| Full disclosure: We may receive financial compensation when you click on links and are approved for products from our advertising partners. Opinions and product recommendations on APYGUY are those of our writers and have not been influenced, reviewed or approved by any advertiser. Learn more about how we make money. |

If you struggle to pick individual stocks that outperform the market in the long run perhaps it’s time to outsource this to some experts who have a proven track record to back them up.

The most popular Motley Fool package – Stock Advisors – has seen a return of 491% as of March 2022 based on the average return of all stock recommendations since inception. When compared to the S&P 500’s returns of just 132% within the same time frame, this is quite remarkable.

To take a closer look at Motley Fool’s premium service packages and what to expect, continue reading our review below.

March 2022 Promotion: Join Motley Fool Stock Advisors for just $79.99/year. Normally $199/year.

What is The Motley Fool?

The Motley Fool started offering investment advice in 1993. The company is now one of the world’s largest financial media businesses. Founded by David Gardner and Tom Garder (brothers who still run the company), the site offers free financial news and premium services like subscription-only newsletters with investment advice.

The Motley Fool employs 47 of the world’s top stock analysts – with 700 employees in total – across 7 offices located across the globe. They research and identify the most significant opportunities for growth in the stock market.

Motley Fool is one of the top financial companies in the marketplace with over 1 million subscribers, and they back their stock picks with in-depth research. The Starter Stocks Report included with your subscription can help you build a strong portfolio from the ground up if you are new to investing.

The “Best Stocks to Buy” series offers a list of recent Stock Advisor picks that are still viable.

What Information Can I Find on the Motley Fool Website?

There’s a large amount of free educational material available on The Motley Fool website. You’ll find timely articles about investing basics, the stock market, retirement, and personal finance. If you are interested in a certain type of stock or a particular industry, you can dive into those categories to find a wealth of free information on the site, as well.

The Motley Fool isn’t stingy with their stock advice. Check out last year’s Top 21 Stocks to Buy in 2021 (And the 1 Ultimate Stock) to get a snapshot of how The Motley Fool’s stock picks may look if you decide to subscribe to one of their premium services.

The Motley Fool doesn’t currently have an app. They are in the process of removing their outdated app from the Apple and Android app store.

Are Motley Fool Stock Picks Any Good?

Yes. Motley Fool Stock picks include growth stocks that routinely outperform the stock market.

In November 2018, Motley Fool Stock Advisor recommended that subscribers buy Amazon, Stitch Fix, Apple, Booking Holdings, Arista Networks, and Shopify. These stocks are wildly successful investments. Shopify sold for $134.45 per share in late 2018, and is now selling for $1,247 per share.

Motley Fool’s stock picks may work for you if:

- You plan to leave your investments alone for at least five years

- You have a stable personal financial situation and understand when it makes sense to buy stocks

- You have a few thousand dollars set aside to invest in the stock market, and can afford to make ongoing investments

- You understand that an analyst’s risk tolerance may differ from yours and feel comfortable making unilateral decisions about your money that are in your best interests, even if those decisions contradict an “expert”

- You understand that you could lose money when you invest in the stock market

What Do I Get With their Premium Services?

In a nutshell you can expect the following from any of Motley Fool’s premium services:

- 2 stock recommendations each month with in depth analysis.

- Historical stock picks with performance data and charts.

- Best buys now.

- Starter stocks.

- Access to live discussions.

Details About Motley Fool’s Premium Subscription Services

You have a wide range of choices with Motley Fool’s premium subscription services. Here, we’ll highlight the subscriptions that offer information about stock picks’ performance since inception.

Stock Advisor

Motley Fool’s Stock Advisor stock picks beat the market average by more than 90%. In the past, they’ve recommended Priceline.com, Costco, Gilead, and Amazon all prior to meteoric rises (among others).

Their services are inexpensive at $199 per year compared to other stock picking subscriptions. Motley Fool frequently runs new subscriber discounts, giving you access to their stock picks for just $99 per year.

March 2022 Promotion: Join Motley Fool Stock Advisors for just $79.99/year.

Philosophy: Buy and hold for at least three to five years.

