There are a few distinct advantages to switching from a traditional bank to an online-only bank. Without the overhead of brick-and-mortar locations, online-only banks can focus their efforts on providing technology that supports their customers’ financial goals. Many online-only banks don’t impose fees. They tend to have better-developed and more intuitive apps and websites, as well.

Oxygen.us does an excellent job of marketing to a younger demographic. They specialize in providing support to entrepreneurs with benefits like cashback rewards, high interest on savings accounts, and virtual cards for enhanced security. There’s much competition in the zero-fee online banking space. Here’s how Oxygen stacks up.

What is Oxygen Bank?

Oxygen is a San Francisco-based neobank with an online-only banking platform owned by The Bancorp Bank, offering checking and savings accounts for both personal and business use. They partner with Visa to provide debit card services.

As a newcomer to the fintech scene, Oxygen provides services targeted to entrepreneurs. Their app won 2021 Best Overall Fintech App at the Fintech Breakthrough Awards.

Oxygen Bank Joins the Neobank Movement

Neobanks, created to meet the banking needs of the tech-savvy customer, provides traditional banking services intending to democratize access to tools via technology. Neobanks don’t have a physical location, which means they can use their resources to provide financial education, budgeting tools, small business management tools, higher interest rates, and fewer fees than traditional banks.

Neobanks don’t usually offer credit cards or lines of credit. This helps limit their risks, which also keeps operating costs low. It’s worth noting that while neobanks provide a myriad of advantages to users, they aren’t subject to the same regulations as traditional banks. If you decide to open an account with Oxygen (or any online bank), make sure they offer deposit insurance via the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Share Insurance Fund, administered by the NCUA.

Neobanks lose an average of $11 per user due to free accounts and general operating costs. Oxygen provides benefit tiers lined up with each element. The bank waives corresponding annual fees after the first year when a user meets specific criteria.

What Information Can I Find on the Oxygen Bank Website?

The Oxygen Bank website offers answers to any questions you may have as you evaluate online banking possibilities. Oxygen’s marketing plan appears to revolve around the four elements; earth, water, air, and fire. Each element represents a “loyalty tier” with varying benefits (and fees) for users.

The site is generally easy to navigate. You can download the app via a link from the website.

Details About Oxygen’s Banking Services

Oxygen Bank provides distinct advantages for both individuals and entrepreneurs. Here’s what they get right:

No fees: There are zero fees associated with an Oxygen Bank account. You’ll enjoy unlimited fee-free transactions, including direct deposits, mobile check deposits, ACH transfers, and incoming domestic wire transfers. Oxygen business account holders get free bill pay services that allow you to send physical checks through the mail to businesses or individuals located in the United States.

ATM access: The Oxygen debit card works at more than 55,000 Allpoint ATMs globally.

Cash deposits: Many competing online-only bank accounts do not accept cash at all. You can’t deposit cash via an ATM; you’ll have to find one of 90,000 Green Dot locations in the United States if you need to make a cash deposit.

Cashback rewards:

All Oxygen debit cardholders receive cashback according to their tier of service and account type. Account-holders can select and redeem cashback rewards by navigating to the cashback area of the app. It’s easy to track earned rewards. After earning $10, users can cash out and have their rewards deposited to their Oxygen account.

Oxygen Bank Tiered Services

Oxygen Bank offers several options organized in tiers with themes that match the four elements: Earth, Water, Aire, and Fire.

Some of the perks and rewards available to every user include:

Cashback:

- Gas, food delivery, TraderJoes, etc.

- $1 back at a coffee shop

Savings management:

- Round up the change to boost savings

- Annual Percentage Yield (APY) up to 20X average national rate

Travel:

- Hotel theft coverage

- Delayed and lost luggage coverage

- Car rental damage waiver protection

Retail:

- Extended warranties

- Cell phone protection

Oxygen bank users enjoy fee-free bank transfers, access to more than 40,000 fee-free ATMs in the United States, virtual cards, card freezing, bill pay, and the ability to pay friends through the Oxygen app. Annual fees apply only once if all conditions are met for 12 consecutive months.

Oxygen Bank Tiers:

Earth

- No monthly fees

- No minimum balance requirements

- No qualifications

- 2% cashback

- 0.50% APY on balances of $20,000 or less

- Three savings goals

- Three virtual cards

Water

- $19.99 annual fee

- Must have more than $1,500 in qualified deposits during a 30-day consecutive period

- Must spend $500 with the Oxygen debit card during a 30-day consecutive period

- 4% cashback

- 1.00% APY on balances of $20,000 or less

- Ten savings goals

- 15 virtual cards

- Two mo. Netflix reimbursement

Air

- $49.99 annual fee

- Must have more than $3,300 in qualified deposits during a 30-day consecutive period

- Must spend $1,000 with the Oxygen debit card during a 30-day consecutive period

- 5% cashback

- 2.00% APY on balances of $20,000 or less

- Unlimited savings goals & virtual cards

- Two months Netflix & Peloton digital reimbursement

- PriorityPass™ Membership plus five annual visits

Fire

- $199.99 annual fee

- Must have more than $6,000 in qualified deposits during a 30-day consecutive period

- Must spend $2,000 with the Oxygen debit card during a 30-day consecutive period

- 6% Cashback

- 3.00% APY on balances of $20,000 or less

- Unlimited Savings Goals & Virtual Cards

- Two mo. Netflix & Peloton reimbursement

- PriorityPass™ Membership plus ten annual visits / Global Entry Reimbursement

Business account holders receive the following perks:

- Cashback on rideshare, gas, etc.

