| Full disclosure: We may receive financial compensation when you click on links and are approved for products from our advertising partners. Opinions and product recommendations on APYGUY are those of our writers and have not been influenced, reviewed or approved by any advertiser. Learn more about how we make money. |

Yieldstreet is an online investment platform that offers several alternative investments options.

With Yieldstreet one can invest in marine projects, art, real estate, litigation deals, and commercial loans like merchant cash advances.

Most of the assets available through Yieldstreet are open to accredited investors only. Their Prism Fund, which launched in August 2020, is available to non-accredited investors with a minimum investment of $500.

While competing alternative investment and real estate investment sites allow investors to buy a portion of a block of commercial real estate properties, Yieldstreet crowdfunds debt that finances those (and other) deals.

The company’s first offering rolled out in 2015 in litigation finance, pairing investors with plaintiffs who need a loan to cover lawsuit expenses before the settlement.

While there’s always a risk of default, Yieldstreet investors can earn interest payments and eventually receive a principal return over the investments’ life.

You can learn or get started on YieldStreet’s website here.

What is Yieldstreet?

Yieldstreet is an online platform that allows investors to participate in crowdfunding a variety of alternative investments backed by several asset classes, including real estate. Investing with Yieldstreet may provide passive income and allow diversification of portfolios to reduce correlation to the stock market.

Qualified Yieldstreet investors can choose from short-term investments (fund options, equity deals, etc.) with a maximum term of three years.

Yieldstreet employs experts in every asset class offered on the platform, and they vet the sponsors and originators who want to list on the platform as well as the deals offered to investors. Retail investors may not have the knowledge necessary to properly evaluate the deals offered on Yieldstreet, so it’s crucial that there are experts on staff there who can make sure that investors get access to high-quality deals.

Yieldstreet favors investment opportunities with the following characteristics:

- Low minimums

- Short durations

- Target 8%+ yield

- Low stock market correlation

There are risks associated with investing in debt, even if assets secure it. A higher potential reward attracts investors willing to take a chance, but hopefully, investors realize that they may lose money with Yieldstreet.

Yieldstreet backers include Citi (NYSE: C); the company plans to use Yieldstreet to invest $2 billion for wealthy clients. Billionaire philanthropist George Soros is also backing Yieldstreet.

Yieldstreet Pros and Cons

✅ Pros:

- Access to alternative investments including art, real estate, lawsuits, debt, etc.

- Individuals can invest in privately structured credit deals

- Open to non-accredited investors.

- Tangible assets back each investment.

- Easy to use platform.

- Can be managed online or through mobile apps.

🛑 Cons:

- Illiquid investments.

- Many investments are available only to accredited investors.

- Higher fees than competing platforms.

- Consumer complaints and customer ratings raise concerns.

You can learn or get started on YieldStreet’s website here.

How Does Investing With Yieldstreet Work?

To invest with Yieldstreet, users look for a deal on the platform that interests them. They can search by asset type, loan term, and net yield parameters. Investments are a loan to the asset owner, with the asset serving as collateral for the loan.

Most of the investments available on the Yieldstreet platform are for accredited investors only. Accredited investors must meet the following criteria:

- Minimum net worth of $1 million, excluding the value of a primary home

- Minimum annual income of $200,000 ($300,000 for couples filing jointly) with the expectation that current income will continue.

Prism Fund Investment Requirements

The Yieldstreet Prism Fund is available to non-accredited investors as of late 2020. Retail investors can access multiple investment opportunities across several asset classes in a single fund.

Minimum investments for the Prism Fund are $500, which is much lower than Yieldstreet investments reserved for accredited investors.

How Yieldstreet Sources Investments

Yieldstreet investors lend money through the platform and make a return on the yield borrowers pay. Yieldstreet charges fees to manage the loan, collect payments from borrowers, and distribute funds + interest to borrowers. If a borrower defaults on their loan, Yieldstreet works to recover the investors’ funds.

Minimum Yieldstreet Investment

Certain investments on the Yieldstreet platform require an initial investment as low as $10,000. These investments are likely Borrower Payment Dependent Notes. Special Purpose Vehicles (SPVs) structured as LLC subsidiaries of the platform are owned by investors, and minimums may be higher for SPVs.