Membership includes:

- Two growth stock recommendations monthly

- Sell notices

- Best Buys Now; top opportunities among existing Stock Advisor recommendations

- Regular email updates

2022 Promotion: Join Motley Fool Stock Advisors for just $79.99/year. Normally $199/year.

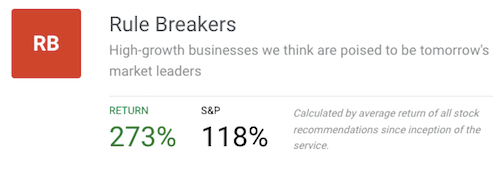

Rule Breakers

Rule Breakers informed subscribers about growth stocks including Tesla, Mercado Libre, and Under Armour before mainstream investors understood their potential.

Rule Breakers beat the S&P 500 three to one over the past 15 years by finding and investing in overlooked companies poised for success.

Philosophy: Purchase at least 25 stocks. Hold them for at least five years.

Membership includes:

- Two growth stock recommendations monthly from the Motley Fool analyst team

- Sell notices

- Best Buys Now; top opportunities among existing Rule Breakers recommendations

- Regular email updates

- Access to the Rule Breakers library of expert stock picks

Price for new subscribers: $99 ($1.90 per week) with a 30-day membership refund period, or you can choose one month of Rule Breakers for just $39 (non-refundable). All memberships automatically renew at $299 per year.

New members join Rule Breakers for just $99 per year!

Motley Fool offers a bundle that includes their Stock Advisor and Rule Breakers subscriptions for $498 per year. You’ll get Motley Fool’s 15 “Best Buys Now” stocks via email each month along with access to Motley Fool’s advice about which disruptive stocks have maximum upside potential.

Supernova

Supernova works best for investors with a portfolio of $90,000 or more. This service offers a look into real-money model portfolios built around investing themes.

Philosophy: Invest in aggressive growth stocks with higher than average volatility and risk

Performance Since Inception: +327.6%

Membership includes:

- 3-5 Timely Trade Alerts with explanations from the Supernova Portfolios each month

- “Exploration Missions” where analysts choose favorite theme-based or Best Buys Now stocks

- Allocation Calculator to help you calculate funds to match analyst’ model portfolios

- Regular email updates

- Supernova discussion boards

Price for new subscribers: Supernova is not currently accepting new subscribers.

Discovery

Tom Gardner, CEO (and one of Motley Fool’s founders), offers a look into his portfolio of publicly traded stocks along with quarterly buy and sell advice. Discovery: Everlasting Portfolio is designed for investors with at least $100,000 invested in the stock market who want to update their investments just a few times each year.

In 2012, Tom Gardner sold his publicly traded stocks and pledged to invest his own money into the Everlasting Portfolio.

As of 2021, The Motley Fool has more than $15 million of its investment capital in the Everlasting Portfolio’s recommended stocks. The fund is up 579%.

Philosophy: “Be fearful when others are greedy and greedy when others are fearful.”

Performance Since Inception: +660%

Membership includes:

- Timely Trade Alerts with explanations

- Allocation Calculator to help investors match the Everlasting Portfolio positions

- “Best of the Best” stocks from across Motley Fool’s investing services

- Investor Action Guide including How to Know When to Sell, Tom’s Principals for Selling, and Tom’s Everlasting Portfolio Guidebook

Price for new subscribers: $2,999 per year, automatically renewable every 365 days; no refunds or credit transfers

Fool ONE

Fool ONE offers complete access to all of Motley Fool’s premium US services as well as international premium services, excluding Mogul. You’ll also get exclusive access to member events and early access to the newest services.

Philosophy: Buy and hold investing with a three to five year timeline with a high tolerance for risk and a relatively large investing budget

Performance Since Inception: NA

Membership includes:

- All Motley Fool stock services at a discount

- All stock investing services launching in the upcoming year

- Access to stock-ranking database including evern stock that the Motley Fool analyst team recommends and tracks

Price for new subscribers: Motley Fool ONE’s price isn’t published. If you are interested in learning more about the service, please contact the Motley Fool Investor Solutions team via email: InvestorSolutions@fool.com.

Options

With Motley Fool’s Options subscription, you’ll get emails alerting you to timely advice that includes fully-vetted options opportunities from Motley Fool’s analysts. Adding options investments to an established portfolio can significantly increase returns.

