| Full disclosure: We may receive financial compensation when you click on links and are approved for products from our advertising partners. Opinions and product recommendations on APYGUY are those of our writers and have not been influenced, reviewed or approved by any advertiser. Learn more about how we make money. |

In the 13+ years following the 2008 financial crisis, the stock market has seen some of its biggest gains in history.

The S&P 500 has only had 3 years of negative returns during this period. The worst year, 2018, only dipped 6.24% according to macrotrends.net, while the best 3 years produced annual gains of over 25%. The other 10 years saw ~10%+ growth with most years in the teens.

Needless to say, investing in stocks has captured new audiences and capital from large swaths of retail investors.

That said, while investing in individual stocks can be exciting, it can also be tremendously challenging even in favorable markets. That is why a whole industry of stock advisors has grown over the years, with many posting eye-popping returns.

In this review, we’ll take a look at Stansberry Research to see if this service is legit and worth the cost of membership.

What is Stansberry Research?

Stansberry Research is a privately owned publishing company founded in 1999 by Frank Porter Stansberry with headquarters in Baltimore, Maryland. Its parent company, The Agora, also owns Common Sense Publishing, FSP Financial Services, Port Phillip Publishing, and Fleet Street Publications. The company currently publishes hundreds of newsletters each year. Bill Bonner, owner of The Agora, is a leader in the field of persuasive copywriting.

Stansberry Research Podcast: Free Stock Picking Advice

Before you pay for Stansberry’s research, listen to the Stansberry Investor Hour podcast to get a feel for the tone and depth of research you can expect from a paid subscription. Dan Ferris interviews guests with specialized knowledge of the current economic climate. He covers dynamic topics like inflation, how to find gains in resource stocks, and how to find long-term trends among inflated valuations.

Stansberry Investor Hour is available on Apple Podcasts.

Are Stansberry Research Stock Picks Any Good?

Yes. Stansberry Research chooses worthwhile stocks targeted at certain investment styles. The company is also well known for providing market and industry commentary to help investors understand how the economic environment may influence individual stock performance.

Stansberry Research’s stock picks may work for you if:

- You classify yourself as a passive investor with a long-term strategy; Stansberry Research doesn’t make recommendations designed for day traders.

- Your personal financial situation allows you to invest in single stocks without fear that you’ll go broke, even if the stock doesn’t do well.

- You have a portfolio of at least $20,000 to help justify the cost of a subscription to one of the Stansberry Research newsletters.

- You have some experience investing and are comfortable with the fact that you may lose money in the stock market.

Stansberry VS Motley Fool

The Motley Fool (our review here) is an investment advisory newsletter service and one of the most popular in the industry. Their history stretches 20 years and in that time they have picked some of the most successful stocks.

Here’s a look at their popular subscription offers and the annual returns those picks have provided investors since inception to give you an idea:

| Motley Fool Service | Inception | Returns | S&P 500 | |

| Stock Advisor | 1993 | +508% | +134% | |

| Rule Breakers | 2004 | +270% | +115% |

March 2022 Promotion! Join Motley Fool Stock Advisor for just $79.99/year (normally $199.99/year).

Details About Stansberry Research Subscription Services

You can choose from three newsletter subscription tiers to get recommendations from the Specialized Investment Research team at Stansberry Research.

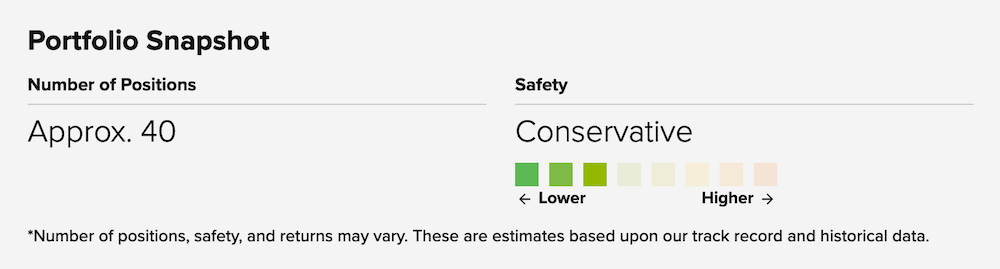

The Total Portfolio

The Total Portfolio includes about 40 recommendations ranging from safe income stocks to riskier small cap investments. This newsletter is positioned as advice for those seeking “the ultimate commitment to their financial future.”

