If you’re in the market for a new checking account and you don’t already have one with Fifth Third Bank, you’re in luck.

This midwestern bank is currently offering a checking account bonus of $300 to new customers who open a qualifying personal checking account and meet activity requirements. This bonus is available to new customers only.

Here’s how to qualify for a new account bonus with Fifth Third Bank and an overview of the two eligible accounts to help you choose the one that’s right for you.

How to Get the $300 Bonus

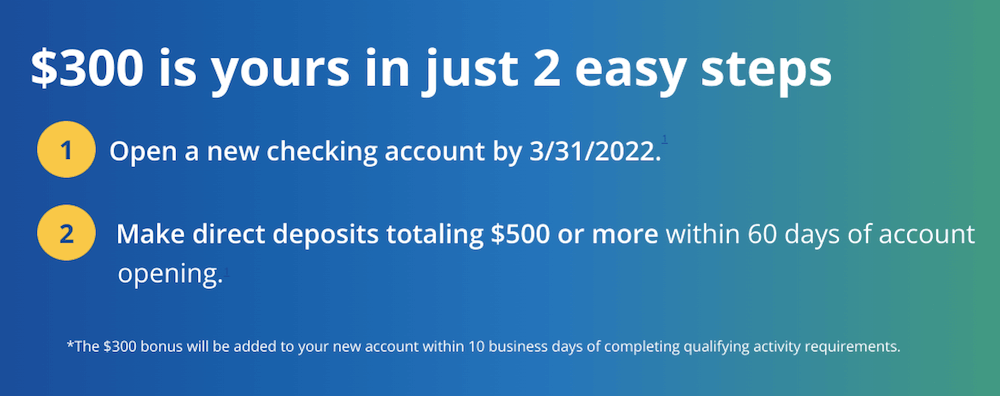

Right now through March 31st, 2022, Fifth Third is paying a $300 account bonus to all new customers who open either a Fifth Third Momentum Checking or Fifth Third Preferred checking account. While these are not the only personal checking accounts available from this bank, they are the only two that qualify for the bonus offer.

To qualify, you must get a code from this link and use this when signing up for an account. Then, you need to set up direct deposit and receive a total of $500 from direct deposit transactions within the first 60 days. After meeting these requirements, the $300 bonus will be deposited into your account automatically within 10 business days of qualifying.

That’s it. As long as you open your new account by March 31st and don’t forget to use the offer code, you’ll qualify for this offer. You will not be eligible if you already have an account with Fifth Third or you have closed a Fifth Third Checking account within the last 12 months.

Fifth Third Momentum Checking Account

The Fifth Third Momentum Checking Account does not have a minimum opening deposit requirement. You can make a deposit of any amount (you must do so within 45 days of account opening) and there is no minimum monthly balance required to keep your account. This is not an interest-bearing checking account.

This account does not charge a monthly maintenance fee. Some fees to be aware of are the $2.75 for out-of-network ATM withdrawals, a $5 fee for international ATM withdrawals, 0.20% currency conversion fee, a 3% international POS/ATM transaction fee, and $5 inactivity fee if you don’t use your account for 12 months. There is also a $37 overdraft fee, but there are a couple of ways to avoid paying this.

These fees apply to all Fifth Third personal checking accounts. For a complete list of checking account fees, read the Fifth Third Debit Card Disclosure and Card Agreement.

Fifth Third Momentum Banking customers enjoy the following benefits:

- Early Pay to receive direct deposits up to two days in advance

- Fifth Third Identity Alert provided by Trilegiant

- Extra Time for overdrafts

- MyAdvance

- Unlimited check writing capabilities

There are no fees for using any of these features but you will pay interest when using MyAdvance (and you will pay fees when using cash advance at ATMs).

Early Pay allows you to receive payment from your employer up to two days before they are scheduled to post as long as your employer agrees to this.

Extra Time is an optional overdraft extension feature that gives you extra time to make a payment when you have attempted to overdraw your account. If you have this feature enabled, you will have until midnight (EST) on the day of an overdraft to fund your account with the amount needed to fully cover the overdraft as well as any pending debit card purchases, outstanding checks, or automatic payments. Items returned unpaid are not eligible for protection.

You can also qualify for free Overdraft Protection, a service that will automatically transfer the necessary funds to cover an overdraft from a linked checking or savings account, if you have this account. However, you can only use Overdraft Protection for one of your checking accounts at any given time.

MyAdvance lets you get a cash advance on your next qualifying direct deposit if you are found to be eligible. Eligibility is determined by how many times you have applied for a MyAdvance line of credit in the last 90 days and how many qualified direct deposits you have received in the last 35 days.

Fifth Third Preferred Account

There is no required minimum opening deposit for a Fifth Third Preferred checking account as long as you fund the account at all within 45 days of opening it.

There is a $25 monthly maintenance fee for this account. The only way to waive it is to maintain a combined total balance, across all of your Fifth Third deposit and investment accounts, of at least $100,000. You will need to qualify every month to avoid the fee.

This is an interest-bearing checking account that pays an APY of 0.01% on all balances. Interest is compounded continuously and credited monthly to your account. More likely, however, it’s the other exclusive benefits you’ll be interested in.

In addition to all of the benefits mentioned above for the Momentum Checking account, Fifth Third Preferred Checking customers enjoy the following perks:

- Secondary checking account

- Lower borrowing rates on Fifth Third Loans and mortgages

- Online bill pay (pay most bills as soon as the next day)

- Enhanced mobile banking features

- Waived fees for savings and business banking accounts (as long as you are listed as the owner for both)

Preferred Checking account holders enjoy exclusive Preferred rates when they take out Direct Auto loans, Easy Home Ref, Home Equity loans and Home Equity lines of credit, and personal loans and personal lines of credit. But you don’t automatically qualify for these rates. To be eligible, you need to have a combined total balance of at least $100,000 across all of your deposit and investment accounts at the time you’re applying for a loan.

Plus, you’ll get personalized support as a Preferred customer. There are dedicated Preferred Bankers as well as a 24/7 customer service line available only to those with this checking account.

You’ll also be eligible for $0 self-directed online trades with a Fifth Third brokerage account. Life360 is a wealth management platform that can help you organize all of your financial planning in one place. This portal, operated by eMoney Advisor LLC, is completely optional but may help you track your net worth and manage your accounts more easily.

Final Thoughts

If you don’t already have a checking account with Fifth Third Bank, now is a great time to get one. $300 is a pretty solid offer for a checking account and you don’t have to jump through a bunch of hoops to qualify, as you do with some promotions. If you think you can easily meet the direct deposit requirements and you need a new checking account, use this article to sign up.

We recommend the Fifth Third Momentum Checking account to anyone looking for a place to park their money for free and Fifth Third Preferred for people looking for a priority banking experience at a modest annual price.

Leave a Reply