Detailed investment advice helps you decide whether the trade is a good choice for your portfolio. If you choose to proceed, you simply click “Get the Details” in the email for instructions about how to place the trade.

Since its inception, Motley Fool’s Options recommendations have an 84+% win rate. This service works best for investors with at least $50,000 in their portfolio.

Philosophy: Master options investing for financial success

Performance Since Inception: NA

Membership includes:

- At least four recommended options trades each month

- Access to online educational resources; Options U

- Access to Options discussion boards

- Regular email updates

Price for new subscribers: $899 with the option to transfer credit to a different Motley Fool portfolio service within 30-days of purchasing the subscription. Motley Fool Options is non-refundable. Subscription renews automatically every 365 days at $999.

Which Motley Fool Premium Subscription Offers the Best Value?

Motley Fool’s Stock Advisor is one of their most popular subscription services. It has a low introductory price of $99 for new users and an 18-year track record of beating the market. Stock prices can fluctuate wildly, so the Stock Advisor subscription comes with instructions to buy at least 25 stocks and hold on to them for a minimum of five years.

Stock Advisor picks include stocks from every industry. Motley Fool analysts choose overlooked and undervalued companies ready to soar in value. Subscribers get immediate access to 191 stock recommendations that have a history of 100%+ returns.

Stock Advisor’s Stock Picks

Two new high-growth stock picks come via email each month from Tom and David Gardner, so there is a constant flow of solid advice about which stocks to buy next.

The “starter stocks” report offers a list of 10 stocks with a history of providing excellent returns. This report is ideal for new investors who want to diversify their portfolios by investing in time-tested stocks.

The “Best Stocks to Buy” list offers advice about Stock Advisor’s recent stock picks that are still a good buy. Subscribers can add these stocks to their portfolios right away.

On average, Stock Advisor recommendations returned more than 566%, compared to 103% from the S&P 500.

Stock Advisor Research

All of the stocks recommended by the Gardner brothers are researched extensively. Each stock comes with a report explaining the rationale behind the recommendation. You’ll get a taste of how The Motley Fool chooses specific stocks by diving into Stock Advisor research.

Stock Advisor Education

The Stock Advisor’s education resources offer general investment lessons and information about research methodology for those interested in learning more about choosing winning investments.

Stock Advisor Community Forum

Stock Advisor members can discuss investing and stock picks in the community forum. This is a great way to connect with like-minded investors, learn more about how others get the most from their Stock Advisor subscription and ask questions. The forum is active, so it’s easy to get timely feedback from other users.

Is Motley Fool Worth it For New Investors?

Maybe. Before you subscribe to Stock Advisor, check out The Motley Fool’s How to Invest Guide. You’ll get a feel for The Motley Fool’s philosophy about investing, including when it’s smart to buy stocks, how to establish an emergency fund to protect your financial stability, and how to allocate assets.

New investors may want to start by investing in a diversified fund like the Vanguard Total World Stock Index Fund ETF (NYSEMKT:VT), recommended by The Motley Fool’s stock analysts as a set it and forget it fund that works well for investors who need to learn more about the stock market, but don’t want to wait to invest.

Motley Fool Customer Reviews

Before you spend your money on a stock advising service, it’s wise to read online reviews from verified customers. The Motley Fool marketing team makes excellent use of reviews from customers who are thrilled with the subscription services. It’s crucial to expand your research into areas of the internet beyond The Motley Fool website to get a balanced view of customer sentiment.

The Motley Fool Suffers on Trustpilot

The Motley Fool has 1,242 reviews on Trustpilot:

- Excellent: 33%

- Great: 10%

- Average: 5%

- Poor: 5%

- Bad: 47%

The customers posting negative reviews complain that they experienced losses in the stock market after following Motley Fool’s advice to purchase certain investments. However, Motley Fool repeatedly states that they recommend that investors buy a minimum of 25 individual stocks with plans to hold those investments for at least five years to “counteract the whims of the market.” Investors who get nervous when stock prices dip and sell at a loss are understandably upset.

