrowdStreet | DiversyFund | Yieldstreet | |

| 2014 | 12.25% | NR | NR | NR |

| 2015 | 12.42% | NR | NR | 10.61% avg |

| 2016 | 8.75% | NR | NR | 10.61% avg |

| 2017 | 11.44% | NR | 18% | 10.61% avg |

| 2018 | 9.11% | NR | 17.3% | 10.61% avg |

| 2019 | 9.47% | NR | NR | 10.61% avg |

| 2020 | 7.42% | 17.7% | NR | 10.61% avg |

| 2021 | 22.99% | NR | NR | 10.61% avg |

Not all real estate investment platforms are alike, so be sure to research them each individually before making a decision.

Fundrise vs. REITs

Real estate investment trusts (REITs) trade on stock exchanges, allowing investors to purchase or sell stock quickly. Even so, a big part of the real estate investment market is private and only available to institutional investors. The JOBS Act of 2012 allowed private investments for a wider group of investors. Fundrise jumped at the chance to take advantage of opportunities created by the JOBS Act and become one of the first companies to provide high-quality investment opportunities to everyone.

Fundrise specializes in proprietary public non-traded REITs (eREITs), similar to those on the stock market. Some non-REIT fund options (eFUNDS) are available to certain investors.

Assets in many publicly traded REITs are comparable to assets available in Fundrise eREITs. Fundrise’s eREITs invest primarily in affordable housing across the Sun Belt. This region of the United States stretches from southeast to southwest. It includes Alabama, Arizona, Florida, Georgia, Louisiana, Mississippi, New Mexico, South Carolina, Texas, the lower two-thirds of California, certain areas North Carolina, Nevada, and Utah.

Comparable REITs, including Camden Property Trust, Invitation Homes, and Mid-America Apartment Communities, also own single-family residences in growing markets across the southern states.

There are a few critical differences between eREITs and publicly-traded REITs, however.

Pricing and liquidity: REITs provide instant liquidity, limited only by the stock market’s trading hours. Fundrise investors purchase shares of eREITs, but can’t pick specific eREITs. Some investments accept limited new investments, as dedicated by the constraints of the JOBS Act. Fundrise can halt redemptions if the market is in turmoil like it did early in 2020. So liquidity may be limited with eREITs as opposed to REITs.

Volatility and valuation: The stock market significantly impacts REIT share prices, as the value of shares with this type of investment correlates to the stock market. There’s no connection between the stock market and eREITs, however. Investors buy and sell eREIT shares at their NAV, which is updated quarterly or semiannually.

Fees: REIT investors pay the management team overseeing the real estate portfolio. For example, the Vanguard Real Estate ETF charges a 0.12% expense ratio. Fundrise acts as the manager of eREITs and eFunds, so investors pay the platform an annual investment advisory fee. Fundrise’s fees are higher; eFunds and eREITs charge investors 0.15% of their portfolio.

Many REITs have internal managers. Thus, investors aren’t paying fees to an external manager who oversees the real estate portfolio; and instead, they pay the REIT’s management team.

Strategy: Investors can choose between two main types of REITs; equity and mortgage. Equity REITs are primarily residential, office, industrial, self-storage, infrastructure, hospitality, diversified, data center, timberland, healthcare, retail, and specialty. Mortgage eREITs invest in pools of mortgage loans backed by commercial or residential real estate. This allows investors to narrow down their REIT selection based on sector. Fundrise eREITs focuses on affordable housing in the U.S., only. Investors interested in this trend may prefer Fundrise as an investment platform.

Fundrise is a niche platform, so it may not appeal to many investors. At the same time, REITs are versatile enough that many investors’ plan to diversify their portfolio includes this type of investment.

How To Get Started With Fundrise

New Fundrise investors must create an account online through the Fundrise platform. After choosing a portfolio strategy, Fundrise managers diversify the investor’s funds across multiple investment funds tailored to meet the stated goals in the portfolio strategy.

Even after the initial investment, fund managers work to add new assets to the portfolio over time. There’s no additional investment required to receive this service, and adding assets allows portfolios to become stronger over time.

Users can watch assets evolve through the in-app newsfeed. Fundrise regularly publishes asset updates like new construction progress, market data trends, project completion alerts, and occupancy reports. This level of transparency sets Fundrise apart from other investment firms.

Interval Fund Option

Interval Funds are more liquid than eFunds and eREITs with Fundrise. Investors can opt into the Fundrise Interval Fund for better ongoing access to invested funds via quarterly repurchase offers. Unlike eFund and eREIT investments, Fundrise Interval participants won’t pay a penalty if they decide to liquidate Interval Funds during a quarterly repurchase offer.

The Interval Fund is also larger than other funds on the Fundrise platform. It may offer a higher level of diversification, and it provides the same benefits of eFunds and eREITs.

Fundrise Fees

Real estate investors are familiar with the high fees often associated with exposure to this sector. Hidden management fees and high advisory fees limit potential returns. With Fundrise, investors can own real property at a low cost.

New software designed by the Fundrise team makes many required processes less expensive, and Fundrise passes those savings on to their investors in the form of fewer and smaller fees.

All real estate business is also handled in-house, as Fundrise works directly with operators and real estate developers to manage deals one-on-one. Eliminating most intermediaries allows the company to keep fees low.

Here’s a breakdown of Fundrise fees.

- Annual Investment Advisory Fee: 0.15% (waived under certain circumstances)

- Standard Portfolio Fee: 0.85% annually

- Redemption Program Participation Fee: 0% reduction in share price value if investors sell shares back to Fundrise within 90 days; 3% if shares were held 90 days to 3 years; 2% if shares were held 3-4 years; 1% if shares were held 4-5 years; zero fees if shares were held more than five years.