- Ability to tag expenses

- Virtual cards with spending controls

- Business Savings Account

- Form an LLC from within the app

Oxygen Bank Pros and Cons

Pros:

- Zero monthly fees

- Zero minimum balance requirements

- Zero opening deposit requirements

- Fee-free ATMs via Allpoint network

- Ability to deposit cash (Green Dot network imposes fees)

- Create an LLC via the Oxygen app before opening a business account

- Reusable and temporary virtual cards

- Fee-free transactions are unlimited

Cons:

- Out-of-network ATM transactions cost $3 per withdrawal

- Cash deposit service fee of up to $4.95 each

- No international or domestic wire transfer sending; can’t receive international wire transfers

- Mobile banking only; no ability to see a teller face-to-face and no access to brick-and-mortar banking locations or offices

- No ability to authorize additional users on a single account

- Businesses can deposit a maximum of $10,000 worth of cash per month; fees apply

Oxygen Bank Review: How Entrepreneurs Could Benefit From Switching to Oxygen

Business owners can conduct all banking activities via the Oxygen.us app. There’s no need to visit a physical branch and wait in line to speak with a bank representative.

Business owners can receive up to 7% cashback from places like Walmart, Whole Foods, and Trader Joes. Here are some examples of cashback possibilities for entrepreneurs from Oxygen Bank:

- Pharmacy: 5%

- Coffee and Food: 1%

- Gasoline: 5%

- Food Delivery: 5%

- Gaming: 5%

- Public transportation and rideshare: 5%

How to Open an Oxygen Business Bank Account

Setting up an account is easy for entrepreneurs. Oxygen specializes in small business accounts. You’ll need to send your personal or business information via an application through the app. It may take three to five weeks for the Oxygen team to put your documents through the federally -mandated verification process.

Business account applications require digital copies of your EIN letter, operating agreement, and other documents, depending on the business structure. You must also provide a digital copy of your driver’s license or other government-issued identification, your Social Security number, date of birth, and U.S. mailing address.

If you want to form an LLC, sign up for a personal account via the Oxygen Bank app. You can start the process of creating your LLC after Oxygen Bank verifies your information and your account is up and running. You can go through the entire process of forming an LLC through CorpNet. Depending on your state of residence and which services you choose, you may have to pay fees to start an LLC.

Your new account has a routing number and account number, just like every other bank account. You can connect your Oxygen account to Stripe, PayPal, Square, or any other accounts you use to connect with customers.

Connect to Other Bank Accounts with the Oxygen App

Oxygen.us provides an all-in-one solution that allows users to see each of their connected bank accounts on a single dashboard. On-the-go entrepreneurs won’t have to log in to multiple accounts to get a bird’s eye view of their current financial situation.

Oxygen for Individuals

Personal accounts with Oxygen Bank offer a convenient and secure way to manage personal financial matters. The bank aims to create a flexible and intuitive user experience ideal for evolving financial situations.

Users can create single-use cards and merchant-locked cards to keep details private. Lost cards are easy to lock and unlock via the app. Oxygen maintains the strictest global standards in the industry with PCI DSS certification. Users receive immediate alerts when Oxygen’s security system sees unusual activity.

Get Your Paycheck Two Days Early

One of the most attractive perks of opening an Oxygen bank account for many users is the ability to get access to their direct deposits up to two days earlier than they would with a traditional bank.

There are no overdraft fees, monthly fees, minimum balance requirements, or ACH bank transfer fees with a basic personal Oxygen bank account.

Is Oxygen Bank Any Good?

Big brick-and-mortar banks ask a lot of their customers. They want their customers to come into a physical location to open a new account. Certain account maintenance activities also have to be handled in person. Oxygen doesn’t offer in-person services, so people comfortable banking via technology can use the site to manage every banking-related task, from opening the first account to creating a US-based LLC.

Oxygen Bank Customer Reviews

Oxygen Bank on Trustpilot

The Oxygen has just 25 reviews on Trustpilot:

- Excellent: 8%

- Great: 0%

- Average: 0%

- Poor: 0%

- Bad: 92%

While the overwhelming majority of reviews on Trustpilot are negative, there seems to be a theme. If you need to deposit cash or a physical check, you’ll have to jump through some fee-laden hoops to do so.

