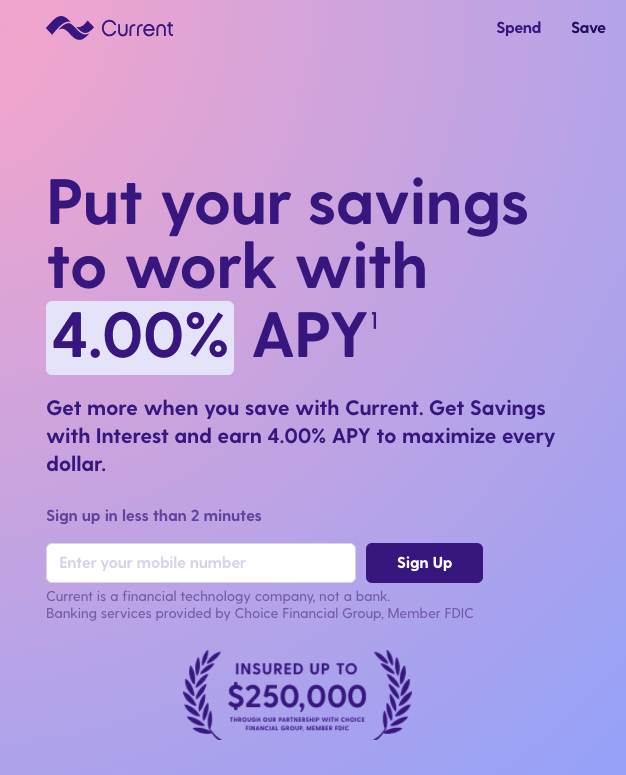

[Update February 2022: Current now offers a savings account featuring an APY of 4.0% on balances up to $2,000. Read more below.]

Current was founded in 2015 as a modern solution to an age-old problem of inaccessibility in banking. By taking advantage of innovative technology and creating transparency in their products, Current’s goal is to make banking easier and more flexible. And it seems to have accomplished that, especially with its teen bank account.

The Current Visa debit card for kids aims to find that middle ground between giving teens the financial independence they crave and parents the ability to steer them in the right direction. This is a product that gets it right in a lot of ways, and we’ll talk about those—as well as how the Current debit card potentially falls short—here.

After reading our review of the Current Visa Debit card you might want to see where it stacks up against the competition in our rundown of the best debit cards for kids and teens in 2021.

Who’s It For

Average age: 13-18

Good Candidate: Teens that earn an allowance and want to spend, save, and donate their money.

There is no minimum age requirement for this product, so teens of all ages are welcome. The Current app is easy enough for younger teens to use and comprehensive enough for older teens to benefit from.

There are a lot of ways teens can use their money besides just spending and a lot of ways for parents to intervene.

Features and Benefits

Kids with Current debit cards can spend, save, or give their money. Parents can oversee all of their kids’ activity, step in when they want to offer guidance, and easily transfer funds between accounts.

The Current banking experience is something between a traditional checking account and a checking account for kids. Teens can earn allowance and move their money into different categories, options you’ll commonly see with debit products for kids, but will be able to use their card in more ways than less sophisticated products allow (i.e. Apple Pay and Current Pay).

For Parents

Parents can easily pay their teens for completed chores through the Current app. They can set chores for their teens at their desired price, see what chores their teens have completed, and approve chores for payment. Allowance for these can be paid out on a daily, weekly, bi-weekly, or monthly basis.

Chores are assigned and paid on a weekly basis. Parents can create a list of chores for their kids to complete in their own time throughout the week. Chore payments and allowance payments are not related. If a teen doesn’t complete all of their assigned chores, their parents may choose to pay them less for chores that week.

Multiple parents are eligible to manage and contribute money to one teen account. Co-parents can have their own chores lists, allowances, funding sources, etc.

Transferring money from a parent account to a teen account is easy and instant. Once parents have set up funding into their own account and their teen has registered for Current themselves, the parent can link to their teen’s account by selecting this option from their screen and sharing the code with their child. Parents can initiate withdrawals from their funding account into their Current account from the Current app.

Parents may qualify for instant transfers if their Current account is in good standing and they have made several successful transfers in the past.

Parents can control their kids’ spending by prohibiting them from making purchases at specific merchants, setting overall spending limits, or turning their card off from the app.

Many parents also choose to receive account alerts. With these, they will receive push notifications showing when and where their child is using their money.

For Kids

Teens have a lot of flexibility in how they use the money in their Current account and their experience is highly customizable.

💰 Earning: To earn more money, teens can complete chores and mark them complete through the Current app. Teens can also request chores for themselves. If a teen would like additional help funding their account outside of allowance and chore completion, they can send a request to their parent or parents for the amount they need. If their parent(s) approve, this money will be transferred from the parent’s wallet to the kid’s.

Current users can send and request money between their accounts using Current Pay. This is a free P2P feature that gives users QR codes they can use to either pay someone money or request money from them. Current users can also find each other by searching their names through the app.

Teens can link direct deposit to their account if they are earning money for themselves or use the mobile check deposit feature to fund their account with paper checks.

💸 Spending: Teens cannot spend or withdraw more than what is available on their card, and only funds not in a Savings or Giving Pod can be spent. Users can withdraw funds at no cost from any Visa Interlink or Maestro ATM. There are over 55,000 ATMs that are free to Current users. Users can also withdraw cash from merchants that are part of Visa’s Interlink or Maestro network.