All investment funds, EFT, and REITs incur expenses offset by annual management fees paid by investors. However, these fees are rolled into the fund, making it difficult for investors to understand how much of their gains are reduced by fees.

Fundrise’s fees are straightforward. Investors pay $8.50 per year for every $1,000 invested on the platform. Those fees go toward the operating expenses of the real estate projects in Fundrise’s investor portfolios. They may pay for construction, zoning, accounting, or other project-specific costs.

Fundrise eFund investors may also experience Liquidation fees and Development fees applied at the fund level, and these fees aren’t paid by investors directly. eFunds often incur many of the exact costs as eREITs, but eFunds pay the expenses directly, while eREIT projects cover those costs with money from outside borrowers.

Is Fundrise Worth it For New Investors?

Maybe. Many online real estate platforms are available only to accredited investors (those with a net worth of $1 million or more and an annual income of $200,000 or more). Fundrise is available to any investor. The low investment minimums and intuitive platform make it ideal for those who want to get into private real estate investing but don’t have hundreds of thousands of dollars to sink into a fund.

New investors should read the fine print and have a good idea of how and when they could get their money back if they need to close their positions with Fundrise. They should also be careful of fees and understand that liquidating before they’ve been with Fundrise for at least five years could carry a hefty penalty.

Fundrise real estate investments may work for you if:

- You have some experience as an investor, and you have money to invest but aren’t accredited.

- You plan to leave the money you invest with Fundrise alone for at least five years.

- Your personal financial situation is stable, and you understand the risks associated with investing in the real estate market.

- You understand that you will pay fees with Fundrise, and you could lose money on your Fundrise investments.

Fundrise Customer Reviews

Fundrise is a unique platform, and customers who write reviews seem pleased overall with their experience. The company generally receives negative reviews from investors who object to the lack of liquidity with eREITs and eFUNDs, even though the company clearly states the fee structure multiple times throughout the investing process.

Reviewers seem happy with the returns they get from their Fundrise investments, although some who tried to withdraw funds before they had been with Fundrise for five years weren’t pleased with the associated fees.

Fundrise Reviews on Trustpilot

The Fundrise has 312 reviews on Trustpilot:

- Excellent: 84%

- Great: 4%

- Average: <1%

- Poor: <1%

- Bad: 10%

Here are a few Trustpilot reviews from verified Fundrise investors that may help you decide whether the platform is a good fit:

“This is not a savings account, a publicly-traded REIT, or anything else that you can just sell and get your money back. This is a private equity investment and anyone who invested should have taken time to carefully consider the amount of money they were putting in this.” -Paul Bommarito

“I find it very easy to put money in but very hard to take money out. The process should be the same both ways. Other than that, I think the design and implementation has been pretty good compared to your competitors (iFunding.co)” -Raymond L

“I’ve been with Fundrise for 4 years with a total return of 27%. I reinvest my dividends, and get a small increase almost every single day. This investment is for the long haul, and is ideally for those that would like to supplement income with dividends. Interestingly the negative reviews are accurate. Fundrise is not liquid. You’ve chosen to invest in real estate. Your money is literally tied up in property. You cannot just pull your money out when you feel like it. I no longer add funds to my Fundrise account. I just allow the reinvested dividends and compound interest to do its job.” -Terez Lundquist

Fundrise on the BBB Website

Fundrise has 77 published customer reviews on the Better Business Bureau (BBB) website. The company has an average rating of 3.66 stars out of five. The BBB closed 59 customer complaints in the past three years and 32 in the past 12 months.

Customers typically complain about having difficulty getting their money out of the investments promptly. Fundrise responds to each customer complaint, often with some variation of this statement:

“For context, under our redemption program, all redemption requests that are made during any given quarter, regardless of when the request is made, remain in a pending state until the end of the quarter at which time they are expected to be reviewed and processed.

We make an extensive effort to ensure that investors are made aware of this fact prior to placing an investment with us. For example, as part of the process of placing an investment, each investor is required to acknowledge the following: ‘I recognize that my investment is in real property, which is fundamentally a long-term, illiquid investment; that liquidations, if approved, are paid out quarterly for the eREITs and Interval Fund, and monthly after a minimum 60-day waiting period for the eFund; and requests for liquidation for the eREITs and eFund may be suspended during periods of financial stress‘”

Fundrise on Reddit

Reviews of Fundrise as an investing platform from Reddit users line up with Trustpilot and BBB reviews. Investors who didn’t understand Fundrise’s fees for early withdrawal of funds weren’t pleased with their experience.

“I invested a lot of money through Fundrise early last year and I just withdrew all of it after a 3 months waiting period. Overall, I lost money with Fundrise.com due to minimal dividends and 3% penalty for redeeming investment after 15 months.”

-re-emerald

“Fundrise is legit, but it might not be the best way for you to get exposure to real estate. A publicly traded REIT or REIT index fund is much easier to get in and out of. Private REITs like Fundrise should really be held until they liquidate, which could be five or ten years. I like Fundrise but I think an illiquid long-term investment like this should not be a core part of your portfolio.”

-Citryphus

“Invested a few times up to a certain amount, and am holding any further investments. I think the actual returns are/will be less than the claims. Also, look at the “process” to get your money out.”

-RedditDogX

Is Fundrise Worth it?

The Fundrise platform provides an easy-to-navigate way to diversify your investment portfolio into the world of real estate.

The platform may be ideal for investors with a portfolio that includes stocks and bonds and are willing to leave their investments alone for at least five years. Investors interested in real estate may find that his platform allows them to easily access high-quality assets while experiencing returns that far outpace REIT stock investments.