Originally founded in Salt Lake City, Utah as an industrial loan corporation, CIT Bank has come a long way in a short period of time since their inception in 2000.

Today, with just two decades of growth, CIT bank has more than $100 billion in assets and offers a full array of banking products to individuals, small businesses and corporations.

For the purpose of this review, we will focus on CIT Bank’s CDs (certificates of deposit) which are available to consumers nationwide.

CIT Bank currently offers the following types of CD accounts:

- Standard Term CDs with terms ranging from 6 months to 5 years.

- Jumbo CDs with terms ranging from 2 – 5 years and requiring a minimum deposit of $100,000.

- No Penalty CD with 11 month term. Allows for full access to your funds penalty-free prior to maturity.

- Ramp-Up CDs. These are good during an increasing interest rate environment. They allow for a one-time interest rate bump during the life of the CD (if rates rise); however, you are not allowed to add funds to the deposit. Ramp-UP CDs by CIT Bank are not offered on new money at this time.

Below are the current rates and APYs (annual percentage yields) offered on CIT Bank CDs as well as the fine print details you’ll want to know before proceeding with an account.

CIT Bank CD Rates + Account Details

CIT Bank is a member of the FDIC (FDIC# 58978) and all consumer deposits are federally insured up to $250,000 per depositor or $500,000 for joint accounts.

CD Rates

| Term | Min. Deposit | APY |

| 6 months | $1,000 | 5.00% |

| 12 months | $1,000 | 0.30% |

| 13 months | $1,000 | 4.65% |

| 18 months | $1,000 | 4.60% |

| 2 year | $1,000 | 0.40% |

| 3 year | $1,000 | 0.40% |

| 4 year | $1,000 | 0.50% |

| 5 year | $1,000 | 0.50% |

To provide some context for CIT Bank’s yields (shown above), the current national average on a 12 month CD and a 60 month CD sit at just 1.54% APY and 1.37% APY, respectively, according to FDIC data.

All standard term CDs come with a minimum deposit requirement of $1,000 which is fairly standard for online bank deposits.

Compounding and Crediting Interest

Interest is compounded daily and credited monthly. You can choose to have this interest deposited into another CIT Bank account, an external account or mailed to your home. This is a great feature for those living off of their deposit interest for income.

Grace Period

You will have a standard 10 day grace period in which you can withdraw funds or add funds to your deposit penalty-free. If nothing is done during this time, your CD will automatically renew with the same terms and present APY at that time, with exception to the 13 month CD and the 18 month CD. The 13 month CD will instead roll into a 12 month CD and the 18 month CD will instead roll into a 2 year CD.

Early Withdrawal Penalty

If you need funds prior to your standard CIT Bank CD’s maturity you will incur a fee. The fee structure is as follows:

| CD Term | Fee |

| Up to 1 year | 3 months’ simple interest |

| 1 – 3 years | 6 months’ simple interest |

| 3+ years | 12 months’ simple interest |

CIT Bank 11 Month No-Penalty CD

As the name implies, the 11 month No-Penalty CD allows you full access to your funds after 7 days from opening the account without incurring a penalty. No withdrawals are permitted within the first 6 days.

This is a good alternative to a variable rate online savings account or money market account whose rate can change at any time without notice to the customer. That said, the rate currently offered on CIT Banks 11 month No-Penalty CD lags the top yields of online savings accounts by a sizable margin.

CIT Bank 11 Month No-Penalty CD

| Term | Min. Deposit | APY |

| 11 month | $1,000 | 4.80% |

In comparison, top yields from 12 month CDs from FDIC-insured online banks and nationally available credit unions are now inching over 5.00% APY – while the national average still sits at 1.54%.

Interest is also compounded daily and credited monthly for the 11 month No-Penalty CD.

There is still a 10 day grace period for the 11 month No-Penalty CD even though your funds are accessible throughout its life. If nothing is done during this time, your CD will renew with the going interest rate and APY.

CIT Bank Ramp-UP CDs

Before we dive into the details and yields of these accounts, we should note that these are not currently offered to new money at this time.