Some Total Portfolio Results:

- 293% gain in consumer electronics

- 265% gain in digital business

- 189% gain in cryptocurrencies

- 103% gain in comfort foods

Overview:

- Number of positions: ~40

- Safety: Conservative

- Publishing frequency: Monthly

- Recommended amount of capital to get started: $100,000

- Typical holding period: One to three years

Membership includes: An “all-access pass” to a model portfolio based on the best ideas from Stansberry Research. You’ll get lifetime access to all underlying research behind each of Stansberry Research’s 12 most popular services. This newsletter suggests the exact number of shares to purchase for every $100,000 invested.

The subscription also includes The Capital Portfolio and The Income Portfolio.

With a Total Portfolio subscription, you’ll get access to Stansberry publications including True Wealth, Retirement Millionaire, Commodity Supercycles, Stansberry’s Investment Advisory, Extreme Value, Stansberry Gold & Silver Investor, Income Intelligence, Stansberry’s Credit Opportunities, Stansberry’s Big Trade, True Wealth Opportunities: Chian, True Wealth Opportunities: Commodities, Retirement Trader, True Wealth Systems, and Cannabis Capitalist.

Price for new subscribers: The Total Portfolio can not be purchased online. If you are interested in learning more, please call (888) 863-9356 to speak with a customer service representative.

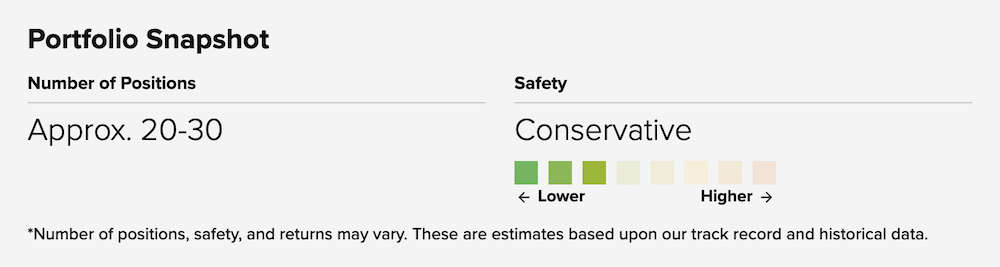

The Income Portfolio

The Income Portfolio includes advice designed to help you invest to generate extra monthly income. This newsletter provides retirees and those who want to retire soon with 20-30 stock recommendations including bond funds, income-generating stocks, and fixed income bonds. The goal of this newsletter is to help you keep your investments safe while providing reliable income from a low-risk investment portfolio.

Some Income Portfolio Results:

- A 10.1% yield from a market-leading mortgage real estate investment trust (“REIT”).

- An 8.2% yield from a great income generator with lower volatility than the overall market.

- A 7% yield from a cyclical heavyweight in plastic processing.

- A 4.9% yield from a major fund that invests in fixed-income markets.

Overview:

- Number of positions: 20-30

- Safety: Conservative

- Publishing frequency: Monthly

- Recommended amount of capital to get started: $100,000

- Typical holding period: One to three years

Membership includes: An “all-access pass” to a model portfolio based on the best ideas from Stansberry Research. You’ll get lifetime access to all underlying research behind each of Stansberry Research’s 12 most popular services. This newsletter suggests the exact number of shares to purchase for every $100,000 invested.

The subscription also includes The Capital Portfolio and The Income Portfolio.

With a Total Portfolio subscription, you’ll get access to recommendations pulled from Stansberry publications, including True Wealth, Retirement Millionaire, Commodity Supercycles, Stansberry’s Investment Advisory, Extreme Value, Stansberry Gold & Silver Investor, Income Intelligence, Stansberry’s Credit Opportunities, Stansberry’s Big Trade, True Wealth Opportunities: Chian, True Wealth Opportunities: Commodities, Retirement Trader, True Wealth Systems, and Cannabis Capitalist.

Price for new subscribers: The Income Portfolio can not be purchased online. If you are interested in learning more, please call (888) 863-9356 to speak with a customer service representative.