There is a maximum daily purchase limit of $2,000, a maximum ATM withdrawal limit of $500, and a $5,000 limit for Current Pay transactions.

A Current debit card can be used almost anywhere Visa is accepted. Users can also use their cards through Apple Pay. Teens can lock and unlock their cards from the app.

🤑 Saving: As of February 2022, you can earn a whopping 4.0% APY on balances up to $2,000! The account is FDIC-insured up to the applicable limits. To put this yield in perspective, the current national average for a savings account sits at just 0.06% according to recent FDIC data.

Teens can save money easily with Current by setting savings goals. Funds allocated to a Savings Pod are not eligible to be spent using the Current debit card. After a user reaches a savings goal, they can move the money into their available checking account balance to spend.

Giving: Teens can also donate their money by moving funds into their Giving Balance. They can then select from a number of pre-chosen charities and set goals toward their charity or charities of choice. Much like the Savings Pods, they will be able to see their progress toward a given goal from their Current account and see all transactions toward them.

Another great feature for saving or donating is the Round Up setting. By enabling this, teens can save or donate a little money every time they spend. This feature rounds all transactions up to the nearest dollar and automatically deposits this money into either a Saving or Giving goal. Teens can choose which of their goals they’d like round ups to go toward and change this as needed.

Users can move their money to different pods at any time, no parent approval required.

Current Debit Card Cost(s) and Fees

Fees: No fees for low balance, no fee for inactivity, no fees for transfers, no fees for overdrafts, no fee for transactions at in-network ATMs, up to $2.50 per transaction at out-of-network ATMs, $5 per replacement card.

The subscription fee for the Current debit card is $36 per teen, charged annually. This is a flat rate that includes all Current services and products for your kids—every teen gets their own card and account—, and cannot be waived.

Give the 30-day free trial a shot if you want to see if the product is worth this price.

Current VS Competitors

Current beats its competition in a few important ways.

The first one is the round up feature. Although not something offered by many traditional checking accounts, this option will make it easier for teens to reach their goals. It will help them get into the habit of putting money away toward saving and giving before they have a checking account by themselves and no longer have this feature built in.

Another pro to the Current debit card for kids is how much control it gives parents. By letting them set spending limits, merchant restrictions, and chores and allowances, Current allows parents to play a more active role in their kids’ spending than other products like it.

Current also has flexibility for teen users going for it. Teens can spend, save, or give their money to charity easily through the app and use their card to make purchases in-person or online, withdraw money from an ATM, link to Apple Pay, or transfer money to or accept money from other Current users.

Current is straightforward with its pricing structure as well. Although an annual fee of $36 is not ideal, this account doesn’t come with unnecessary fees for things like card reloads or declined transactions due to low balance.

The 4.0% APY on savings up to $2,000 is also a feature that no other debit card product offers currently. Especially our historically low interest rate environment, this is a pleasant surprise to see.

Potential Drawbacks

One of the main disadvantages of Current is the price. The subscription fee may also turn some families away, especially families with multiple teens. Many banks offer the ability to link a teen to a checking account for free, though this usually comes with fewer features and customization capabilities.

Another disadvantage of the Current debit card is that it’s not like a regular checking account. Although this is a product geared toward teens, it is actually pretty similar to products geared toward kids in that it lets users put their money in different buckets, complete chores, and the like. Current will probably help your kids become more responsible, but it won’t give them an accurate depiction of how adult checking accounts typically operate, if that’s your goal.

Consumer Sentiment

Current seems to do pretty well in the customer service department, though this wasn’t always the case. If you go to review boards, you will see complaints from a few years back about trouble reaching customer service representatives and issues with suspicious account activity. Today, however, users praise Current’s customer service—which the company seems to have corrected—and its level of security.

The Current mobile app is eye-catching and well organized. Its minimalistic design makes it easy to find what you’re looking for and use different features. This app has a rating of 4.6 out of 5 stars on Google Play and 4.7 out of 5 stars in the App Store.

To reach Current customer support, you can email support@current.com or call 1 (888) 851-1172 Monday through Friday between 9 AM and 6 PM. You can also chat with an agent live through the app 24/7 Monday through Friday or between 9 AM and 8 PM EST on Saturday and Sunday

Is It Safe

All Current checking accounts are covered by up to $250,000 of FDIC insurance.

Current also uses both fingerprint and facial recognition software to protect each account.

You are not liable to pay for unauthorized transactions as long as you notify Current of suspicious activity within two days. Otherwise, you may pay up to $500.

How to Sign Up

To sign up for a parent Current account, enter your phone number on the Current home page and you will be sent a link to finish registering. You’ll just need to enter your personal information, no credit check required. You will be automatically enrolled in the 30-day free trial when you register.

Your teen will need to sign up for an account too. One you have both registered, you can link your account with your teen’s and start giving them money, assigning them chores, etc. You’ll need to pay the annual fee for every teen you add after linking your accounts.

You can add cash via:

- ACH transfer

- Direct deposit

- PayPal transfer or

- Bill pay

There is no minimum balance required at any time for your account or your teen’s, but there is a maximum balance of $10,000 for a teen’s account.

Final Thoughts

Current is a great joint checking account for parents and teens. Both kids and their parents are likely to be happy with the options they are afforded by Current—freedom for the teens and control for the parents—, and this is a modern product that can be used in a number of ways. If a checking account with a debit card is more appealing to your family than a more restrictive prepaid debit card, then Current is a good place to start your search.

For its reasonable terms and transparency with pricing, Current is an excellent option all around.

Leave a Reply