Oxygen Bank is an online-only bank. Suppose you are an entrepreneur or individual who receives payment via cash or physical check and doesn’t want to use the Oxygen app to deposit a check. In that case, you’ll have to go through Green Dot or Ingo Money (subcontractors) to get the money into your account.

Many reviewers complained of difficulty with issues such as fraud alerts triggered by cryptocurrency transactions. One user noted that he could not use his Oxygen card in Albania and did not have a backup payment method on hand.

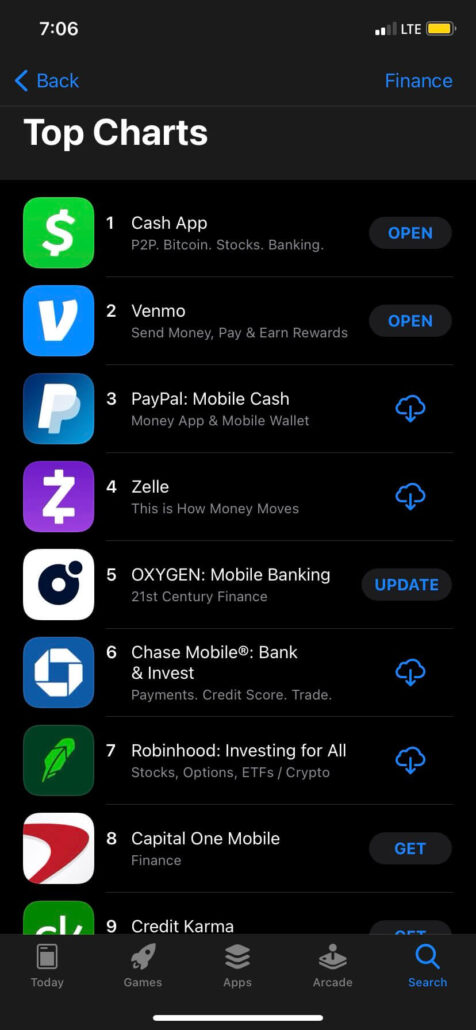

Oxygen Bank’s App Reviews in the Apple Play Store

More than 81,000 Oxygen customers provided ratings for the bank’s app. With 4.7 stars out of five, Oxygen appears to be a popular option for customers who prefer to bank via their phone, tablet, or computer.

It also holds the #5 spot for the most downloaded finance app on Apple’s “Top Charts.”

“I was immediately surprised at how easy and fast I was able to successfully open my Oxygen account. Almost before I knew it, I was told that my personal info was accepted, my account was approved and an Oxygen Visa debit card was on its way to me. I was already able to use a virtual card if I needed to as well. The Oxygen app is very user friendly and has an extremely slick appearance. I quickly realized that Oxygen was something I definitely needed, in more ways than one.

Kudos to the developers for creating an extremely likable and efficient application with several very unique features. This is how it is supposed to be.”

-Djdonny2 06/19/2021

“The best free checking account I’ve ever had. Literally no fees, has the best banking app I’ve ever used, has great security, money management features, & compared to other online banking apps, it has much better development and stays frequently updated. They have to be the best, if not one of the very best when it comes to their app. Since they don’t have physical branches, this is where they are able to deliver a banking experience that made me close my other account, in general; their app is GOOD. It works flawlessly on my iPhone 8. Haven’t had any issues since banking at Oxygen. anytime I need something that I need to talk to a human, customer service has taken care of me with a great sense of urgency. -Seriously the best mobile, or actually, general banking experience I’ve had, & I’ve had accounts with several of the major banks out there. They even have a cool debit card design.”

-Sleeptron 06/23/2021

Oxygen Bank on the BBB Website

The Better Business Bureau (BBB) Oxygen.us profile shows a physical address of 100 1st St Ste 2250, San Francisco, California. There are just three customer reviews with an average rating of 1.33 out of five stars. Nineteen complaints were closed in the past 12 months.

All complaints made by Oxygen.us customers to the BBB appear to have roots in alleged fraud and/or the customer’s inability to use the Oxygen app to manage their finances.

Here is one of Oxygen’s responses:

11/25/2020: “Oxygen has researched the alleged loss of money in this customer’s account, and we cannot find any discrepancy or source of potential confusion. We have communicated intensely with this customer for a long period. We have also filed, investigated, and completed numerous transactional disputes for this account-holder.”

Is Oxygen Bank Worth It?

Switching banks means working your way through a long and non-negotiable to-do list. Much of that pain is unavoidable, so it pays to research your options carefully before starting down the road of moving your finances from one banking institution to another.

If you’ve been interested in online banking and are ready to gain access to advanced features and a few nice perks, Oxygen Bank deserves a spot on your shortlist of neobanking options.

The free tier offers a lot of great perks, so if you aren’t comfortable diving into the paid levels, or you don’t think you need extras that could end up costing you money, starting with the basic earth tier at Oxygen Bank. This starter account offers excellent advantages that make going through the process of switching banks worth the hassle.

Leave a Reply