Short-term note options have a $1,000 minimum investment requirement.

How Investors Keep Tabs on Their Account

Investors can check their portfolios on the Yieldstreet platform to understand how their specific investments perform over time, the amount of money earned so far, and progress toward the fund’s goals. Yieldstreet sends every investor monthly and quarterly statements and updates any time there’s new activity with their investments.

What You Should Know About Yieldstreet Before Investing

Investment minimums: Yieldstreet states on their website that the typical minimum investment is $10,000. However, deals in the past have offered minimums of $5,000, and some reach a $60,000 minimum requirement.

Type of investments: Yieldstreet investments are debt-related, and investors lend money to the platform to fund high-risk loans in various sectors. Fortunately, the loans are secured by property, which reduces the financial risk if a borrower defaults.

Yieldstreet platform: Investments featured on the website include details like the minimum and maximum investment accepted, expected annual return, duration of the investment, the total offering size, and information about why Yieldstreet recommends the investment, any associated risks, expenses, and projected repayment schedule.

Asset-based investing: Yieldstreet investments are backed by underlying assets, which helps protect investors from losing the money they invest on the platform.

Fees: Annual management fees range from an average of 1% to 2.5%. There may also be an originator listing fee. Certain investments have an annual fee of $100 to $150 during the first year and $30 to $70 in subsequent years. Expenses come out of initial interest payments.

Self-directed IRA option: Investors can choose to participate in Yieldstreet’s opportunities through a self-directed IRA. The custodian broker is IRA Services.

Liquidity: Yieldstreent investments can’t be cashed out at any time during the target duration.

Investments have limited availability: Investments are open for a set period of time and are first-come-first-served.

Are Yieldstreet Investments Any Good?

Yieldstreet has a 7% to 12% target rate of return.

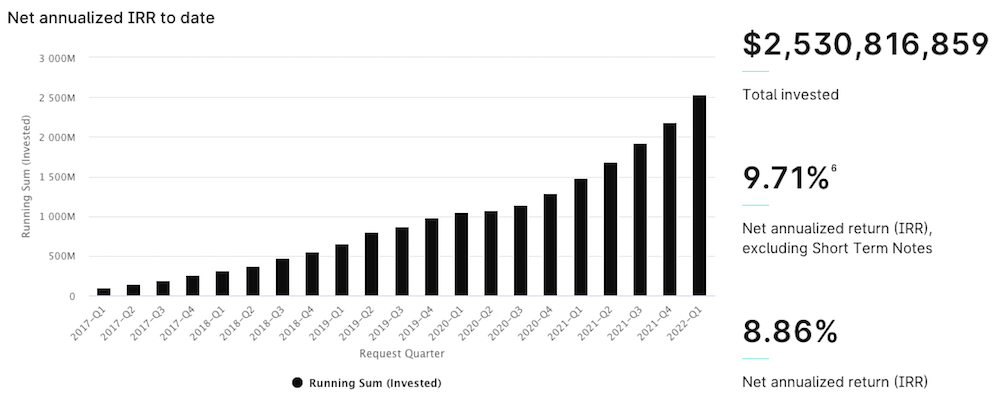

To put this into perspective, private investment vehicles had an internal rate of return (IRR) of 9.71% across all investments between 2015 and 2021 after the deduction of expenses and management fees. This is down from ~11.0% across all investments in February 2022 when we last surveyed their investor returns.

Investors have entrusted Yieldstreet with $2.3 billion since the company’s inception. As of early 2022, the company has returned nearly $1.35 billion of capital to investors, $189 million of which is interest. In 2020, Yieldstreet appeared on the 2020 Inc. 5000 and was ranked number 46 on the list, a collection of the fastest-growing privately held companies in the United States.

As of January 2022, more than 350,000 people have joined the platform. Each investor requests on average 6.5 different investment vehicles to spread their funds across.

Yieldstreet has experienced some challenges, and it’s willing to go after borrowers if they default on loans. In 2020, the company won a $77 million judgment in U.K. courts. A vessel deconstruction project didn’t go as planned, and the borrower defrauded numerous investors, including Yieldstreet. The lawsuit allowed the company to seize assets in an attempt to return investors’ money as promised.