Many of the negative reviews point to information found in Motley Fool’s free content, generated by in-house analysts and contracted experts. Motley Fool encourages investors to conduct their research before deciding whether an analyst’s advice works for their situation.

The Motley Fool customer service team responds to each negative review to solve any ongoing problems.

Motley Fool Stock Advisor Customers Sound Off on Reddit

Reddit users have a lot to say when asked,”Is Motley Fool worth it?” Many users posted responses to a question posed by a curious Motley Fool user who was on the fence about whether to pay for a premium subscription.

Investors who purchased shares of FICO, Shopify, Wix, and Amazon before they were well-known successful companies offer glowing reviews of the paid-for subscription services. New subscribers point out that even if they make just a few hundred dollars following Motley Fool’s advice, it will be worth the Stock Advisor service subscription price. “…at least the Gardner brothers know what they are doing (they outperform the market consistently)” -lame_corprus

Other Reddit commenters point out that unless you have a hefty sum of money to invest, you may not fare well with Motley Fool’s stock picks. “The problem was, that some of the lesser expensive ones, tanked, and the more expensive stocks, were the ones that doubled, or tripled in value. So, if you didn’t buy the “whole set” and trade exactly what and when suggested . . . you were likely to lose out.” -PhesteringSoars

The Motley Fool Responds to All Customer Complaints on the BBB Website

The Motley Fool Inc. has 160 published customer reviews on the Better Business Bureau (BBB) website. The company has an average rating of 4.03 stars out of five. The BBB closed 123 customer complaints in the past three years and 66 in the past 12 months. Customers complain about various hardships, including a lack of response from Motley Fool’s customer service department.

Many of the customer complaints on the BBB website have to do with trouble logging in, not receiving a free report via email as promised, or automatic renewals. Customers complain that Motley Fool emails them with special offers too much and that they can’t get a full refund after they’ve signed up for Motley Fool’s non-refundable offers.

The Motley Fool customer service representatives offer this explanation for their lack of accessibility: “We have been experiencing unusually high call and email volume; we sincerely apologize for any inconvenience this may have caused. Our team is working diligently to respond to each email.”

Motley Fool representatives respond to each complaint filed with the BBB with a detailed explanation of precisely what happened along with an immediate resolution.

Motley Fool Review: A Warning About Stock Advice Subscriptions

Motley Fool’s menu of stock picking services operates on the buy-and-hold philosophy of stock market investing. If you want help becoming a successful day trader, move on.

Motley Fool’s menu of stock advisor services renews automatically. Make sure you are comfortable with Motley Fool automatically charging your credit card for the total amount of the yearly subscription service every 365 days.

Many of the subscription services work best if you can afford to invest at least $25,000 in the stock market. Suppose you have a small budget for investing and can’t afford to put money into the stock market each month. In that case, you may be better off reading the free information offered by Motley Fool writers on their website and using that knowledge to make investing choices.

The Motley Fool is prohibited from offering personalized investment advice, so they provide equal access to information for anyone who subscribes to one of their services. Their strategies appeal to different investment styles and interests, but they don’t offer a one-size-fits-all solution.

Is Motley Fool Worth it?

If you decide to try a Motley Fool subscription to level up your investing game, don’t get so excited that you skim over the Important Notes right above the green “Submit My Order” button. Make sure you understand the price of your subscription as well as how and when it renews. The rate you pay for year one could be significantly lower than the amount you pay in subsequent years.

You must be willing to open a brokerage account (if you don’t already have one), purchase the stocks recommended by Motley Fool’s analysts, and leave those investments alone for at least five years. Before you decide to invest in a Motley Fool premium subscription, consider your budget, investing style, tolerance for risk, and willingness to follow the advice. The service should meet your needs without pushing you to make investments that are too far out of your comfort zone.

If you plan to purchase stocks regularly, want to learn more about how to make the right investments to help you reach your financial goals, and don’t have the time or knowledge to do your research, it’s wise to look into a stock advisor subscription. Motley Fool stock advice subscriptions consistently outpace the stock market as a whole. If you pay for a subscription, you will receive the information you need to invest in stocks with a high probability of providing a great return.

2022 Promotion: Join Motley Fool Stock Advisors for just $79.99/year. Normally $199/year.

Leave a Reply