Varo Bank is a trendy, one-hundred percent digital bank based out of San Francisco that offers its entire product suite through its mobile apps on IOS and Android.

Varo has two main accounts. An online checking account that comes with a Varo Debit card, and an online savings account.

The checking account is about as hassle-free as they come and provides many services for free that typical brick and mortar institutions generally do not. These include:

- no monthly maintenance fees of any kind,

- no transfer fees or debit card replacement fees and

- no foreign transaction fees.

There is also no minimum balance requirement to keep the account open and you can activate it with a minimum deposit of just $0.01.

The online savings account features one of the top yields on the market for FDIC-insured accounts and has the ability to earn even more if you open and use the online checking account and its debit card.

With the savings account, you’ll immediately earn a competitive APY (annual percentage yield) of 2.00%.

If you open it with a checking account, you’ll have the ability to earn up to 5.0% APY on balances under $5,000. You’ll have to meet a couple monthly requirements to earn that advertised APY, however. You can see those details further below.

Like the checking account, the savings account has no fees or minimum deposit requirements and you can start earning the exceptional APY once you place your first deposit into the account.

Full details on both accounts and Varo Bank continue reading our review below.

Varo Money Online Savings Account Details + APY

Like other online banks, Varo is member FDIC and accounts are insured up to $250,000 combined.

Varo Bank’s online savings account offers tiered yields. You immediately start earning an APY of 2.00% but can earn up to 5.00% APY on balances of $5,000 and below if two specific conditions are met each month.

These are:

- You must receive a minimum of $1,000 in qualifying direct deposits, AND

- Keep at least 1 penny in both your Varo bank account and Varo savings account (i.e. end the month with a positive balance).

Varo Bank Online Savings Account Rate Tiers

| Balance | APY | Conditions Met? |

| $0 – $5,000 | 5.00% | Yes |

| $0 – $5,000 | 2.00% | No |

| $5,000 + | 2.00% | Yes |

| $5,000 + | 2.00% | No |

To give the yields above some context, the current national average for a savings account sits at just 0.17% APY according to recent FDIC data. That said, there are now a handful of online banks paying 2.50% – 3.00% APY on all balances following the FED’s most recent rate hike of 0.75%.

Outside of the solid yield, Varo’s savings account has some helpful tools that allow you to automate your savings (more in the features section below). Plus, package your savings and checking account together for better insights into your spending habits and how much you’re able to save each month.

Opening a Varo Checking Account

Getting your Varo Money checking account set-up is a fairly quick and straightforward process that can be done online in minutes.

To get started, navigate to the Varo checking account page and either submit your email, or click on the black “Get Started” button in the upper right. If you choose to submit your email, they will email you a link to navigate to the same sign-up page, but your email field will be filled out already.

When filling out your basic information you will want to have the following pieces of information handy:

- email address (if you haven’t submitted it already)

- full name

- date of birth

- address

- social security number

After you complete the application process, you will be directed to download the app from the Apple or Google Play store to begin funding and managing your account(s). Remember, the entirety of this digital bank’s products and services are accessed and managed solely through their native apps.

Once you’ve downloaded the app and opened the checking account, you’ll be ready for your first deposit. If you have any questions or get stuck during this process you can email – help@varomoney.com – and you should receive a prompt response.