Assuming economic conditions remain strong, investors with Yieldstreet could reasonably expect the company to continue to make profitable loans yielding the promised rate of return. If borrowers default, the company is expected to continue to make every effort to recoup their investors’ money.

Several deals on Yieldstreet are short-term, with projected high-interest yields. Each deal on Yieldstreet has unique risks, however. Lower-than-average minimum investment amounts for nonaccredited investors may attract those who have less than $1 million in the bank but want to get involved in non-traditional deals. Building a diversified collection of loans could help reduce the overall risk of default resulting in permanent losses.

A Note About Yieldstreet Liquidity

Yieldstreet investments are illiquid, and each individual investment opportunity has a term of 180-days to four years. Like other crowdfunded investments, it’s not possible to pull money out of the investment before its end date.

The Prism Fund has a duration of 48 months. During this time, investors can’t liquidate their assets and receive a return of capital. It may take up to one year after the fund’s end date for investors to receive their capital plus interest. Certain investments offer limited liquidity every quarter, however.

Yieldstreet vs. REITs

Investors interested in the real estate market can buy shares in real estate investment trusts (REITs) or invest directly through a platform like Yieldstreet. REITs allow investors to buy and sell stock quickly, just like investing in any other stock. Even so, like the investments on the Yieldstreet platform, much of the REIT market is reserved for institutional investors.

Yieldstreet investments are illiquid; investors must wait until the target date attached to the specific investment to gain access to their money plus any interest it earned. Target dates aren’t guaranteed, however, and investors may end up waiting longer than they planned to access their investment funds. REITs provide instant liquidity, restricted only by the stock market’s operating hours.

REIT values fluctuate according to the stock market, while alternative investments like Yieldstreet offerings are largely unrelated to stock market activity.

Yieldstreet vs. Competitors

Here are some of the other big players in the online alternative investment world and their annual returns to investors since inception.

Keep in mind, these online platforms primarily provide passive real estate investment products.

| Fundrise | CrowdStreet | DiversyFund | Yieldstreet | |

| 2014 | 12.25% | NR | NR | NR |

| 2015 | 12.42% | NR | NR | 9.71% avg |

| 2016 | 8.75% | NR | NR | 9.71% avg |

| 2017 | 11.44% | NR | 18% | 9.71% avg |

| 2018 | 9.11% | NR | 17.3% | 9.71% avg |

| 2019 | 9.47% | NR | NR | 9.71% avg |

| 2020 | 7.42% | 17.7% | NR | 9.71% avg |

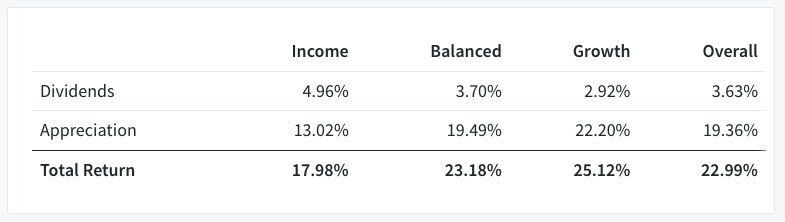

| 2021 | 22.99% | NR | NR | 9.71% avg |

Not all real estate investment platforms are alike, so be sure to research them each individually before making a decision.

Yieldstreet Fees

Yieldstreet doesn’t impose trading fees, commissions, or inactivity fees, which may be attractive to investors who want to diversify but don’t want to get hit with a ton of fees. The annual management fee ranges from 1% to 2% of assets. Prism Fund investors pay an annual administrative fee of 0.50%.

Flat annual fund fees vary according to the investment and are deducted from initial contributions. Expect a $100 yearly fee for Special Purpose Vehicles during the first year and $70 for subsequent years. Borrower Payment Dependent Note investors pay $150 during the first year and $30 for the following years.

Short-term notes don’t have fees.

Each investment’s fees are detailed on the deal page. Yieldstreet may impose a listing fee or deal origination fee, as well. For example, the Prism Fund has a 1% annual management fee with a maximum annual administrative fee of 0.5%. The Aviation Fund has a 0% to 0.25% management fee and a 0% to 2.5% incentive fee.

