First Internet Bank of Indiana, also simply called First Internet Bank, was the very first FDIC-insured, 100-percent online bank.

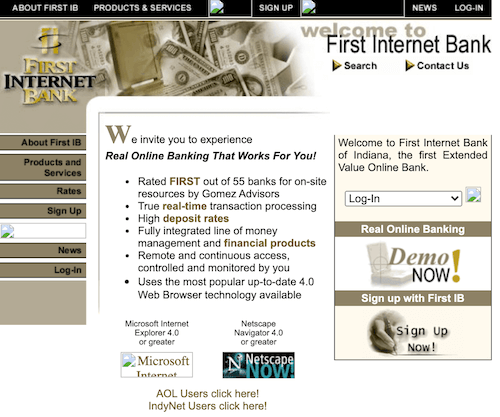

To give you an idea of how far things have come for them, take a look at their online presence in 1999 below. We dug up this snapshot in time using the web.archive.org tool. This is their homepage only months after launch.

When First Internet Bank launched their primary focus was on personal, FDIC-insured deposit accounts. Today, they offer a full suite of deposit products for both personal and business accounts and a full suite of loan products consisting of auto loans, home loans, mortgages, personal loans and credit cards.

For the purpose of this review, we will focus on First Internet Bank’s three main deposit products that earn interest. These include:

- First Internet Bank’s CDs (certificates of deposit)

- First Internet Bank’s Money Market Account

- First Internet Bank’s Online Savings Account

To see if First Internet Bank’s savings products are a right fit for you, continue reading our comprehensive review below.

First Internet Bank CD Rates + Account Details

First Internet Bank has eight term CDs with durations ranging from 3 months to 5 years. Their CDs come with a minimum deposit requirement of $1,000 and are federally insured by the FDIC up to the applicable limits.

CD Rates

| CD Term | APY |

| 3 months | 4.18% |

| 6 months | 5.33% |

| 12 months | 5.48% |

| 18 months | 5.07% |

| 24 months | 4.85% |

| 36 months | 4.75% |

| 48 months | 4.54% |

| 60 months | 4.59% |

To put the yields above in perspective, the current national average for a 12 month CD and a 60 month CD sit at 1.63% and 1.37%, respectively, according to FDIC data, with top yields from online banks inching up to the 5.50% and 4.60% APY mark.

How Do First Internet Bank’s CD Rates Compare?

Take a look at the table below to see how First Internet Bank’s best CD rate compares with the best CD rates from other FDIC-insured online banks.

| Bank | Best CD Rate (APY) |

| Barclays Bank | 4.80% |

| Crescent Bank | 5.45% |

| Discover Bank | 5.00% |

| Live Oak Bank | 4.90% |

| First Internet Bank | 5.48% |

How Much Can You Make with a First Internet Bank CD?

The amount of money you can earn with a First Internet Bank CD depends on your deposit size, the CD term you select and its APY (annual percentage yield). Take a look at the table below showing potential earnings based on a $10,000 deposit.

| CD Term | APY | Earnings |

| 6 months | 5.33% | $263.04 |

| 12 months | 5.48% | $548.00 |

| 36 months | 4.75% | $1,493.76 |

| 60 months | 4.59% | $2,515.58 |

Compounding and Crediting Interest

All of First Internet Bank’s CDs come with monthly compounding interest. Interest payments are also made to the account monthly.

Grace Period and Early Withdrawal Fees

First Internet Bank will send you a notification letting you know that your CD is about to mature. Upon maturity you will be given a 10 calendar-day grace period in which you may modify your CD or close it out without facing any early withdrawal fees. If nothing is done during this grace period the CD will automatically renew for the same term and the going APY at that time.

If you need access to your funds prior to maturity, First Internet Bank will impose an early withdrawal fee. Fortunately, they have these penalties clearly laid out on their CD rate page. The penalties are as follows:

First Internet Bank CD Early Withdrawal Penalties

| CD Term | Penalty |

| 3 months | 90 days’ interest |

| 6 months | 180 days’ interest |

| 12 months | 180 days’ interest |

| 18 months | 180 days’ interest |

| 24 months | 360 days’ interest |

| 36 months | 360 days’ interest |

| 48 months | 360 days’ interest |

| 60 months | 360 days’ interest |

First Internet Bank Money Market Account Rate + Details

First Internet Bank’s money market account is a variable-rate product that comes with a competitive yield on balances above $1 million. For balances below that amount, the yield is on par with other online banks.

The account can be opened with just $100 but you will have to maintain an average daily balance of $4,000 to avoid a $5 monthly maintenance fee. Account details and APY below.

Money Market Account Rates

| APY (daily balance of $1m or less) | 3.56% |

| APY (daily balance of more than $1m) | 5.20% |

| Min Deposit | $100 |

| Monthly Fee | $5 |

| Average daily balance to avoid fee | $4,000 |

To put this yield in perspective, the current national average for money market accounts sits at just 0.59% APY.

As per federal regulation D, First Internet Bank allows just 6 transactions per month with this money market account. You will be charged an excessive transaction fee of $5 per transaction if you go over 6 in any given month.

If you need access to cash, First Internet Bank will provide ATM surcharge rebates of up to $10 per month with their money market account.

Online Savings Account Rate + Details

The online savings account requires a minimum deposit of just $25 to open the account. There is zero monthly maintenance fee and no average daily balance to maintain.

Online Savings Account Rate

| APY | 0.80% |

| Min Deposit | $25 |

| Monthly Fee | $0 |

| Average daily balance to avoid fee | $0 |

To put this yield in perspective, the current national average for traditional savings accounts is just 0.40% APY. That said, there are still several online savings accounts featuring APYs over 4.50% with no minimum balance requirements or fees.

First Internet Bank’s online savings account also limits you to just 6 transactions per month per federal regulation.

As with the money market account, the online savings account also features up to $10 in ATM surcharge reimbursement per month.

Leave a Reply