Citibank, the retail banking division of Citigroup, kept their high yield “Accelerate Savings” account competitive during the low rate environment we had prior to 2022.

Today, in our rising interest rate environment, the Citi Accelerate Savings rate remains well above the national average but Citi has struggled to be a rate leader as other online savings accounts have caught up and surpassed them.

Plus the fact that this account needs to be opened in conjunction with another Citibank account makes it more of a burden than other alternatives on the market.

To see if the Citi Accelerate Savings account is right for you, continue reading our review below.

Related: Citibank’s CD rates, while currently lower than what you can find with online banks, have the highest yields of all the big banks (Wells Fargo, Chase, Bank of America and US Bank).

Citi Accelerate Saving Account Rate + Details

The Citi Accelerate Savings account is only available in select markets, however this market has expanded since Citi launched the account. As of January 2023, residents in all states except New York and select markets in Florida and Illinois are eligible.

Accelerate Saving Rate

| Min. to earn APY | APY |

| $1.00 | 4.05% |

📌 Please note: This rate varies by region. The rate we’ve listed below is accurate in the regions we surveyed which included Florida, Pennsylvania, Colorado and Washington state. You’ll have to check your own individual zip code here to see the rate available in your region.

To put this yield into perspective, the current national average for a money market account and a savings account sit at just 0.61% APY and 0.42% APY, respectively, according to recent FDIC data.

That said, some of the highest yielding variable-rate accounts from FDIC-insured online banks and nationally available credit unions are now inching up to the 5.00% APY mark.

Additional Citi Accounts Required

Prior to setting up your Citi Accelerate Savings Account you’ll need to first open one of Citibank’s 6 banking packages and meet some monthly requirements to avoid fees. Keep in mind there may be fees on both the checking side AND the Citi Accelerate Savings side if criteria isn’t met.

Below are the 6 packages to choose from. All come with the Citi Accelerate Savings Account:

- Citigold – For high net worth clients. In order to have a Citigold Account Package, you must have at least $200,000 across eligible linked deposit, retirement and investment accounts. There are no monthly service fees for Citigold clients on the checking or Accelerate Savings side.

- Citi Priority – Also tailored to higher net worth individuals or joint account holders. Package includes a regular or interest checking account and Citi Accelerate Savings Account upon opening. Must maintain a combined average monthly balance of $50,000+ in eligible linked deposit, retirement and investment accounts to avoid a $30 monthly service fee.

- The Citibank Account – Package includes a standalone Citi Accelerate Savings Account upon opening. Link to a regular or interest checking account and maintain required balances to help avoid monthly service fees. Must maintain a combined average monthly balance of $10,000+ in eligible linked deposit, retirement and investment accounts to avoid a $25 monthly service fee.

- Citi Elevate Account – Package includes an interest checking account and Citi Accelerate Savings Account upon opening. To avoid a $15 fee on the checking side, you’ll need to keep a monthly balance of at least $5,000. If your Citi Accelerate account is not linked to your checking account you’ll need to maintain a $500 average balance in it to avoid a $4.50 monthly fee.

- Basic Banking/Access Account – Package includes a standalone Citi Accelerate Savings Account upon opening. To avoid a $12 monthly service fee, you must either make one qualifying direct deposit AND one qualifying bill payment per statement period OR maintain a combined monthly average of $1,500 in linked accounts. As with the Elevate Account, if your Citi Accelerate account is not linked to your checking account you’ll need to maintain a $500 average balance in it to avoid a $4.50 monthly fee.

Compounding and Crediting Interest

Interest is compounded daily and paid to your account monthly.

Accessing Your Money

Citi customers have free access to more than 65,000 ATMs as well as 723 branches here in the United States alone. There are also plenty of online options to access and manage your money.

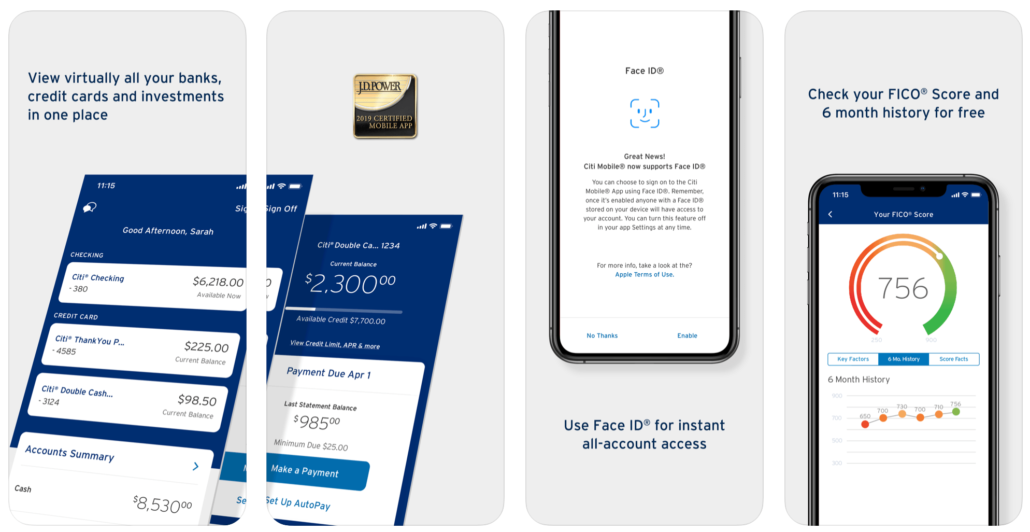

Citibank has taken pride in building industry-leading digital banking products and tools. In 2018 Citibank was named (again) as the “World’s Best Digital Bank” by Global Finance.

Once you have your username and password, you can login anytime, anywhere to your account here.

You can also download their native app(s) on IOS or the Google Play Store.

The app has over 3.3 million user reviews on IOS devices and holds a 4.9 star rating out of 5.

The app has over 942,000 user reviews on Andriod devices and holds a 4.7 star rating out of 5.

Depositing Funds

There are a number of ways to deposit funds into your Citi Accelerate Savings account. These include:

- ATM deposit

- Direct Deposit

- Check by Mail

- Electronic bank transfer

- Local Citi branch

- Mobile Deposit

- Wire transfer

Funds from Citi savings account deposits are typically available immediately if made before cutoff times around 6-7pm EST. Any deposit made after this time is generally available the next business day.

Withdrawing Funds

If you would like to withdraw funds from your Citi Accelerate Savings account, first transfer them to your Citi checking account that was required upon opening. You can do this via the Citi apps (links provided above), online, over the phone or at a local branch.

Once the money is in your Citi checking account you can withdraw cash at a local ATM with the debit card that came with your checking account. You can also perform a wire transfer or electronic bank transfer just be sure to take note of the associated fees that may come with these services.

Citi Accelerate Savings Account FAQs

Still have questions about the Citi Accelerate Savings account? See what other consumers are asking around the web along with our responses below.

Is the Citi Accelerate Savings Account FDIC-insured?

Yes. Citibank is member FDIC and deposits held in all Citibank accounts (cumulatively) are federally insured up to $250,000 per depositor.

How can I close my Citi Accelerate Savings Account?

The easiest way to close the account is to speak with your account manager and get the required form needed. Once you’ve filled out the account closure form, return it to your representative and transfer the remaining funds out of the account to $0 the balance.

Leave a Reply