Because the fees vary for each investment, it’s crucial to evaluate each option and understand the fees before proceeding with an investment.

Is Yieldstreet Worth it For New Investors?

Maybe. New investors who have a solid portfolio and want to diversify should fully understand how Yieldstreet works before committing to an investment. They should understand that they may not get their investment back for several years, and there’s a risk of losing their money.

Understanding Crowdfunded Debt

Yieldstreet has several resources designed to help new investors understand how crowdfunded debt could produce returns. This information is available to potential investors even before they create an account. After opening an account, detailed information about each asset class and individual investments is readily available, as well.

Yieldstreet Customer Reviews

Yieldstreet doesn’t fare so well in customer reviews. There are only a few reviews on Trustpilot, and they are generally negative. Many customers who wrote reviews on various platforms seem disappointed with their inability to get their money out of the investment before the target end date. They didn’t seem to understand the terms of the investment with Yieldstreet.

Yieldstreet on the BBB Website

Yieldstreet has an F rating on the Better Business Bureau (BBB) website, with 20 user reviews. Yieldstreet reviewers gave the investment firm an average of 2.05 stars out of five stars. Many negative reviews point out that an advertised $200 bonus was difficult or impossible to receive from Yieldstreet.

Here are two reviews that may help you decide whether to invest with Yieldstreet:

July 21, 2021

“As a retired hedge fund manager who invested in equities and distressed debt, I had high expectations for what YieldStreet should be, and I have been very impressed. The investments have worked, and my returns have been exactly what I expected. They provided help along the way, from detailed deal memos and access to YS analysts, to simplified tax reporting and, most importantly, an easy and friendly mobile app. I have been very happy. My only gripes would be that the timing and attractiveness of the new offerings have been choppy, and I prefer single-name investments over blind pools, but a lot of the recent offerings have been funds…”

-Kevin L.

July 12, 2021

“I’ve been an investor with Yieldstreet for 3-4 years now. They are, in my view, a responsible investment firm offering very favorable, secured returns for Accredited Investors.. Yieldstreet offers the opportunity to invest in secured bridge loans as well as an increasing number of other related investment funds and vehicles normally available only to institutions and very high net worth individuals, earning 7-11% interest or higher. At the moment, I’ve put more than 50% of my investments into it, a reflection of the poor returns of conventional fixed investments, and an overpriced equity market. However, this is definitely not for everyone, which is my main reason for not rating 5 stars..”

-Keith

Yieldstreet on Reddit

Reddit users are not fans (in general) of Yieldstreet. They are suspicious of the investment quality offered by the platform and seem to prefer other investment options.

“I have experience with YieldStreet and FundRise, and my advice is to steer clear of any startup promising high returns and low risk. Go with a mutual fund or stable dividend stocks (4%+ yield) like Verizon. The reality of platforms like YieldStreet is that you’re getting the bottom of the barrel – I’ve already had two YieldStreet investments go into default because they deal with shady companies that can’t get funding elsewhere.”

-Absolutboss

The whole appearance of every loan is ‘we worked hard to get Yieldstreet members a chance to participate in this high quality, private investment opportunity!’ The truth is actually ‘no one else would loan them money because it’s so risky so they came to us'”

-dinedal

Yieldstreet Customer Service

Investors requiring assistance can contact Yieldstreet customer service by emailing investments@yieldstreet.com or call the company at 844-943-5378. The site doesn’t have a live chat feature, but representatives aim to return emails within 24 hours.

Is Yieldstreet Worth it?

Yieldstreet provides individual investors with a means by which to invest in privately structured credit deals. The platform offers the unique opportunity to diversify into offerings typically reserved for institutional investors.

Not all loans through Yieldstreet have performed well for investors. Overall, the platform has a solid track record of generating passive income backed by alternative assets.

Investors who understand alternative asset classes, have discretionary income to spend on the investment, and are comfortable with illiquid investments, may find that Yieldstreet provides access to the type of diversification they want.

You can learn or get started on YieldStreet’s website here.