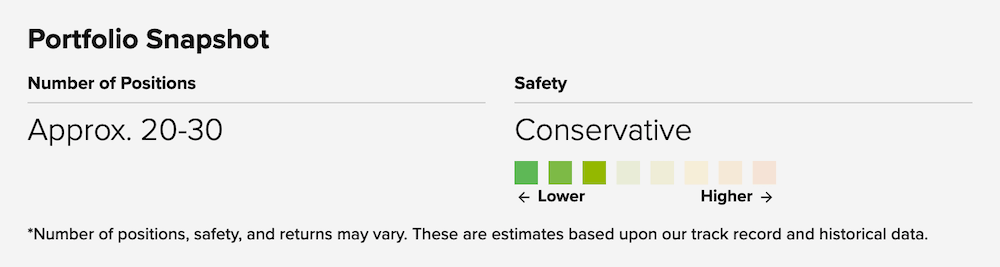

The Capital Portfolio

The Capital Portfolio contains 20 of the highest conviction ideas from Stansberry Research. These U.S.-listed stocks and ETFs are easy to buy and designed to beat the market while providing investors with maximum capital gains.

Some Capital Portfolio Results: As of mid 2021, there were 6 picks that were up in the triple digits. These include:

- Nearly 500% gains on Sea Limited (SE) in just over a year.

- More than a 300% gain from DocuSign (DOCU) in less than two years.

- Approximately 200% gain on bitcoin (BTC) in less than a year.

Overview:

- Number of positions: 23-30

- Safety: Conservative

- Publishing frequency: Monthly

- Recommended amount of capital to get started: $100,000

- Typical holding period: One to three years

Membership includes: Access to the 20+ investment position portfolio, monthly newsletter update, and Stansberry NewsWire. You’ll also get access to True Wealth, Retirement Millionaire, Stansberry’s Investment Advisory, Commodity Supercycles, Extreme Value, and Stansberry Gold & Silver Investor.

Price for new subscribers: The Capital Portfolio can not be purchased online. If you are interested in learning more, please call (888) 863-9356 to speak with a customer service representative.

Macro-Level Services

Stansberry’s Investment Advisory

How to make money from the most promising emerging stocks including tech and energy investments. The newsletter also includes information about which stocks to avoid. You’ll get subscriber-only reports that include information about how to buy the most sought-after stocks.

Stansberry’s Investment Advisory Newsletter Basics

- Number of positions: ~20-30

- Safety: Conservative

- Publishing frequency: Monthly on the first Friday

- Recommended amount of capital to get started: ~$1,000

- Typical holding period: Minimum of one year

- Price: $199 per year

- Trial Subscription: 30-days

- Price: $199 for one year

Edited by Steve Sjuggerud with recommendations by lead analyst Brett Eversole, True Wealth is a newsletter that helps investors choose valuable assets during times when they aren’t in demand. Dr. Sjuggerdund told subscribers they would be wise to buy gold in 2002 at the price of $320 per ounce.

True Wealth Newsletter Basics

- Number of positions: ~25

- Safety: Conservative

- Publishing frequency: Third Friday of each month with occasional email updates

- Recommended amount of capital to get started: $1,000 minimum

- Typical holding period: One year

- Price: $199 per year

- Trial Subscription: 30-days

Dr. David Eifrig Jr., MD, MBA, is the editor for Retirement Millionaire. This newsletter offers advice on how to live the lifestyle of a millionaire for less money than you’d think you need. This newsletter is ideal for beginning investors, those planning to retire soon, and retirees.

Retirement Millionaire Newsletter Basics

- Safety: Conservative

- Publishing frequency: Second Wednesday of each month with occasional email updates

- Recommended amount of capital to get started: $1,000

- Typical holding period: Minimum of two years

- Price: $199 per year

- Trial Subscription: 30-days

For a steady stream of stock recommendations that include the safest stocks at steep discounts, look no further than the Extreme Value newsletter. Dan Ferris’s strategy, covered extensively in Barron’s, is to buy only safe and cheap stocks at an excellent price. His track record is one of the best in the industry, and he shares his best advice here. Extreme Value launched in 2002, and Dan’s readers have made some impressive purchases with his direction:

Super-safe stocks recommended by Dan:

- Alexander & Baldwin

- International Royalty

- Encana

- Portfolio Recovery Associates

- Icahn Enterprises

Extreme Value Newsletter Basics

- Safety: Moderate

- Publishing frequency: Monthly newsletter and mid-monthly updates

- Recommended amount of capital to get started: $5,000 minimum

- Typical holding period: Three to four years

- Price: $1,500 per year

Commodity Supercycles

John Engle, Commodity Supercycles newsletter’s editor, watches for solid companies in the tech industry. With a background in biotech as a bench scientist for one of the biggest pharmaceutical companies in the United States, Engle has an eye for up-and-coming tech stocks with great potential.

