[Update March 2022: OneWest bank has yet to raise the rates on any of their fixed rate CDs this year. They have, however, lowered the top yield on their variable rate money market account from 0.20% APY to 0.15% APY. See all rates below.]

OneWest Bank is an offshoot of CIT Bank that was founded in 2009 in Southern California.

A hodgepodge of private equity investors led by Steve Mnuchin established OneWest Bank through a holding company they bought into called IMB Holdco.

Today, OneWest Bank has headquarters in Pasadena, California and has 70+ locations throughout the southern portion of the state.

They offer a full range of deposit accounts, IRAs and loan products, but many of their products are limited to residents in Southern California.

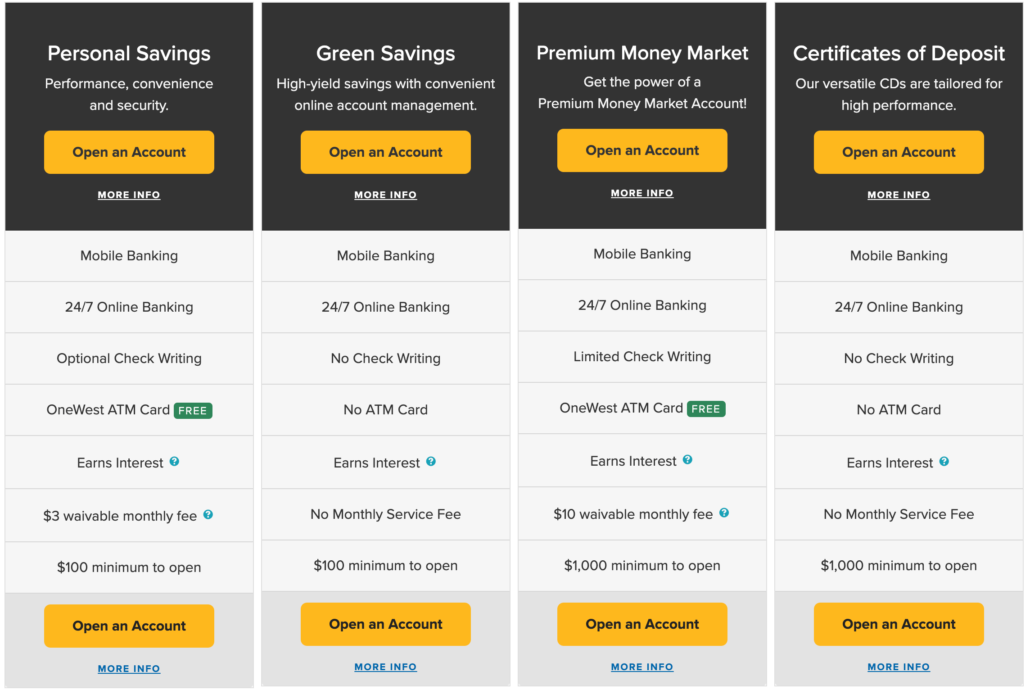

The following FDIC-insured deposit accounts can be opened online by consumers anywhere in the country:

- CDs (certificates of deposit)

- Personal Savings account

- Green Savings account (a high yield online savings account)

- Premium Money Market account

For the purpose of this review, we will focus on OneWest Bank’s fixed and variable rate savings products listed above that are available online and nationwide.

OneWest Bank CD Rates + Account Details

OneWest Bank currently offers ten CDs with terms ranging from 3 month to 5 years. All CDs are federally insured by the FDIC up to the applicable limits and come with a minimum deposit requirement of $1,000.

OneWest Bank CD Rates

| CD Term | APY |

| 3 months | 0.10% |

| 6 months | 0.10% |

| 9 months | 0.15% |

| 12 months | 0.25% |

| 13 months | 0.30% |

| 18 months | 0.30% |

| 2 years | 0.35% |

| 3 years | 0.40% |

| 4 years | 0.40% |

| 5 years | 0.45% |

To give the yields above some context, the current national average on a 12 month CD and a 60 month CD sit at just 0.14% APY and 0.28% APY, respectively according to FDIC data.

We should note that CD rates at OneWest Bank may differ from those at CIT Bank.

Also, the $250,000 in FDIC coverage spans deposits in both banks. Therefore if you hold a CD at CIT Bank with $100,000 in the account, you would only be provided $150,000 in FDIC coverage for deposits at OneWest Bank.

Interest compounds daily on all OneWest Bank CDs and is credited either monthly, quarterly or at maturity depending on the term of your CD.

Early Withdrawal Fees and Grace Period

OneWest Bank allows for a grace period of 7 days upon the maturity of your CD in which you may add or withdraw funds penalty free. This is a slightly tighter deadline than most banks and credit unions offer which is a 10 day grace period.