CIT Bank Ramp-UP CD Rates

| Term | Min. Deposit | APY |

| 1 year Ramp-Up Plus | $25,000 | 0.25% |

| 2 year Ramp-Up Plus | $25,000 | 0.25% |

| 3 year Ramp-Up | $25,000 | 0.25% |

| 4 year Ramp-Up | $50,000 | 0.25% |

With these accounts you are entitled to one interest rate bump during the life of the deposit.

As rates continue to rise, check back on these products as they may become more competitive later in the year.

How do CIT Bank’s CD Rates Compare?

Below we compare CIT Bank’s best CD rate with the best CD rates from other well known FDIC-insured banks. Rates surveyed April 27, 2023.

| Bank | Best APY | CD Term |

| CIT Bank | 5.00% | 6 months |

| Ally Bank | 4.80% | 18 months |

| Bank of America | 4.30% | 13 months |

| Chase Bank | 3.75% | 12 months |

How Much Can You Earn with a CIT Bank CD?

The table below shows how much you can earn with CIT Bank’s most competitive CD accounts. It assumes a deposit size of $10,000.

| CD Term | APY | Total Earnings |

| 6 months | 5.00% | $246.95 |

| 13 months | 4.65% | $504.71 |

| 11 month No Penalty | 4.80% | $439.13 |

| 18 months | 4.60% | $697.88 |

Opening and Funding a CIT Bank CD

To get started, navigate to CIT Bank’s CD account page to get a holistic view of their entire certificates of deposit offerings. From here you can use the green buttons which say either “Learn How,” “See More,” or “Get started” to navigate to the precise product page you intend to open.

Once at that page, you will have another chance to get more details about the product before clicking on the green “Get started” button to proceed with the application.

Once beginning the application process you will need the following pieces of information:

- Full Name (have your driver’s license handy)

- Address

- Phone Number

- Social Security Number or other taxpayer ID

Once you’ve opened the account, you can fund it in several ways. These include:

- electronic transfer

- mail in check

- mobile check deposit

- wire transfer

If doing a wire transfer you will need both the routing number and account number of the bank in which you are transferring funds from. If you have a check from the account you will be transferring funds from that will suffice as well as all the required information is there.

If you need to contact CIT Bank at any time while applying for or funding your account, you can use the contact information below. We’ve also included the routing number.

- Bank Address: P.O. Box 7056 Pasadena, CA 91109-9699

- Telephone Number: 855-462-2652

- CIT Bank Routing: 124084834

Managing Your CIT Bank CD and Using Mobile Banking

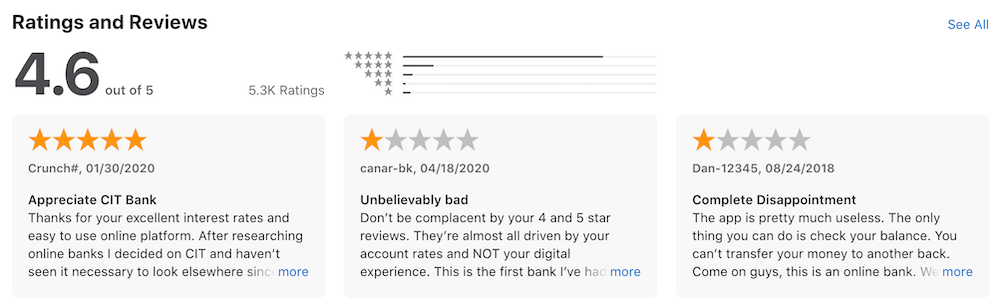

You can manage your CIT Bank CD with online banking, mobile banking or through their native IOS and Android apps. CIT bank has a respectable 4.6 star rating out of 5 for their IOS app and a more modest 3.4 stars out of 5 for their android app. Both scores are above average as far as banking applications go.

Whether managing your accounts through desktop web, mobile web, or the aforementioned apps, customers will have the ability to do the following:

- Check account balances, interest rate accumulation and transaction history

- Transfer money between CIT Bank accounts and external linked accounts

- Deposit checks (if you also have the CIT Bank online savings account)