Commodity Supercycles Newsletter Basics

- Number of positions: ~20

- Safety: Moderate

- Publishing frequency: Third Friday of each month

- Recommended amount of capital to get started: $1,000

- Typical holding period: Three to five years

- Price: $199 per year

- Trial Subscription: 30-days

Stansberry Gold & Silver Investor

Investors interested in learning how to successfully diversify their portfolio with gold and silver get access to some of the most important research conducted by Porter Stansberry and his team with the Stansberry Gold & Silver Investor newsletter.

Bill Shaw serves as editor of both Commodity Supercycles and Gold & Silver Investor. He’s been helping Stansberry readers make wise investments since 2015 to prosper even during times of crisis. You’ll get regular updates on the currency and precious metals markets with Porter’s market analysis.

Stansberry Gold & Silver Investor Newsletter Basics

- Number of positions: ~20

- Safety: Moderate

- Publishing frequency: Second Tuesday of each month with occasional email updates

- Recommended amount of capital to get started: 15 – 20% of your investment portfolio

- Typical holding period: A few months to years, depending on market conditions

- Price: One-time $2,500 portfolio fee + $49 per month; call (888)863-9356 to purchase

Investors who want to participate in the excitement of technology revolutions can use the information in Stansberry Innovations Reports to catapult their portfolios with John Engel’s advice about which stocks are poised for explosive growth.

Stansberry Innovations Report Newsletter Basics

- Number of positions: 20

- Safety: Conservative

- Publishing frequency: Third Friday of each month

- Recommended amount of capital to get started: $1,000

- Typical holding period: Three to five years

- Price: $199 per year

- Trial Subscription: 30-days

Stansberry Specialized Investment Research

If you want to learn more about a specific investment niche, you may find the information you need in one of Stansberry Research’s Specialized Investment Research newsletters. Stansberry’s Big Trade, True Wealth Opportunities: China, Stansberry Venture Technology, Stansberry Venture Value, Advanced Options, Cannabis Capitalist, Ten Stock Trader, and Crypto Capital include speculative investments ideal for someone with a high tolerance for risk.

Other, more conservatively oriented newsletters under the Specialized Investment Research heading include Stansberry’s Election 2020 Portfolio, Silver Stock Analyst, Gold Stock Analyst, DailyWealth Trader, Income Intelligence, Stansberry’s Credit Opportunities, and True Wealth Real Estate.

Is Stansberry Research a Good Resource For New Investors?

Maybe. Before you subscribe to any of Stansberry’s research-packed newsletters, look around on the company’s website and listen to Stansberry Investor Hour. This will give you some idea of what to expect and whether Stansberry’s recommendations may work with your portfolio and investment style.

New investors should check out the free guides available on the Stansberry Research website. Beginners may benefit from free educational resources like Managing Your Wealth, Investment Basics, and Getting Started.

If you have a portfolio of at least $10,000, you may be able to justify the cost of a subscription to one of the company’s Macro Level service subscriptions. Otherwise, it may be wiser to learn everything you can from the free information available on the site before committing to a paid subscription.

Does Stansberry Research Have an App?

Yes. Stansberry Research supports a free app allowing subscribers access to their subscription information on the go. The most recent update to the app, released June 17, 2021, fixed a few minor bugs. The app is only available for iPhone, iPad, and Mac users running OS 11.0 or later.