OneWest Bank will send out grace period notifications prior to your CD maturing, however, we would recommend setting up your own notifications as well if you plan on moving funds about. If nothing is done during the 7 day grace period the CD will renew with the same terms and the going APY.

If you need access to funds prior to the maturity of your CD, OneWest Bank will impose an early withdrawal fee.

OneWest Bank Early Withdrawal Fees

| CD Term | Fee |

| 90 days – 1 year | 90 days’ simple interest |

| 1 year – 18 months | 180 days’ simple interest |

| 2 years | 270 days’ simple interest |

| More than 2 years | 2% of amount withdrawn |

These early withdrawal fees are less stringent than some we’ve seen lately that have the potential to eat into your principal.

Personal Savings Account APY + Details

OneWest offers a personal savings account that can be opened by anyone in the country either online or over the phone (or in a SoCal branch).

It comes with a minimum deposit requirement of just $100, but imposes a $3 monthly service fee if your average daily balance dips below $1,000. Anyone over the age of 55 or minors under the age of 18 are exempt from this fee. You must also elect to receive e-statements.

Rates are paid in tiers based on your average daily balance during the month. Currently all tiers other than the $100k + tier pay the same rate and APY. Rates on the personal savings account are variable and subject to change at any time.

OneWest Bank Personal Savings Account Rates

| Balance | Fee | APY |

| $100 – $999.99 | $3/mo | 0.05% |

| $1k – $4,999 | $0 | 0.05% |

| $5k to $9,999 | $0 | 0.05% |

| $10k – $24,999 | $0 | 0.05% |

| $25k – $49,999 | $0 | 0.05% |

| $50k – $99,999 | $0 | 0.05% |

| $100k + | $0 | 0.10% |

| $10m + | $0 | 0.05% |

To give these yields some context, the national average for a savings account sits at just 0.06% APY, according to recent FDIC data.

Features of OneWest Bank Personal Savings Account:

The personal savings account comes with some OK perks but nothing really out of the ordinary for a modern day online savings account.

The main perks are:

- 24/7 access to online banking and an automated telephone system. They also have apps available for download on IOS phones and Android devices.

- Check writing capabilities

- ATM card and free access to OneWest ATMs

- Online funds transfers

Green Savings Account Rates + Details

The OneWest Bank Green Savings account is similar to the Personal Savings account in many ways but with a few key differences.

The big ones being that this account comes with ZERO monthly fees but also ZERO check writing capabilities and no ATM card.

It can also be opened online or in a local branch whereas the Personal Savings account can also be opened over the phone.

The rates are nearly identical at the moment except at the $50k and $100k marks and also pay interest on tiers.

OneWest Bank Green Savings Account Rates

| Balance | Fee | APY |

| $100 – $999.99 | $0 | 0.05% |

| $1k – $4,999 | $0 | 0.05% |

| $5k to $9,999 | $0 | 0.05% |

| $10k – $24,999 | $0 | 0.05% |

| $25k – $49,999 | $0 | 0.05% |

| $50k – $99,999 | $0 | 0.10% |

| $100k + | $0 | 0.15% |

| $10m + | $0 | 0.05% |

This account also requires a minimum deposit of $100 to open.

We should also note that all variable rate online savings accounts and money market accounts offered by OneWest Bank come with the limitation of just 6 transfers per month per federal regulation D.

Premium Money Market Account Rates + Details

The last of the variable rate products offered by OneWest Bank which can also be opened online throughout the country is their “Premium Money Market” account.

This account’s features are identical to the Personal Savings account but it comes with a steeper minimum daily balance requirement (of $10,000) to avoid a steeper fee of $10.

It comes with the same ATM card, online transfer and check writing capabilities.

The rates are also paid on tiers.

OneWest Bank Premium Money Market Account Rates

| Balance | Fee | APY |

| $100 – $999.99 | $10 | 0.05% |

| $1k – $4,999 | $10 | 0.05% |

| $5k to $9,999 | $10 | 0.05% |

| $10k – $24,999 | $0 | 0.05% |

| $25k – $49,999 | $0 | 0.05% |

| $50k – $99,999 | $0 | 0.10% |

| $100k + | $0 | 0.15% |

| $10m + | $0 | 0.05% |

This account also requires a minimum deposit of just $100 to open, but remember you will be on the hook for a $10/month fee if you do not maintain an average daily balance of $10,000 or more.

To put the yields in perspective, the current national average for a money market account sits at just 0.08% APY, according to FDIC data.

Final Thoughts

While OneWest Bank has offered more lucrative savings rates on both variable rate accounts and fixed rate certificates of deposit in the past, their current yields barely keep up with the national average(s) for each respective term.

On top of that, you’re on the hook for monthly fees with most of their variable rate savings accounts unless you can meet certain requirements.

We would suggest considering a credit union with nationwide acceptance or even an online bank if you’re after high rates and no fees.