Varo Money Checking Account Features

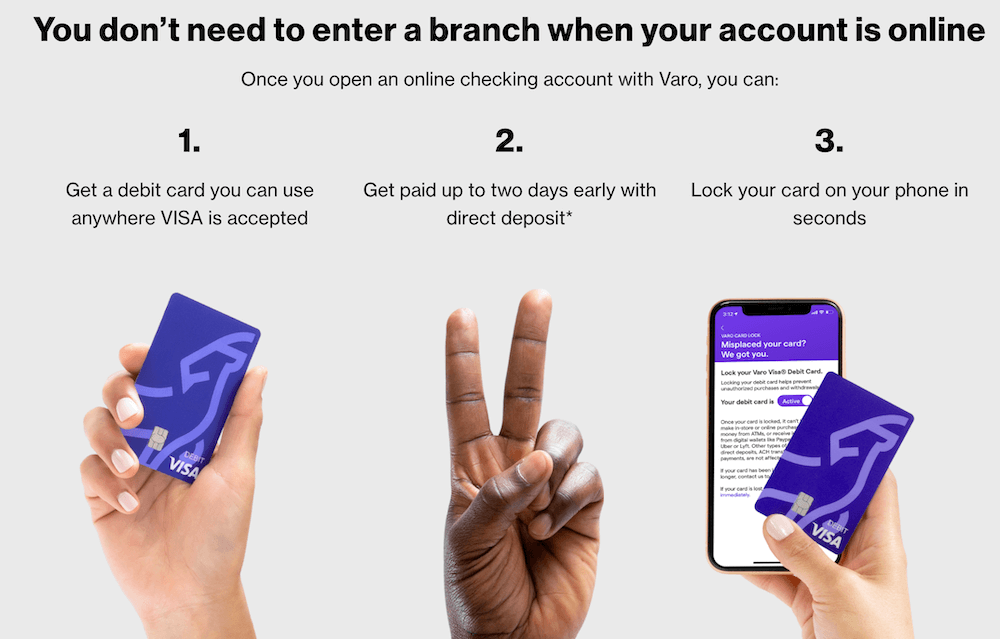

The Varo Money checking account has several noteworthy features and very little drawbacks.

For starters, the nature of Varo Bank and its digital product suite allow for Varo to save on costs and pass these savings along to consumers in the form of no-fee accounts with above average interest rates. Without an expensive branch network, staff, rent and utilities, Varo is able to simplify its product offerings and make them extremely low cost.

Second, Varo Checking account consumers are provided a debit card that can be used for free at 55,000+ AllPoint ATMs around the country. These ATMs are generally found in places like Walgreens, CVS, and target.

If you have cash to deposit into the account, you can do this at any of the 90,000+ retail locations using Green Dot Reload. We should note that fees and cash deposit limitations will apply. You can see a complete breakdown of these fees by retailers in our table further below.

On top of this, you can easily transfer money freely between Varo accounts and even connect a popular payment app like Apple Pay™, Google Pay™, PayPal, Cash App, or Venmo to pay for everyday purchases.

No credit checks of any kind will be run by Varo to open their checking account. In some instances they may request identity documentation, but your credit report, history, or FICO score will not be checked.

If you set up direct deposits with Varo checking, you’ll also be provided access to your funds up to two days in advance.

If you choose to open the savings account along with the checking account, Varo has some great tools available that allow for automatic transfer from your checking to savings to allow idle cash to grow with a lucrative APY.

The two noteworthy automated savings features are:

- Save Your Pay lets you choose and set up the automatic transfer of a certain percentage of your direct deposits to your savings account. This is similar to Wells Fargo’s Way2Save product, except in Varo’s case you get to select the percentage.

- Save Your Change rounds up every transaction from your checking account to the nearest dollar and automatically transfers these funds to your savings.

ACH Transfers

As mentioned, Varo Money stands out from the pack with its lack of fees – especially when it comes to moving money around.

The average domestic wire charge in the US sits at a hefty $25. With Varo Money, you have the ability to move money around via ACH transfers for free.

There are two kinds of ACH transfers, both of which can be set up by Varo Money. These are:

- ACH debit transactions “pull” the money from your account, like for an automatic bill payment.

- ACH credit transactions “push” money into your account, like a direct deposit of your paycheck or tax refund.

To set up either of these kinds of ACH transfers, you will need your Varo Bank account number and the routing number of the other party’s financial institution.

The time frame in which the money is received is generally between 1 – 4 days. Here a more specific breakdown:

- If you initiate the ACH transfer in your Varo app to or from an external bank account you own, it will take 2–4 business days.

- If you initiate the ACH transfer from an external bank account to Varo, it will generally take 1–2 business days.

Potential Fees to Look Out For

Depending on where you use your debit card and how you add funds to your account, you may encounter fees from time to time.

If you plan on making cash deposits, you will encounter a fee each time. These fees will vary by retailer. Below is a list of fees and limitations when depositing cash into your Varo account. You can read more about the fees and limits listed below on Varo’s support page here.

Varo Cash Deposit Fees & Limits by Retailer

| Retailer | Limit | Price |

| 7-Eleven | $500 | $4.95 |

| Albertsons | $500 | $4.95 |

| ACE Cash Express | $1,500 | $4.50 |

| CVS | $500 | $4.95 |

| Dollar General | $500 | $3.95 |

| Dollar Tree | $500 | $4.95 |

| Family Dollar | $500 | $3.95 |

| Rite Aid | $500 | $4.95 |

| Safeway | $500 | $4.95 |

| Vons | $500 | $4.95 |

| Walgreens | $500 | $4.95 |

| Walmart | $1,000 | $3.74 |

The other potential fee to look out for is usage of non-Allpoint ATMs. Varo imposes a $2.50 fee per transaction, but the bank or ATM owner may charge an additional fee on top of that.

Leave a Reply