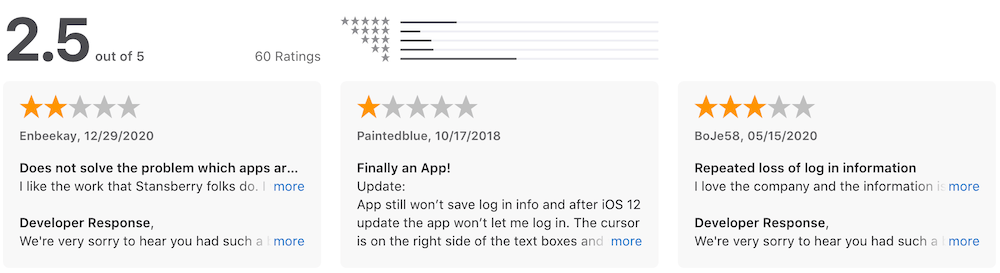

The app gets an average of just 2.5 out of five star ratings from 60 users’ reviews.

Stansberry Research Customer Reviews

Of course, the Stansberry marketing team uses positive customer reviews to their advantage on the site. Before you decide to hand over your credit card numbers, check out reviews not under the company’s control.

Stansberry Research Newsletter Reviews on Quora

Stansberry Research customers who’ve paid for subscriptions express their views about the company’s newsletters.

“I decided some years ago to have a go at investing in shares, so I opened an execution-only share dealing account and set aside a small sum of money and started to do my research.

I ended up subscribing to two share tipping newsletters, Motley Fool and Porter Stansberry.

I invested some money, half with the Motley Fool tips and the other with the Porter Stansberry tips.

Both did very well, in fact one share with PS did very well and I made the mistake of thinking I was some sort of investment genius and canceled both subscriptions and went on to experiment with CFDs.

Now regarding PS in general, having been a subscriber I still to this day am bombarded with marketing materials and newsletters.

I my opinion no it is not a scam but unless you have your discrimination filter turned up to the max you could well end up with some very unsuitable products at eye wateringly high prices.”

-Stephen Morgan, CEO of A.S. Nieruchomości

Stansberry Research is well-known for effective and persistent marketing. Much of the free information on the website includes long-form videos and letters aimed at acquiring new subscribers. Investors who know what they are looking for and who aren’t prone to getting distracted by well-honed marketing techniques are likely to find the investment advice they need to help them level up.

“Ultimately, services like Stansberry and Motley Fool are designed to provide stock picks or investment information. So, technically, as long as they deliver that information, they deliver on what they promise in the subscriptions.

That said, their aggressive marketing can attract the wrong types of investors. If you’re looking to get rich quickly, avoid these types of services.

These services are of more value to diligent investors who want to generate investment ideas. You need to have the ability to look past the hype. You also need to have the focus to avoid getting sucked into the next biggest thing.”

Josh Anderson, Day Trader

Stansberry Research Parent Company The Agora Settles FTC Lawsuit

After 15 months of litigation, Agora Financial agreed to pay more than $2 million to customers that the FTC says the company tricked into buying products that promised to cure Type 2 diabetes.

Agora Financial also allegedly promised to help seniors successfully navigate a government-affiliated program. The defrauded seniors will receive refunds for publications purchased from The Agora and it’s affiliates. The FTC states that Agora Financial and its affiliates are barred from making additional false claims.

While there were no fines imposed by the FTC, it’s important to be aware that The Agora and its subsidiaries are experts in the art of persuasion. When you sign up for a newsletter, you’ll receive additional marketing emails.

Is Stansberry Research Worth it?

If you decide to try a Macro Level Stansberry Research newsletter subscription priced at $199 per year, you have 30 days to find out whether it’s worth your money. Mark the deadline on your calendar so you can get a refund if you decide to cancel your membership.

Remember that even if Stansberry Research highly recommends investing in certain stocks, they can’t legally promise a successful outcome. Investing in the stock market carries an inherent risk that you’ll lose money if you choose to sell stock for less than you paid for it.

If you don’t already have a brokerage account, you may not be ready to pay for investing advice. Spend some time on the Stansberry Investor homepage learning about various stocks. Check out the free “Tip of the Week”, the daily Morning Market Update, and create a customized watch list to try your hand at choosing stocks worth your attention.

Seasoned investors who want a hand choosing stocks without having to devote the time and energy necessary to make the best possible investments may enjoy the depth of research provided by a paid subscription to any of the available newsletters highlighted here.

Stansberry Research’s advice consistently beats the market, so if you have a large enough portfolio to justify the cost of a membership, doing so could help you make better decisions while spending less time in the research phase of investing.

Leave a Reply